88 Energy cashed up to explore high-value targets in Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy Limited (ASX:88E; AIM 88E) has completed a bookbuild to domestic and international institutional and sophisticated investors to raise up to AU$10.07 million before costs through the issue of up to 1,678,333,334 fully paid ordinary shares in the capital of the company at an issue price of A$0.006 (equivalent to £0.033) per New Ordinary Share.

Each of the directors intends to participate in the Placement.

Accordingly, the company will seek shareholder approval for the directors to participate in the Placement by subscribing for a total of 11,666,667 New Ordinary Shares.

A shareholder meeting notice will be dispatched shortly and made available for shareholders on the company’s ASX platform (ASX:88E), with the anticipated meeting date for the upcoming general meeting scheduled towards the end of December 2020.

The capital raised under the Placement, together with the company's existing cash reserves (A$4.6 million as at 30 September 2020, inclusive of Joint Venture cash), will be used to fund the ongoing evaluation of the conventional and unconventional prospectivity of the company’s existing assets.

Funding to assist in progressing Peregrine

This includes its share of any potential costs in respect to the Peregrine wells, which are due to spud in late February 2021, and to enable it to identify and exploit new opportunities on the North Slope of Alaska.

By strengthening the company’s balance sheet, the Placement will also provide the company with sufficient capital to fund well costs for Project Peregrine wells above an anticipated farm-out/carry.

The company will be in a position to meet lease rental payments, service its debt facility, apply funds towards new venture opportunities and finance ongoing general costs.

Managing director Dave Wall provided some further details on the application of funds and upcoming operational developments in saying, "Completion of this placement positions the company strongly as preparations continue for the drilling of the Merlin-1 and Harrier-1 wells which will test multiple conventional targets, in the March quarter of 2021.

"Final documentation in relation to the Peregrine farm-out with the preferred bidder is progressing with execution of final documents expected in the next few weeks.

Planning and permitting remains on schedule for a late February 2021 spud of the first well at Project Peregrine.

Read: 88E is Primed for Another Run in Lead Up to Multi-Billion Barrel Drilling Event

Momentum builds at Project Peregrine

Project Peregrine received a shot in the arm in September when reprocessing of data collected in 2019 and early 2020 demonstrated that the resources attributed to Peregrine could be much more substantial than originally estimated.

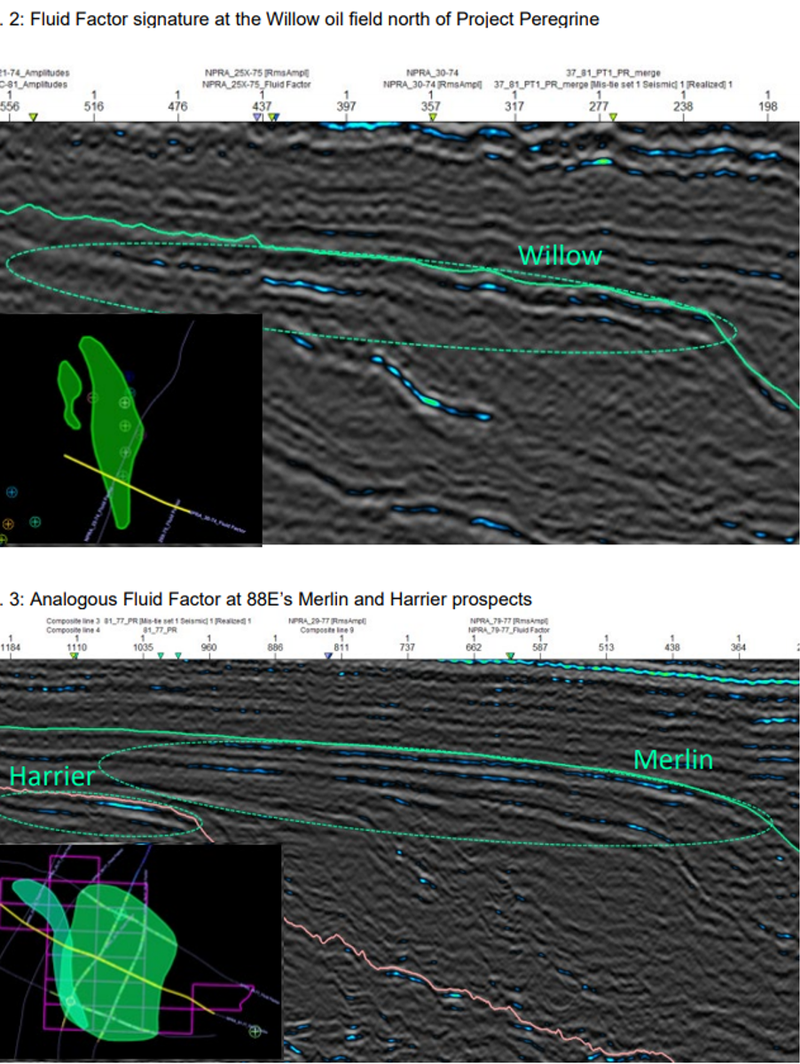

The studies were calibrated to the existing Willow oil field to determine if similar attributes (in addition to those observed on the reprocessed seismic) could also be observed at the Project Peregrine prospects, Merlin and Harrier.

As indicated below, the signatures observed, in particular for Fluid Factor, are very similar between the Willow oil field and the Merlin and Harrier prospects.

The Willow oil discovery is considered a direct analogy to the Merlin prospect.

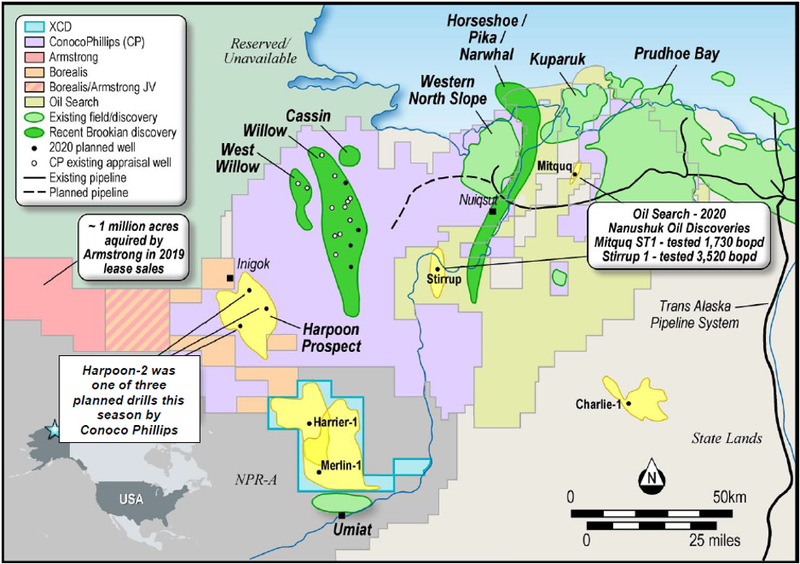

Adding further flavour to the story is the fact that the Harpoon prospect is just 15 kilometres north-west of Project Peregrine’s lease position.

Shallower wells make for cheaper drilling

The Harrier-1 and Merlin-1 exploration wells will be drilled into the shallow Nanushuk reservoir using a lightweight workover rig that can be transported off-road in pieces by tundra-safe track vehicles, versus a heavier rotary rig which would require an ice road.

As indicated below, the Peregrine Project lies directly to the north of the Umiat oil accumulation that is estimated to have greater than 1.0 billion barrels of oil in place.

The Peregrine leases are also just 35 kilometres south of ConocoPhillips’ 450 to 800 million barrels of oil equivalent (MMBOE) Willow discovery.

Existing gravel roads and snow trails will be used to conduct the entire exploration program.

Given both prospects are in the Nanushuk formation, the wells will only require drilling to about 5,000 feet to fully test, whereas a third prospect in the Peregrine block, Harrier Deep, has a Torok objective at about 10,000 feet.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.