KNI’s new Swedish lithium projects

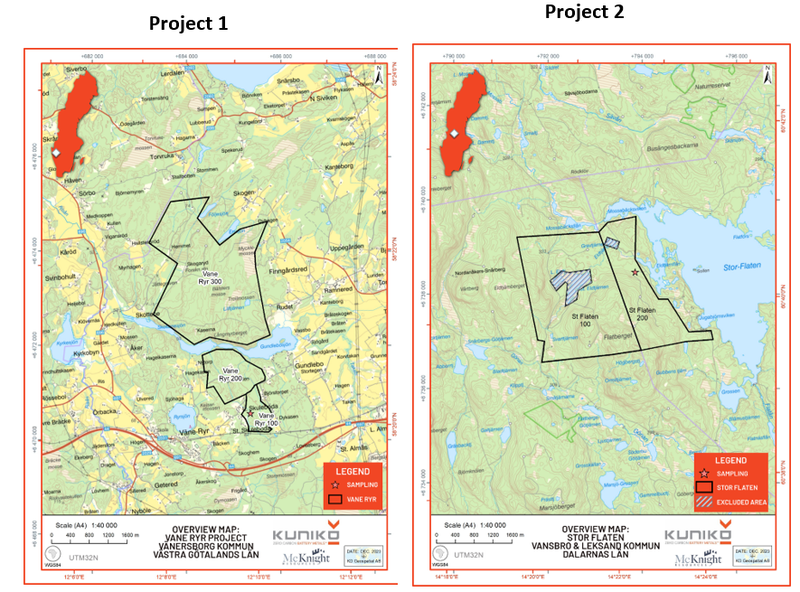

Today, our Nordic focussed battery materials Investment, Kuniko (ASX: KNI) announced it is acquiring a 70% interest in two lithium projects in Sweden:

Both are relatively early stage greenfields projects - meaning KNI still has a lot of work to do before it drills.

The projects are still under application and expected to be granted inside this quarter, after which KNI will have to do rock chip/soil sampling to work out the highest priority drill targets.

Geologically, the projects are chasing a similar style of discovery to another one of our Portfolio Company’s projects - the European Metals Holdings Cinovec project - the biggest lithium project inside the EU.

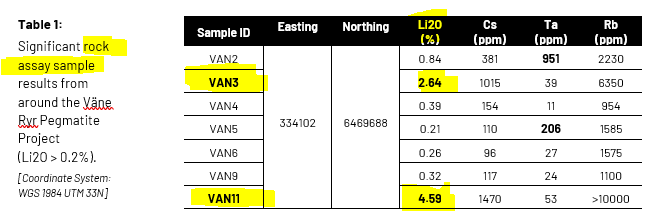

Both of KNI’s new projects have not been explored since the 1980-90s and KNI is primarily targeting lithium.

Despite the lack of exploration, historical sampling has turned up rock chips grading as high as 4.59% lithium.

It's still early days for the project especially considering exploration permit applications are still pending.

Ultimately, the goal will be to try and define a Cinovec style resource where tonnage is more the emphasis as opposed to grades.

The geology is different to the projects we are used to seeing across WA (spodumene bearing), BUT the geographic context is important when it comes to EU based lithium.

The continent has virtually no other lithium projects/deposits and IF the continent is serious about building domestic supply chains, it needs to try and commercialise whatever resources it has.

Eventually, we think EU funding will flow into unlocking lithium resources from projects with different geology to the spodumene hosted deposits we see being mined in WA.

The perfect example of this happening was the US$67M in funding the UK government awarded to Cornish Lithium aimed at unlocking its project in the UK.

(Source)

This company’s test work, along with the Cinovec testwork, has shown the possibility of unlocking less energy intensive processing.

All up, we see KNI’s move into lithium exploration as a low cost exploration effort that could unlock significant upside if it is successful.

What’s next for KNI?

JORC resource at nickel project 🔄

The next major bit of newsflow we are waiting for from KNI is from its nickel project in Norway.

KNI ended 2023 with drill results from the Ertelien nickel project and confirmed that work was ongoing around announcing a maiden JORC resource estimate for the project.

Back in 2009 the project previously had a foreign (non-JORC) resource estimate of 2.7mt at 0.83% nickel, 0.69% copper and 0.06% cobalt.

After the resource estimate, KNI’s plan is to go back and drill for extensions to the deposit at depth so there is even a chance the resource gets upgraded later in the year (assuming the drilling returns good results).

At the moment, our focus is on seeing what comes from the maiden JORC announcement.

One of the key reasons we are Invested in KNI is to see it discover and define JORC resources on projects in the EU that get developed or taken out - this forms the basis for our KNI “Big Bet” which is as follows:

Our KNI ‘Big Bet’

“To develop a sustainable battery metals mine within European borders that is of strategic importance - and hence highly valuable as an acquisition target.”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved, and it will require a significant amount of luck. There is no guarantee that it will ever come true. Some of these risks we list in our KNI Investment Memo.