Fatally flawed or ‘fixer upper’? How to upsell a dud

Published 28-JUN-2017 16:29 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Selling a property can be taxing.

That’s not just a sneaky reference to the raft of mandatory tax levies, routinely bestowed upon property wheelers and dealers. The fact remains that selling a property is tough — but help is at hand.

Courtesy of the market-stomping power wielded by ‘perspective’, selling property has become largely about emotion and wherewithal. If you have what it takes, you can move on even the more bedraggled properties out there (and for a pretty penny too).

Buyers Beware: The amount of housing stock is dwindling nationwide, while the number of prospective buyers and residents is skyrocketing — property is now officially, a seller’s market.

Here are some tips that will help you re-establish value in your property, and attract the long-awaited buyer you’ve always dreamed of.

Sell It Like You Mean It

The first step to selling your property, starts with yourself.

Ask yourself this question: “Am I ready to sell this property?” and also consider the likelihood of someone wanting to buy it ‘as-is’.

It is often recommended to put some elbow grease into tidying up your former home before selling, but with the property market stuck in ‘perma-flate mode’, there’s hardly any reason to bother, these days.

Take the example of Levy Birdlegranger, a brand-new addition to the Melbourne property ladder last year, upon splashing down in excess of A$500,000 in exchange for his first rung on the property ladder on the outskirts of Toorak — described as a “remarkably flexible, open-space palatial nirvana, including sprawling rooftop terrace”, by its estate agent.

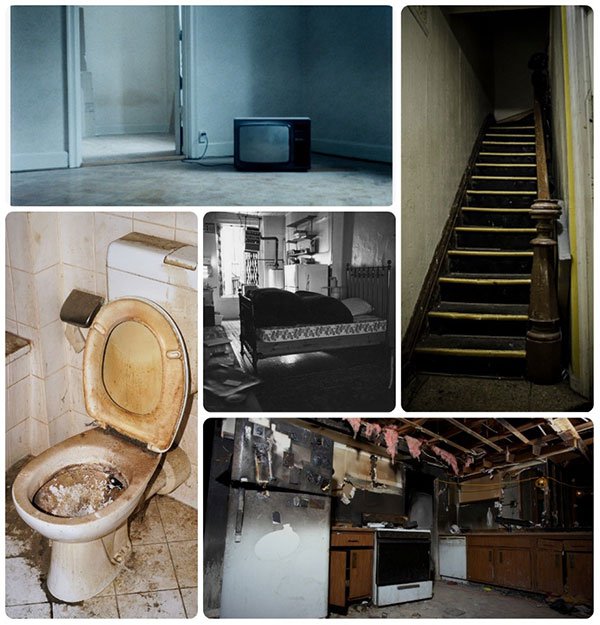

Here it is:

“I was absolutely dumbstruck by this acquisition,” says Birdlegranger.

“As a millennial, squabbling for part-time work and peer recognition, I was delighted to have my tentative offer of A$754,000 accepted immediately without further negotiation. The seller must have had pressing issues, and I took advantage”.

Bottom-of-the-cycle: Rustic interior of a house which sold for A$785,000 last year.

“I know it’s a bit of a ‘fixer upper’, but being on the property ladder is crucial. The other youngsters just don’t get it — if you’re not on a ladder of some sort or another, it means you’re not getting ahead, and you’re lagging behind.

Property-rung-bound, Levy Birdlegranger (right), and soon-to-be-fiancé, Abelladonna McBore-Masterson-Smithe (left).

“If I have to claw my way up the property ladder, by sinking every cent I have into DIY costs; well then, so be it,” says Birdlegranger. “Maybe I’ll learn something,” he adds with a whimpering smile.

“I’ve got no problem with Levy’s life goals — I let Levy do whatever he wants. We’re like two peas in a pod, so as long as he keeps me warm at night, I’ll still love him...Oh wait...” murmured Abelladonna McBore-Masterson-Smithe.

Amplify the Positives &

Mute the Negatives

Hugely important when transacting real-estate, is amplifying the positives and muting out the negatives.

This tip is one of the first to be mentioned, but all too often, the last thing sellers follow, when getting rid of their dilapidatedly distressed stock.

“What it comes down to at the end of the day, is how you appeal to, and incentivise, the emotional side of the buyer,” says Mr. Joli Gunkpeddla, a Melbourne-based “real-estate poverty[sic] management magnate”.

Mr. Joli Gunkpeddla, scoping his next real-estate project.

“I’ve been flogging houses for years, and I’ve never seen business this good. I can pretty much walk up to a house that looks like it’s recently been hit by a missile; have it listed on Gumtree first thing Monday, and I’d bet my last nut on having a genuine prospective buyer visiting before the weekend. With average house prices so inflated, even this manky stuff is selling fast.”

But who would be so naïve, as to think such properties are available (or liveable)?

“There are two distinct client types,” says Gunkpeddla. “Young lovesick couples and urbanised pharmaceutical distributors — they both want it all, and they want a house to go with it”. “Young couples always pay, and never bite back. Urban pharmaceutical distributors never pay and always bite. I’ve seen it all in the past few years — so I know what it takes to motivate a buyer.”

“Prospective buyers are just crawling over each other to see their name in print, or on a deed. They’re willing to go to extreme lengths, and commit extreme deeds to make it happen too”.

According to Joli Gunkpeddla, selling distressed or dilapidated property is “a lot like making love to a beautiful woman. You have to know what you’re doing, or there will be trouble,” he says. “And a lot depends on how selective you are at managing human emotions and cajoling the buyer into agreeing to buy. It’s a technique developed over several years of property sales experience.”

Take this rustic home in St. Kilda, Melbourne as an example — many will say such as property is “unsellable”. But after securing professional consultation services from Joli Gunkpeddla, the house sold within days for a “low-ball” offer of A$1.85 million.

“I accepted immediately,” said the bewildered seller, un-named for legal reasons. “I can’t believe this worked, it’s beautiful. Now I believe in the American Dream.”

“The seller should have held on for more,” according to Joli.

Money Matters

An age-old adage in real-estate is, ‘a properly-priced house always sells — it’s just that sellers don’t want to hear the proper price’.

Rest assured that this adage is entirely true. For a seller of a house, that even a violently-displaced interloping ragamuffin would think twice about inhabiting, it may be wise to remain flexible with regards to asking prices.

Ask for what you yearn for — and you shall not receive.

Ask for what the other sucka is willing to pay — and you will receive cash in exchange for property.

Keep Your Eye On The Prize

Make sure you keep your endgame at the forefront of your mind, at all times. And remember, selling property is solely dependent on the buyer signing on the line that is dotted.

Equally important, is to never allow third parties to sway you from your destiny of passing your property quagmire onto some other poor sap, who’s either too slow, or too thrifty, to realise what on earth has happened to his inspired property acquisition and in tandem, the large amount of capital he’s sent down the swanny.

Don’t Get High On Your Own Supply

With the right training in offloading property, an easy pitfall for any maturing property entrepreneur, is drinking their own cool-aid and buying up dilapidated properties for addition into one’s own property portfolio.

The easy solution is to just take a step back — and realise that only a fool would pay good money for property that needs major structural work and more money spent on it, than the original asking price. Have a day off will ya...

The Real $tat€ of Property

Properties such as these two, needn’t evoke backside-clenching experiences, just to see them get sold:

Working smarter, not harder, and remembering to follow the tips provided, should give trailblazing property sellers just the start they need.

That dilapidated property which you once felt was like an anvil you had to carry around, can actually generate some welcome returns in the sellers’ market of today.

Selling your rust-plagued, structural-integrity-challenged death trap — otherwise known as a ‘fixer upper with great potential’ — can be a doddle. So fret not and get busy.

The great news, is that selling property of this nature can conjure up previously unforeseen retirement savings, supplement your creche fund, and could even pay for an exotic family holiday in Wagga Wagga.

Struth.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.