SGA achieves graphite thermal purification scale up

There was significant positive news today out of our graphite Investment, Sarytogan Graphite (ASX: SGA) - the company has just announced the successful scale up of its thermal purification process in conjunction with the company’s US technology partner.

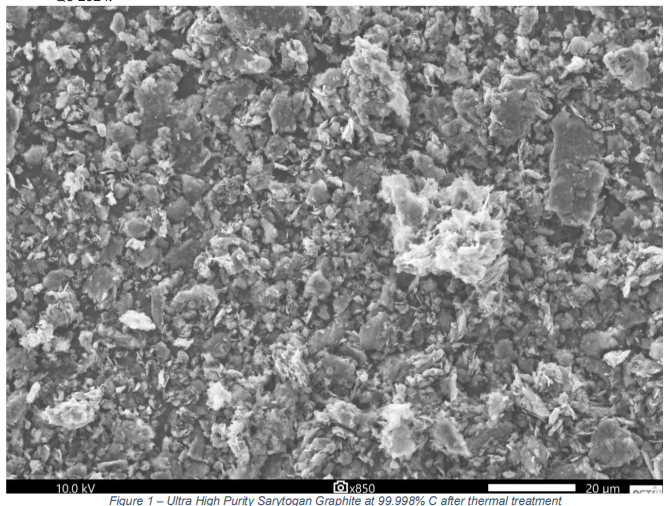

Today, SGA put out its latest purity numbers from its thermal purification process - the company achieved a new best of 99.998% C from 81.4% graphite concentrates at the kilogram scale on its first effort.

This is an important step for SGA, and it comes at a time when graphite is front and centre following recent export controls on graphite imposed in China.

It shows the company is scaling up its flowsheet, which should have additional benefits for the economics of its project as it moves towards PFS completion by Q3 2024.

The US has at least 34 gigafactories in the pipeline, and the IRA is driving capital to ex-China battery materials suppliers.

We’re hoping SGA can become a large part of the future graphite supply chain - especially considering that SGA has the highest grade resource on the ASX and the second largest graphite resource on the ASX in terms of contained graphite.

Strategically located in Kazakhstan - SGA’s announcement today lays the groundwork for a potential push into the North American battery anode market.

SGA is pursuing thermal purification as it is more environmentally friendly, bolsters the company’s ESG credentials for increasingly picky EU and North American customers and the process is economically attractive in places with low energy prices such as Kazakhstan.

This is what the ultra high purity graphite looks like up close:

That type of purity facilitates battery testing which will take place early next year, according to SGA.

Ultimately, we want to see SGA become a major player in the graphite supply chain and being able to sell value added high purity products forms a major part of our Big Bet for SGA:

Our SGA “Big Bet”

“Given this graphite project’s strategic location in between China and Europe, we hope that if SGA proves out the size and economic extractability of the resource, it will generate interest from major mining companies, leading to a takeover of SGA for $1 billion+.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our SGA Investment Memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

While the market has yet to re-rate a number of ASX-listed graphite stocks, such as Syrah Resources in any sustained way - we remain confident that the graphite macro thematic will improve as moe EV companies and governments recognise the criticality of the battery material.

At the moment, China mines ~80% of the world’s graphite and controls almost all of the world’s processing capacity.

What’s next for SGA?

Flowsheet optimisation at scale 🔄

Having now surpassed 99.998% C purity levels with its thermal purification process, the next phase of work will be about optimising and scaling up its flowsheet.

The whole purpose of the current stage of works is to try and test SGA’s flowsheet with larger sample sizes and see if it is scalable.

Spheroidisation is the next step which unlocks battery testing.

Battery testing 🔄

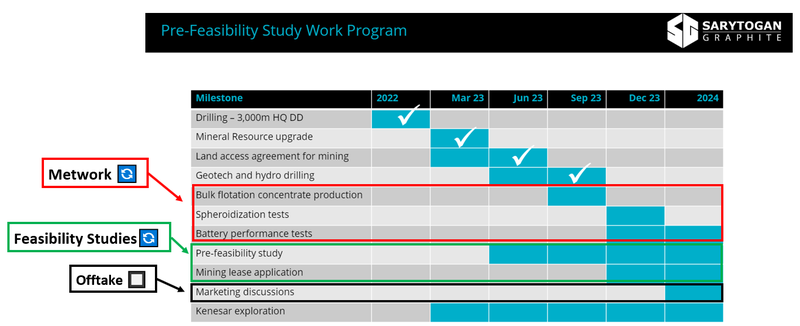

Feasibility Studies 🔄

SGA expects to deliver the Pre-Feasibility Study (PFS) in Q3 of 2024.

In today’s announcement, SGA confirmed that the spheroidisation and battery testing would be the next bit of information plugged into the PFS.

As SGA proves it can scale its flowsheet and pending spheroidisation and successful battery tests, we expect SGA will look to begin product qualification with potential end users.