Armadale Capital forges joint-venture to develop Mpokoto gold project

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Investors considering this stock should not base decisions on historical share price performances. Furthermore, the Mpokoto gold project is located in a region which carries sovereign risk. As an early stage initiative operating in a high risk region where getting mining projects up and running is no simple feat, those considering this high risk stock as an investment should seek independent financial advice.

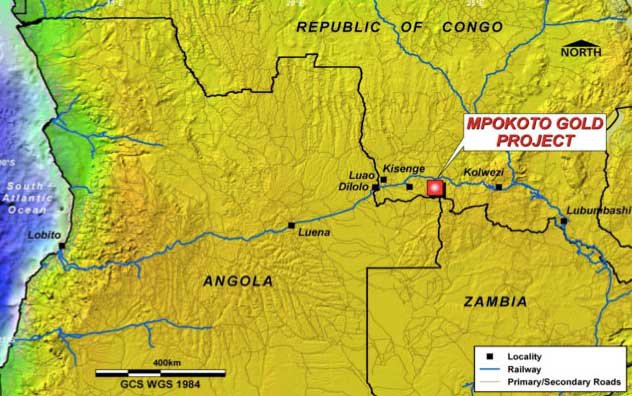

Investors responded positively to Armadale Capital Plc’s (LSE:ACP) decision to exercise its option regarding the formation of a joint venture with Kisenge Mining (KMP) with a view to developing and operating the Mpokoto gold project in the Katanga Province of the Democratic Republic of the Congo.

ACP is an AIM quoted investment company focused on natural resource projects in Africa, and its proposed involvement in the development of the Mpokoto project is in line with the group’s mandate.

Consequently, the circa 3% increase in the company’s shares was a reasonable response, particularly given investors appear to have shifted their focus from precious metals to base metals in recent weeks.

Current DFS to be refined

In terms of the joint venture agreement, Phase I will enable KMP to earn a 25% interest in ACP’s subsidiary, Kisenge Ltd, the joint venture entity, through providing funding and projected related services up to US$1.25 million, including incremental metallurgical test work, refining the current Definitive Feasibility Study (DFS) to incorporate financing the project and initial capital works.

In accordance with the Heads of Agreement, completion of Phase I would provide KMP with an option to proceed with Phase 2 which would involve further funding to bring Mpokoto into production.

Should KMP successfully arrange 100% of the funding it will receive a further 60% in Kisenge, lifting its aggregate interest to 85%, providing Armadale is satisfied KMP has fulfilled its obligations.

Clear line of sight to production

Reflecting on these developments and highlighting project metrics, ACP’s chairman William Frewen said, “Mpokoto has an established resource of 678,000 ounces of gold grading 1.45 grams per tonne and has completed a DFS based on annualised production of circa 25,000 ounces over an initial four year mine life for the first phase of mining”.

Importantly, the results of an expanded scoping study demonstrated a post-tax present value of US$55.3 million based on a discount rate of 8% and a gold price of US$1250 per ounce, slightly below the current price of circa US$1170.

Frewen views the project’s economics as attractive and is buoyed by the fact that there is a defined route to production.

Should the development strategy go to plan, ACP’s profile will change considerably given that it will have a material interest in a producing gold mine.

In tandem with the Mpokoto initiative management is progressing the next phase of the Mahenge Liandu graphite project where an initial JORC resource estimate is anticipated in coming weeks.

This is a potential share price catalyst, as is the upcoming release of results from metallurgical test work and the commencement of feasibility work which will be a key focus in the first quarter of 2017.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.