Uranium prices at decade highs - GTR drilling for more uranium

Our US uranium Investment GTI Energy (ASX: GTR) just detailed its upcoming exploration programs.

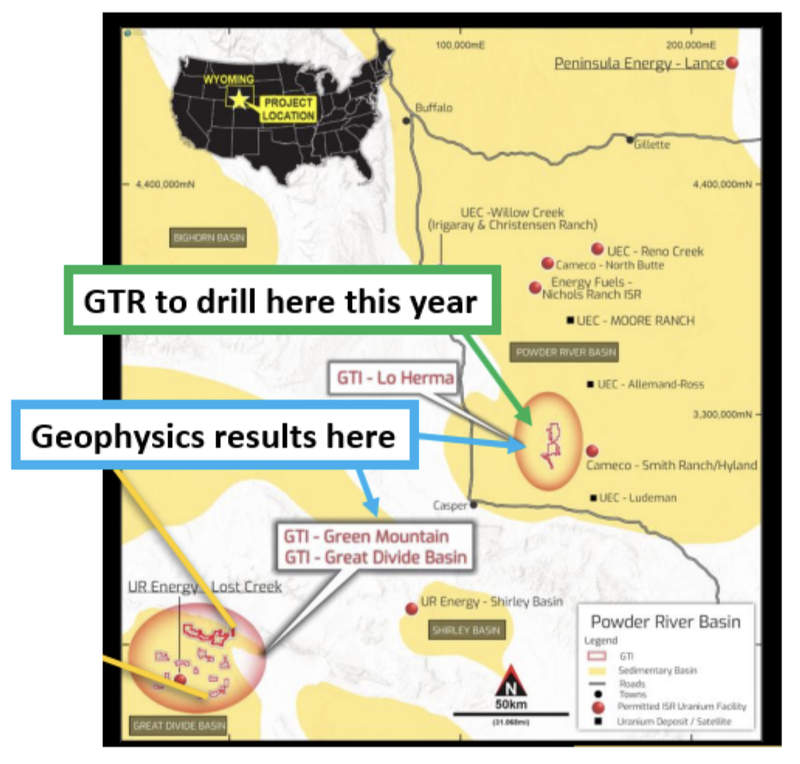

GTR’s projects sit in Wyoming, the uranium capital of the USA.

At the moment, GTR has a JORC uranium resource of ~7.37m lbs across three projects, all within ~80km of five permitted, ready to go uranium processing plants.

Now, it's all about increasing its resource base.

Today, GTR laid out its exploration plan:

- Geophysics results due soon - GTR expects to announce the results from its aerial EM surveys run across its three projects. The results will ultimately determine the best spots for GTR to drill.

- Drill permitting on track for October - GTR expects to have permits granted for its 26 hole ~4,500m drill program in October.

- Drilling expected to start in November - GTR expects drilling to start in November focused primarily on its Lo Herma project.

With the uranium price on a run of late we think GTR could be drilling just as the uranium macro thematic heats up.

Uranium Macro heating up:

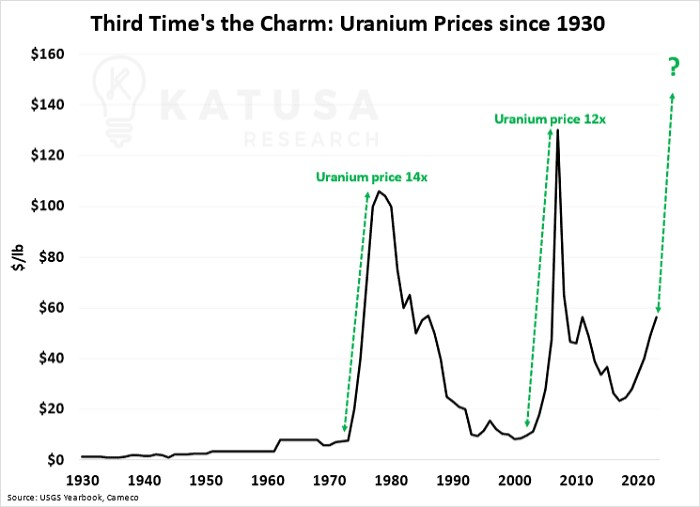

The uranium price has just hit decade highs and is signalling a potential third bull market.

The first uranium bull market was in the 1970s-80s when the price increased by 14x.

The second was in 2007-2009, when the price increased by over 12x.

One thing both of those bull markets had in common was that when spot prices started moving, they increased exponentially.

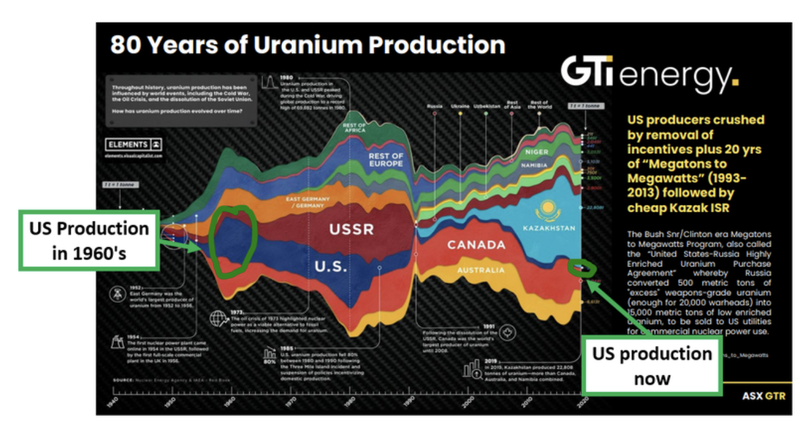

We think the uranium market is heading into a period of structural shortages, made worse by the Russia/Ukraine conflict which threatens to hit the enriched uranium supply chain.

For some context - ~20% of the USA’s enriched uranium capacity comes from Russia.

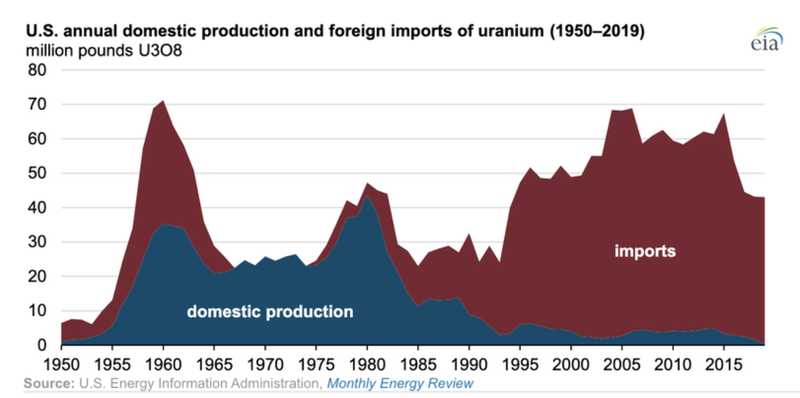

At the same time the US is almost solely reliant on imports for its uranium supply even though it has the worlds largest nuclear reactor fleet.

Basically, the US finds itself in a position where it has almost no domestic uranium supply chain BUT generates ~30% of its electricity through nuclear power.

(Source)

Interestingly, the US was once the world’s biggest uranium producers in the 1960s.

(Source)

We think the recent run in the uranium spot price is in part due to structural supply shortages after decades of underinvestment in new supply AND a combination of the fragility in the nuclear power supply chain.

The US government is looking to get ahead of it and has already introduced up to ~$10BN in funding support for the domestic uranium/nuclear industry:

- US$6BN to maintain and upgrade existing nuclear power plants

- US$4.3BN to wean itself off Russian uranium supplies.

As the price runs, we expect to see capital flow into Wyoming, which we think will be the centre for the US uranium renaissance.

Capital is currently flowing into companies that are closest to production or already in production.

As the uranium price moves higher, we expect to see investor capital shift from the bigger companies into the higher risk/higher reward junior companies like GTR.

What’s next for GTR?

- Permitting for drilling at Lo Herma (late 2023/H2 2024) 🔄

- Geophysics (target generation work) results 🔄