88 Energy up 16% as drilling starts in Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in 88 Energy Ltd (ASX:88E) opened 16% higher on Tuesday morning as the company announced that it had commenced drilling the much anticipated Charlie-1 appraisal well in Alaska.

The company’s share price has held up very well despite the broader market sell-off, and it is now trading broadly in line with where it was at the start of the month.

The Charlie-1 well has been four years in the making for 88 Energy, beginning in 2016 when the company first acquired 2D seismic over its Project Icewine acreage.

Since that time, 88E has reprocessed legacy 2D seismic (2017), undertaken a targeted acreage expansion and then shot modern 3D seismic (2018) before farming down (2019).

Commenting on this backdrop and looking to the future, managing director Dave Wall said, ‘’A prospect of this calibre in a frontier region requires significant time and effort to come to fruition and we are optimistic that success is just around the corner.’’

The Charlie-1 appraisal well has been designed as a step out appraisal of a well drilled in 1991 by BP Exploration (Alaska) Inc called Malguk-1 which encountered oil shows.

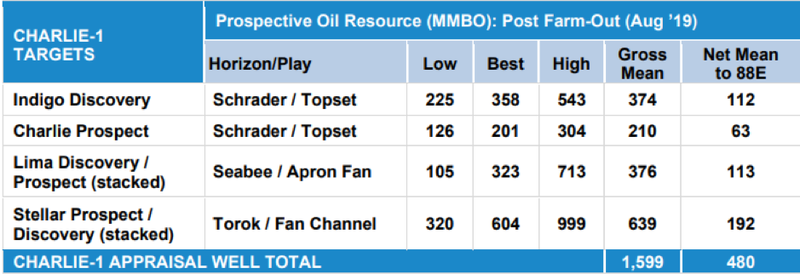

The total Gross Mean Prospective Resource across the seven stacked targets to be intersected by Charlie-1 is 1.6 billion barrels of oil (480 million barrels net to 88E).

Each of these targets could be a potential standalone development in its own right and, when combined, the aggregate gross mean prospective resource potential is 1.6 billion barrels of oil, 480 million barrels of which is net to 88E given its retained 30% interest.

Premier Oil farmout

The cost of the Charlie-1 appraisal well will be funded by Premier Oil Plc (LON: PMO) up to US$23 million under a farm-out agreement that was executed in August 2019.

Premier Oil is a £850 million (A$1.6B) capped oil company with 80,000 barrels of oil equivalent per day in production.

In exchange for funding the well, PMO will gain a 60% working interest in a circa 40% portion of Project Icewine’s conventional acreage in Area A, or the ‘Western Play Fairway’.

To further fund its operations, on 24 January, 88 Energy completed a share placement, raising A$5 million (£2.6M) at a price of A$0.021 (equivalent to £0.011).

88 Energy intends to use the capital raised to fund potential costs of the Charlie-1 well above the Premier Oil carry, as well as to fund lease rental payments, interest payments due on the debt facility, new ventures opportunities, and finance ongoing working capital and general and administrative overheads.

The fact that 88 Energy is now trading in line with the January placement price is a good sign in terms of measuring investor support.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.