FYI impresses Alcoa, a likely near term offtake partner

Published 11-FEB-2021 13:18 P.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

FYI Resources Ltd (ASX: FYI) has released highly promising and commercially crucial analytical results from the recently completed HPA pilot plant trial conducted in collaboration with Alcoa Australia Limited (Alcoa).

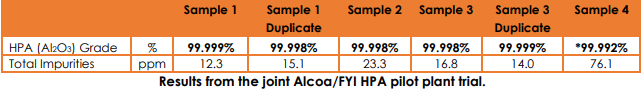

Analytical results indicated more than 99.998% Al2O3 purity was consistently achieved with an average of 99.9986% Al2O3 purity surpassing expectations - just a whisker of the premium 5N product that has a grade of 99.999%.

The fact that some samples achieved results of 99.999% HPA is an outstanding outcome that surpassed both parties’ operational expectations, providing further validation of FYI’s innovative HPA flowsheet design.

In industry terms, this confirms that FYI has drawn significantly closer to being able to offer its customers a 5N product that fetches approximately double the price (circa US$50,000 per tonne) of the 4N product that had previously been applied as a base case in the definitive feasibility study (DFS).

The sale of a 5N product would not only generate substantially higher income, but it would also open up a much wider range of markets where that quality of HPA is essential.

As a backdrop, FYI and Alcoa entered into a Memorandum of Understanding (MOU) on 8 September 2020 for the potential joint development of FYI’s innovative, fully integrated, high quality HPA product.

These results go a long way to meeting a key condition precedent to the Alcoa MOU, being the successful review of FYI’s innovative process flowsheet design and performance and potential operational parameters in terms of FYI’s future production scenario.

Significant upside to DFS financial metrics

The MOU activities continue to progress toward completion of the two other key conditions precedent being the engineering review and the economic/commercial terms. The parties will now work closely to finalise the MOU review.

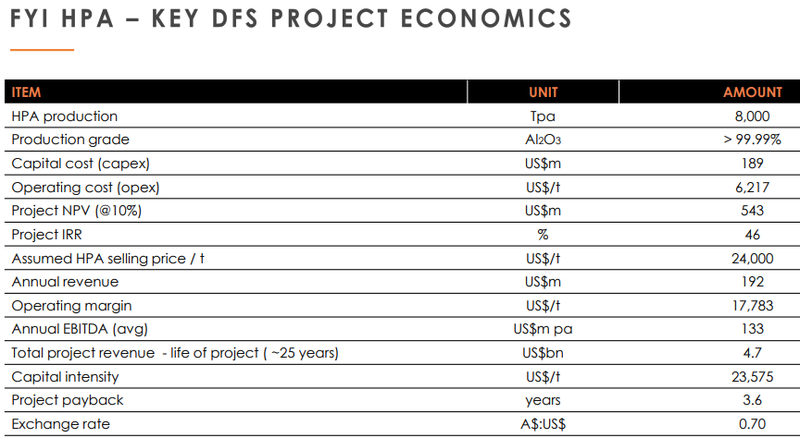

The following excerpt from the group’s DFS provides a snapshot of the base case assumptions that were used to project revenues, sales and the underlying project valuation from the production of 4N.

As you can see, management used pricing assumptions of US$24,000 per tonne which was conservative in terms of 4N pricing, and for the most part everything below that line including revenues, margins, underlying earnings and project payback will reflect more favourable numbers based purely on 4N production.

The project’s net present value and internal rate of return would be a substantially higher even if 99.999% 5N product sales accounted for 25% of production.

For example, just looking at the top line, a split of 25% 5N and 75% 4N would lift the revenue line from US$192 million to US$244 million.

This could have a proportionate impact on margins, EBITDA, project payback time (already a conservative 3.6 years), and in turn result in an increased net present value which would arguably see the company rerated on an enterprise value/NPV basis and/or by applying revised enterprise value/EBITDA metrics.

FYI continues to lead the way with its technical expertise

The 99.999% purity level was not specifically targeted for this trial, and managing director Roland Hill was buoyed by the results saying, “We are delighted with the exceptional results from the joint pilot plant trial.

‘’The achievement continues to demonstrate the outstanding qualities of our flowsheet in delivering consistent and reliably high quality HPA product – a key requirement from a customer perspective.

‘’FYI is encouraged by the outcomes of the pilot plant and will continue to progress with the development of our HPA strategy and advancing the MOU conditions with Alcoa.”

Some HPA from the joint FYI and Alcoa pilot plant trial was retained for detailed internal analysis and product phase work.

In maintaining the company’s on-going high standard of quality control and product assurance, the additional pilot plant trial HPA samples will be forwarded to EAG Laboratories in New York for further independent, elevated Glow Discharge Mass Spectrometry (GDMS) analysis to provide supplementary data that is intrinsic to the level of purity that has been achieved by the collaborative trial production.

Following the final product finishing work of the trial HPA, samples will be sent to several potential offtake parties for further product qualification – particularly directed towards the LED lighting and lithium-ion battery (LiB) markets.

Alcoa agreement could trigger a wave of commercial activity

The production of 5N would allow FYI to target a broad range of markets, providing scale, client diversification and leverage to multiple price points, including a proportion of top-tier product segments that fetch in the order of US$50,000 per tonne.

Given the numerous share price catalysts on the horizon, FYI appears to have what it takes to attract significant investor attention in 2021.

The most likely near-term material development is the finalisation of the memorandum of understanding that has been struck with Alcoa.

It is worth noting that much could be read into a positive decision by Alcoa given its global industry recognition by other potential offtake partners.

The trial product will be particularly directed towards the LED lighting and lithium-ion battery (LiB) markets in particular, industries that are continually under the microscope with upward assessments in what is already considered an exponential growth profile.

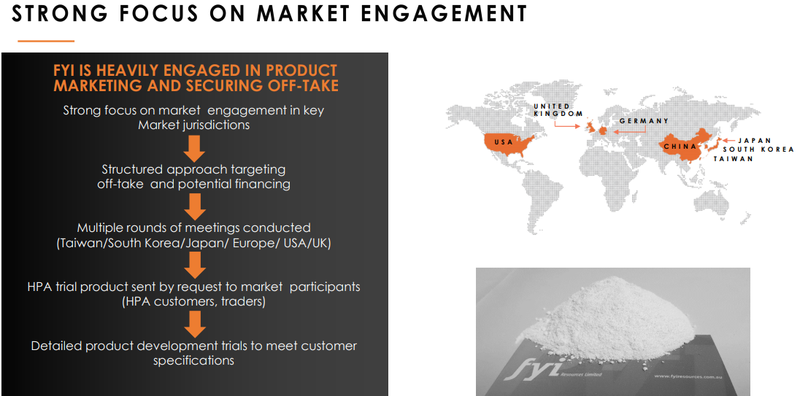

It is worth noting that FYI is already engaged in product qualifications with a number of targeted potential customers whom are focused on diversified applications and in specific jurisdictions – including South-East Asia, Europe and the US.

With management in discussions with other potential offtake clients, intermittent news on this front could commence in the coming months.

Combine these factors with the release of a revised project economics study in March and it is easy to see the company being substantially revalued.

The delivery of a successful final engineering report in the June quarter would position the company to confirm its decision to proceed to construction - another potential share price catalyst.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.