EMN awards EPCM contract, gives permitting update

Today our European and North American high purity manganese Investment, Euro Manganese (ASX:EMN) announced that it had awarded a Engineering, Procurement, and Construction Management (EPCM) contract to Wood Australia.

This edges EMN closer to making its Czech manganese project a reality at a time when Europe and North America are increasingly keen to secure friendly supply of high purity manganese, an important component of next generation battery chemistries for EVs.

The two phase contract will be structured in the following manner:

- Phase 1: Front End Engineering Design ("FEED") - The FEED stage would basically review all of the costings in EMN’s Definitive Feasibility Study (DFS). Completion of Phase 1 is anticipated to take approximately 12 months, with a Final Investment Decision ("FID") to be made prior to commencement of Phase 2.

- Phase 2: Engineering, Procurement and Construction Management - After a Final Investment Decision is made, EMn will enter into the project construction and management stage which includes detailed design, procurement, construction, and commissioning.

We like this as it allows EMN to get a head start on setting up the project for production while it awaits final permitting and debt + equity financing for the project.

We think the 12 month horizon indicates that EMN feels it can wrap up the financing and permitting quickly.

High purity manganese promises to be an increasingly important part of the battery supply chain - currently production and processing is heavily concentrated in China.

Currently 97% of high purity manganese comes from China.

Update on Permitting:

In other news today, EMN said that three key permitting hurdles remain which are - Environmental Social Impact Assessment ("ESIA") approval, the Land Planning Permit, and then finally the Construction Permit.

EMN noted today that 14 relevant authorities commented on the ESIA, with some minor noise abatement issues remaining.

All but one of the authorities approved the application.

We think with continued stakeholder engagement, and the regulatory momentum generated by the proposed EU Critical Raw Materials Act, there is a good chance that this issue can be resolved for EMN.

What’s next for EMN?

Feasibility study on North American

The company has delivered a positive scoping study on the North American project, with a feasibility study for the Bécancour dissolution plant in the works. Located in Quebec, Canada - this is a rapidly emerging battery hub and we want to see EMN be a part of it.

Further offtake updates 🔄

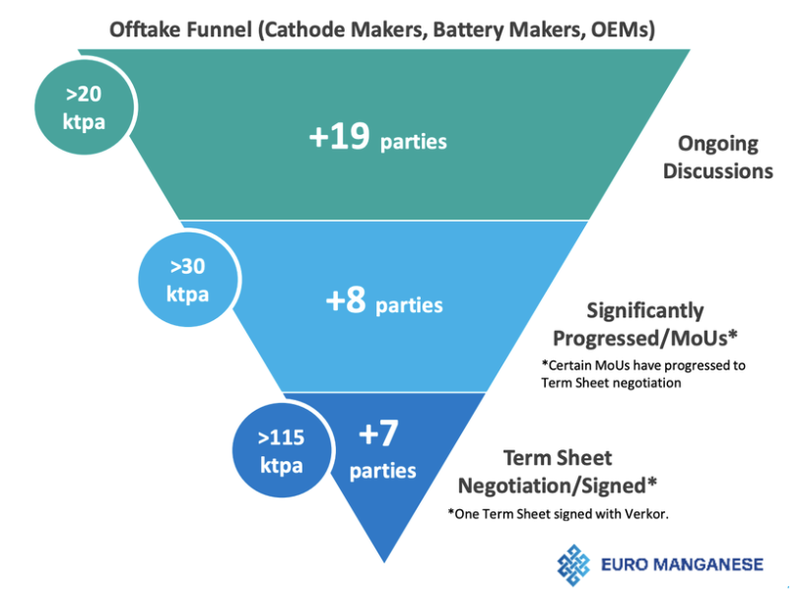

Shortly after the arrival of the EMN Demonstration Plant, EMN signed an offtake term sheet with French battery manufacturer Verkor.

EMN is at the “Term Sheet Negotiation” stage with at least six other parties, so we hope the company can close out these deals soon:

We think EMN is maximising value by extending offtake negotiations given demand for over 100% of EMN’s annual production capacity. Our view is that this strategy will pay off in the long run.

Update on financing 🔄

EMN has flagged it is seeking a mix of debt and equity - closely bound up with offtake discussions, when these two things happen it may surprise the market and we think EMN may experience a sharp valuation uplift as the project aligns all the pieces necessary to make it a reality.

Land Planning Permit 🔄

Anticipated approval by mid Q2 2024 - this will follow the ESIA approval.

Construction Permit 🔄

Anticipated approval by Q3 2024 - final hurdle after Land Planning Permit.