The Food Revolution Group (FOD) enters highly lucrative Health and Wellness market

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If there was a positive to come out of the COVID-19 pandemic, it was an appreciation for health and wellness among large swathes of the global population.

Lockdowns forced people to think long and hard about what they were consuming.

While some turned to the beers, or an extra glass of wine, many looked into ways to combat obesity, or to wellness products that could potentially help keep the virus at bay by strengthening their immunity.

These products covered all natural functional ingredients, increased protein through plant-based foods, delivered through healthy supplements and juices.

The health and wellness market was delivering double digit growth, but during the pandemic it took on a whole new life.

The health and wellness category in Australia is now worth over $650 million... and growing.

And the Food Revolution Group Limited (ASX: FOD) is carving out its own slice of this market.

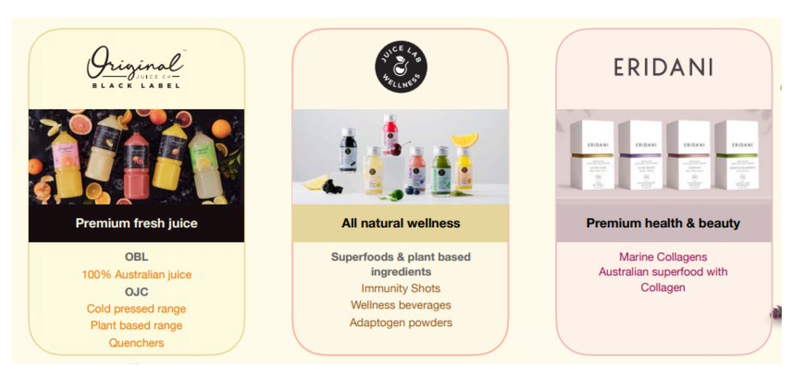

The Food Revolution Group is a food and beverage manufacturing company, specialising in the development of innovative health-focused products.

It is a leading provider of fresh juices, functional beverages, nutraceuticals, and wellness supplements that improve the quality of consumers lives in the use of all-natural ingredients.

Its product range can be seen below:

The Original Juice Black Label (OBL) products are its flagship range and since the Brand relaunch, OBL brand continues to grow market share with revenue growing at 18% as compared to the overall market growing at 4% over past 6 months. 100% Australian orange juice sector of the $560M fresh juice market, is showing dramatic growth due to consumers wanting to boost their vitamin C intake in strengthening their immunity with the best quality fruit available.

However, the company is currently diversifying.

Just this week it made an announcement re its plant-based all natural range of products targeting the $650M Australian wellness category. It launched its range of "Juice Lab Super Shots” – the first three variants are now selling in Coles.

The initial range includes:

- Juice Lab “Focus" which contains Ginseng, guarana, calamansi & ginger

- Juice Lab “Immunity” which contains Ginseng, turmeric & ginger

- Juice Lab “Digest” containing apple cider, acacia & wheatgrass

Initial sales data from Coles shows excellent initial consumer engagement, with sales forecasts increasing dramatically.

In fact, today the company announced sales of the Juice Lab Wellness shots are exceeding expectations and forecasts have had to be increased. The expected run rate when Coles launched the range was that the range would sell two units per store per week.

Following three weeks of the shots being available in over 160 Coles stores, the range of three variants are selling six to seven units per store per week. This is 200% higher than expectations. Forecasts are being reviewed between Coles and FOD management, the forecast cycle is updated monthly. This is part of the Coles integrated business planning process.

CEO Tony Rowlinson is excited by the rollout saying, “Being first to market with ‘all natural plant based’ product in the Wellness beverage category is a massive achievement.

“The US who lead the world regarding ‘better for you’ beverages has seen a dramatic growth of ‘all natural, pick- me up shots & tonics’ due to COVID -19 impact.

“Preventative Foods & Beverages is the fastest growing sector within the $4.8BN US market.”

Suffice to say, the expectations are this new product range will contribute to the increase in total sales and revenues the company is currently experiencing, with further expansion to look forward to.

“Although we have developed nine variants, the first three variants are now selling in Coles and are rolling out into Metcash, IGA, Drakes and Foodland from the 20th March,” Rowlinson says.

The numbers are stacking up

FOD’s roll out of products is responding to increased online consumer purchasing, which should assist in driving sales growth in 2021.

This growth has been set up by a stellar first fiscal half of 2021.

In the six month period to December 31st 2020, the company’s total sales were up 24% to hit $22.2M, delivering $2.2M EBIDTA versus $0.2m in the previous corresponding period – an improvement of over 1000%.

New products accounted for $1.5m in additional sales. The gross profit reached $5.69 million which equates to 31% of Net Sales.

This turnaround in financial performance reflects the improved trading conditions, increasing sales volumes and operational efficiencies.

It is a far cry from figures in the previous years, but can be evidenced by total juice sales for 1H FY21 of $20.7M. This figure is up 15% on the previous corresponding period and has been driven predominantly through the successful re- branding of Original Juice Co brand.

The OBL brand is ubiquitous in supermarkets, however you would be hard pressed to find anyone who could tell you that FOD Is behind it.

Through, under Rowlinson’s leadership that is set to change.

Rowlinson has implemented growth plans, is building the team’s capabilities and as such FOD has enjoyed dramatic profitable growth this financial year, along with greater brand recognition.

For a full analysis of the numbers and FOD's turnaround story read Wise Owl's Comprehensive report: FOD is an Emerging Turnaround Story in the Food and Beverage Sector.

Diversified products also drive growth

As consumers continue to seek out healthier and more environmentally friendly alternatives in the traditional beverage market, FOD is well placed via its range of healthy juices and functional beverages to service and grow in this section of the market.

The Original Juice Co Brand has been a household staple for over 30 years, and the relaunch of the brand, along with extending the range into functional juices, represents a quantum leap for the company and a vehicle for substantial growth in the near to medium-term.

The recent establishment of a new state of the art ‘wellness centre’ that has the capability to supply all natural food supplements will also assist the company in accommodating increased volumes.

Capitalising on the accelerated global trend for preventative medicines, foods and beverages accentuated by COVID, FOD is rolling out a range of wellness shots, beverages and plant-based wellness powder supplements across its Juice Lab Brand formulated from super foods and plant-based ingredients.

While well known for its juices, FOD is making its mark across the superfoods and broader health and beauty market segments within Australia, with the latter being another growth driver as the company launches new brands and products.

Without a doubt, the most significant product diversification has been the launch of the Eridani wellness range with the brand focused on a holistic approach for health and wellness under the premise that beauty is created from within.

Aligning the brand with the group’s underlying philosophy, the wellness range of products contain only 100% natural, sustainable and premium quality ingredients to deliver a range of health and beauty benefits.

The collagen market is worth in excess of $4.6 billion and set to exceed $10 billion by 2025 based on it being the best source of all-natural protein.

Eridani Premium Marine Collagen focuses on targeting the whole body with the addition of Vitamin C, Calcium and Magnesium, creating an age-defying inner beauty foundation with benefits internally and externally.

An extended range of Eridani products is being developed across FOD capabilities in powder, gel and liquid formats.

A growth story to watch

While FOD is generating the bulk of its revenue from one well-established brand, the broader company is very much in its infancy.

Unlike many touted potential growth stories, FOD has proven in a transitional year that it can generate significant growth in sales and earnings with the latter benefiting from astute operational management, a good sign for a growing business.

Having established the infrastructure to cater for an uptick in production to meet increased demand, the company shouldn’t have any near-term large capital expenditure.

Given this backdrop, FOD’s financial performance in the second half of fiscal 2021 appears fairly predictable in terms of mounting a base case scenario, not taking into account the degree of sales growth that can be realised from the rollout of new products into new and established markets.

It is apparent that there is the potential for FOD to undergo a value-based rerating, particularly if it achieves or surpasses the aforementioned earnings levels in fiscal 2021.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.