AusQuest and South32 renew Strategic Alliance Agreement

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

In a milestone development for AusQuest Limited (ASX:AQD), it has reached an agreement with South32 (ASX:S32) to extend the Strategic Alliance Agreement (SAA) between the two companies which has been successfully operating since its inception on 17 February 2017.

Not only does this strengthen AusQuest’s ability to continue its aggressive exploration strategy, the renewal of the agreement represents an endorsement of its ability to successfully identify new opportunities, providing both companies with the opportunity to benefit from early-stage entry into new projects.

The SAA has been extended for a further two years to 31 December 2021, subject to further extension. The parties have also taken the opportunity to update and improve the practical operation of this arrangement.

The SAA established an innovative framework under which AusQuest could use its extensive expertise to target new deposits and mineral provinces with major ore potential, to generate and secure prospective early-stage exploration opportunities which are offered exclusively to South32.

As extended, the two companies will continue to work together to develop a pipeline of high potential exploration opportunities both in Australia and internationally.

Targeted commodities in Australia, Peru and other agreed jurisdictions include copper, zinc and nickel with possible associated gold, silver and lead credits.

Under the SAA, projects secured by AusQuest and offered exclusively to and accepted by South32, undergo a staged evaluation process which sees them classified as either exploration opportunities or drill-ready opportunities.

If a project is rejected twice by South32, at either the exploration or drill-ready opportunity stage, it becomes a rejected property and will no longer be the subject of the SAA.

For exploration opportunities, work programs and budgets to advance each project to a drill-ready stage are agreed by the parties with South32 providing the necessary funds to complete the programs.

Incentives provided to move to prefeasibility study

All funding to advance projects to a drill-ready stage form part of the total earn-in expenditure of US$4.5 million for South32, entitling it to acquire a 70% interest in each project. South32 can then earn an 80% interest in each project by completing a pre-feasibility study.

AusQuest must prepare a drill program and budget of at least US$500,000 in value and following agreement on the program, a joint venture will be established. AusQuest will continue to be the first operator for each joint venture.

The SAA also includes an arrangement to incentivise AusQuest’s project generation activities, with South32 agreeing to pay AusQuest a US$300,000 bonus generation fee in the event that at least two exploration opportunities are accepted by South32 in a calendar year.

AusQuest will also receive an administration fee equal to 15% of monies expended on all projects under the SAA to help cover company overhead expenses and assist with the ongoing requirements for project generation studies.

Commenting on the financial and strategic benefits of the SAA renewal, as well as the significance of reaffirming what is already a strong partnership, Ausquest’s managing director Graeme Drew said,

‘’The agreement is structured to provide AusQuest with the financial capability to identify and evaluate opportunities as well as rewarding the company for success along the way.

‘’The extension of the SAA is clear recognition from South32 about the importance of the relationship with AusQuest and the value it creates for their shareholders.

‘’It also represents a strong endorsement of AusQuest’s credentials and technical skills, and is a vindication of the quality and scale of the projects we have been able to consistently bring to the table both in Australia and Peru over the past three years.’’

Implications for current projects

Six of AusQuest’s projects are currently exploration opportunities under the SAA with three in Australia and three in Peru.

Two have been the subject of initial drill testing of targets, being Balladonia in Western Australia and Hamilton in Queensland.

Follow-up drilling is proposed at these two targets, while three are being advanced towards drilling, being Tangadee in Western Australia, as well as Parcoy and Los Otros in Peru.

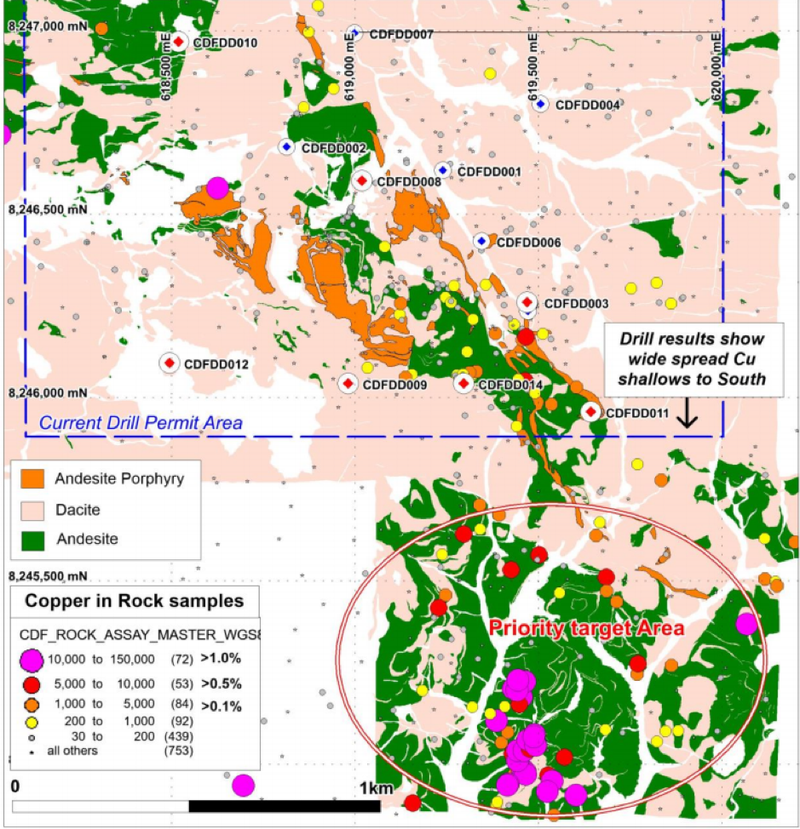

The following map highlights the widespread copper which lies to the south of the area where drilling has just been completed at Cerro de Fierro, and it also shows the new priority area that management intends to target.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.