GTI Resources gives investors a double dose of good news

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

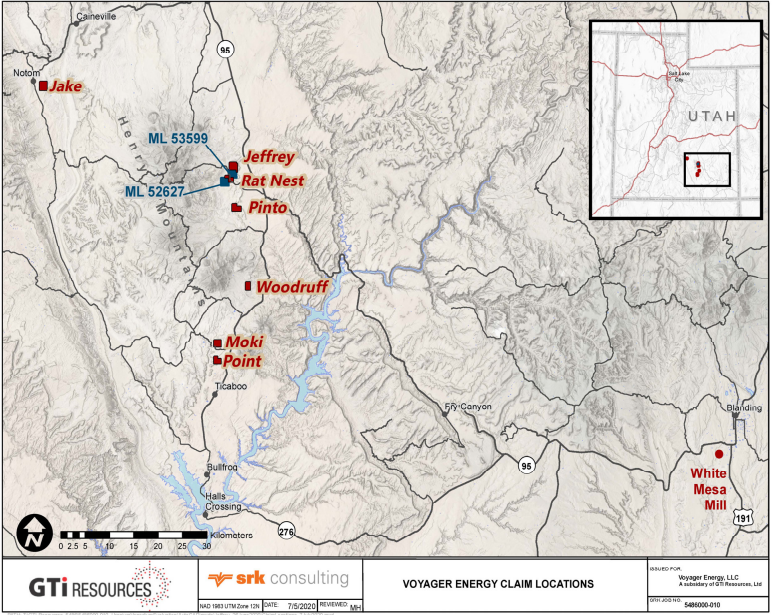

It has been an exciting week for GTI Resources Ltd (ASX:GTR) with the group announcing on Wednesday that it had completed the acquisition of two new leases in Utah, providing it with a large contiguous tract covering 5.5 kilometres along the interpreted strike of the mineralised trend that has been identified at the group’s Jeffery and Rats Nest projects.

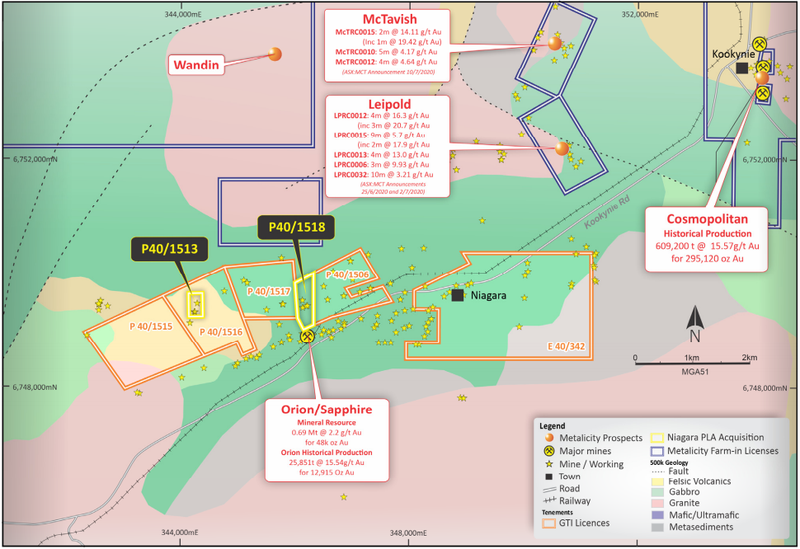

This development has been followed with news that the group has received assay results from the recently completed first-pass shallow aircore drilling program at the company’s Niagara Gold Project.

Importantly, the drilling program intersected elevated gold values and anomalism of up to 2.8 g/t gold, results that will contribute to development of the overall exploration model.

GTR will be testing targets in the course of a reverse circulation drilling campaign that is planned for December.

Harking back to the group’s expanded tenement holdings in Utah, management advised in August that a full review of a recently acquired data package had been conducted with the intention of providing targets for exploration activities on the leases.

The acquired data package also contains valuable information regarding the company’s Jeffrey, Rats Nest and Moki claim groups.

The data includes drill hole logs and maps, resource maps, assay reports and project level exploration and evaluation reports.

GTR rapidly advancing evaluation of Henry Mountains data

In addition to relevant data covering GTR’s projects in the northern part of the Henry Mountains, the data package also provides drill intercept maps and an evaluation report for the company’s Moki project located near Ticaboo, Utah.

This data is of particular interest as significant historical drilling took place on this property which is positioned immediately east of the Tony M Mine owned by Energy Fuels Inc.

The acquired data has allowed management to rapidly advance evaluation of the currently held ground and to facilitate much greater refinement of drill targets.

GTR informed the market in August that it had completed the data review and follow‐up field checks of that data across the Henry Mountains projects.

The completed data review reinforced local geologic and mineralised trend interpretations, validating the company’s acquisition of the mineral leases from Anfield.

The acquired leases contain historical underground production workings, prospective for uranium and vanadium as evidenced from recent sampling that was conducted in anticipation of closing the acquisition, which yielded assay results up to 8,130ppm uranium (0.96% U3O8), and 128,699 ppm vanadium (12.87% V2O5).

GTR establishing comprehensive bank of data at economical costs

GTR has continuously generated high‐quality, low‐cost data to enhance the company’s understanding of the potential of the expanded Jeffrey and Rats Nest project area over the past nine months.

Management is currently developing the prioritised targets for the second phase of drilling within the newly expanded project area and it has initiated the permitting process.

While within the Phase II permitting process, GTR will leverage the extensive underground workings across the project area to study the controls and distribution of ore‐grade mineralisation through refined mapping and sampling.

The company will release further information regarding these activities, representing a continuation of potential market moving developments.

Niagara data to assist in generating exploration targets

Revisiting today’s news regarding aircore drilling assay results at the Niagara Gold Project, this is an important development for the company as it spanned a substantial area of more than 2.5 kilometres, providing data for both gold and multi-element analysis.

Results for the latter should be received during mid-November, potentially representing another source of positive news for the group.

Once received, the multi-element geochemistry will be used to assist in refining the exploration model, taking into account geological alterations and mineralisation.

Historical mining certainly suggests the area is prospective for high-grade gold.

The project is located within the central part of the Norseman‐Wiluna greenstone belt and the geology of the area is characterised by large rafts of semi‐continuous greenstone stratigraphy within the Mendleyarri monzogranite batholith.

Numerous historical workings occur within and to the north of the project area, with a number of major historical mines located in the immediate vicinity of Kookynie, including the Cosmopolitan Propriety Ltd which mined a total of around 630,000 tonnes of ore at an average grade of 15 g/t gold between 1897 and 1911, producing in excess of 300,000 ounces of gold.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.