Opinions split over housing affordability

Published 29-MAY-2017 14:36 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Debate on housing affordability in Australia continues, with several industry leaders weighing in over the past month.

Former Future Fund Managing Director and Chairman of asset management firm Yarra Capital, Mark Burgess, believes Australia’s property market will soon wane.

Burgess, who also serves as the chairman of the investment committee for industry fund HESTA, claimed it was difficult to see how the global economy could maintain the trending stability it has demonstrated over the past decades.

“A trend can make you look a lot smarter than what you are, I’d say my career has been built on a lucky trend. This has essentially been a golden 30 years for equities.”

Burgess puts this sustained period of stability down to “Good growth and a rising share of GDP for corporations.”

Whilst presenting at a Melbourne business breakfast on May 25th, Burgess said he believed increased levels of immigration and flat wage growth were making the market difficult to break into for the incoming generation.

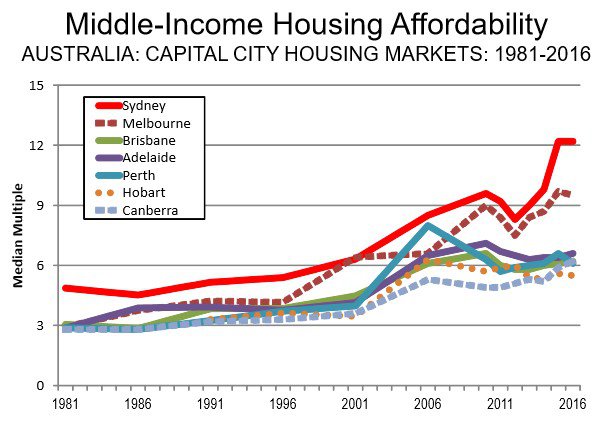

Australian house prices have ballooned over the past decade, with the average median price in some cities exceeding 10 times the average income. Melbourne and Sydney have been at the forefront of the phenomenon, sustaining double digit rises over several years.

In addition, Burgess noted that Australia’s extraordinary appetite for investment properties was a concerning sign, which could impact the market moving forward.

“We have this strange thing that you don’t see anywhere else in the world with property investment. Two million people had investment properties in 2013 and I’m sure it’s much higher today.”

Burgess said the level of investment was unsustainable.

“Supposing we had some disaster, people will try to sell one of their investment properties. If it’s a real disaster they will stick the other five on the market and see which one sells. Many of the others will do the same thing and we will have our moment of correction.”

In contrast, Simon Pressley who is the managing director of Propertyology, believes public opinion about the affordability crisis is inaccurate.

“Let’s be honest, the housing affordability ‘crisis’ is Sydney-centric. Sydney has issues, there’s no denying that – but that’s nothing new. It’s been the most expensive city in the country for the last five or six decades.

“We need to look outside of Sydney and have a conversation about the rest of Australia. You can buy affordable properties under $500,000 in locations across Australia, including houses for $350,000 to $400,000 in capitals such as Brisbane and Hobart,” he explains.

Pressley believes a proactive approach, such as waiving stamp duty to those who relocate from large urbanised areas, could improve affordability in larger cities.

However, Pressley’s opinion may falter under recent property performance.

Alena Chen, who is the Senior Analyst and vice president of Moody’s Investor Services, reported a decline in affordability in the first quarter of 2017.

The report, which examines house prices across the five major cities in Australia, supported the popular narrative of home ownership being out of reach for many Australians.

“Rising housing prices outstripped the positive effects of lower interest rates and moderate income growth,” she said. Chen pointed to the continued gains of markets in Sydney, Melbourne and Adelaide as a sign that affordability was not improving anytime soon.

“In the near term, we expect housing affordability to continue to deteriorate because of ongoing housing price increases.”

Whilst improvements were noted in Perth and Brisbane, the average median price across both cities was roughly $750,000 as of March 2017, which is still around five to six times higher than the average income today.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.