Worrying weather & can iron make 'clean' hydrogen?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Late on Saturday night, the UN Climate talks ended in Poland with a negotiated deal for how Paris signatories can put the 2015 landmark agreement into action — a ‘rulebook’ of sorts, for the Paris goals.

While this was a cause for celebration for some, several critics believe the deal left a list of contentious and urgent issues still to be resolved — and that its stipulations are not ambitious enough to prevent the dangerous effects of climate change.

A key criticism of the ‘rulebook’ — agreed to by nearly 200 countries at the Summit — is that the framework does little in terms of increasing governments’ commitments to cut emissions, with scientists stating that the world remains on track for 3C of warming and with it, catastrophic extreme weather.

The Paris Agreement aims to limit a rise in average world temperatures to below 2 degrees Celsius above pre-industrial levels.

Still, some were feeling optimistic about Sunday’s achievement, including Alden Meyer of the Union of Concerned Scientists who said: “While some rule book elements still need to be fleshed out, it is a foundation for strengthening the Paris Agreement and could help facilitate US re-entry into the Paris Agreement by a future presidential administration”.

But a throng of critics are very concerned, including executive director of the 350.org climate change campaign group, May Boeve.

Boeve said: “Hope now rests on the shoulders of the many people who are rising to take action: the inspiring children who started an unprecedented wave of strikes in schools to support a fossil-free future; the 1,000-plus institutions that committed to pull their money out of coal, oil, and gas, and the many communities worldwide who keep resisting fossil fuel development.”

Hope is needed, as Australia, like the rest of the world, currently face a flurry of extreme weather events front on.

This last week or so in Australia has brought with it some pretty whacky weather, to put it bluntly.

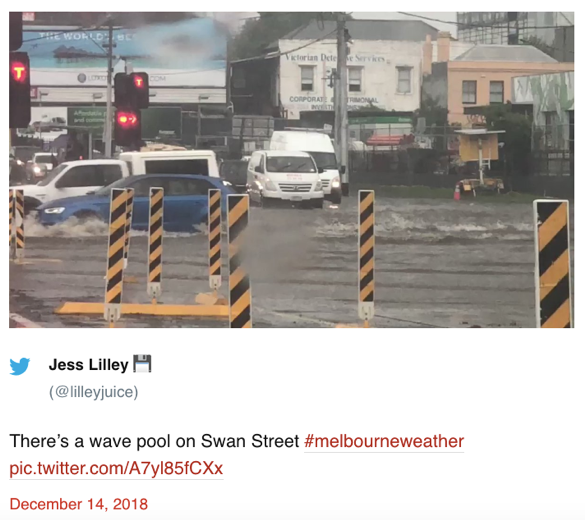

A quick snapshot of headlines from the country in the last week include the likes of ‘Victoria's freak floods prompt 1,400 calls for help’; 'Exceptional' rain from ex-Cyclone Owen dumps 681mm in north Qld in a day’.

In Sydney, we saw ‘Thousands lose power as wild weather lashes Sydney’ followed up by ‘Humid weather creates 'perfect recipe' for rare midday fog at Sydney beaches’.

As well as floods in QLD, news outlets reported ‘45C in November 'Extraordinary': Queensland heatwave smashes records’. And the all round craziness of the weather brought headlines like ‘Cyclone, humidity and a scorching Test all part of an 'extreme weather week' and an article from this morning, ‘Intense heatwaves and heavy downpours: The worrying weather ahead for Australia’.

Melbourne delivered some sensational flash flooding photos including this one:

And this amusing one — of a Porsche driver stuck in flash flooding under the Dudley St underpass — which became Twitter-famous:

In other green energy news from the last week, one of the world's leading development banks — the European Bank for Reconstruction and Development — has voted to adopt a "no coal, no caveats" financing policy which will see it cut lending to oil exploration and production projects.

The move is likely to have the effect of bringing to light other development banks across the world which are still financing fossil fuel projects in large and alarming numbers, against the dire warnings of the global scientific community, and the recommendations of the Paris Agreement and the UN Intergovernmental Panel on Climate Change (IPCC).

With a multitude of global factors, and some nasty looking forecasts, there are companies leading the way towards decarbonisation. Here’s a brief snapshot of one of the only ASX small caps to venture into the world of hydrogen.

Green Keeper limelight: Hazer Group (ASX:HZR)

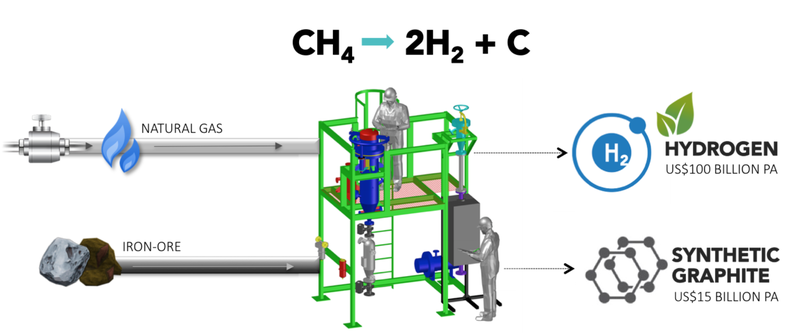

Hazer Group (ASX:HZR) is in the game of commercialising technology that uses natural gas and unprocessed iron ore to create low cost, low emission, ‘clean’ hydrogen.

‘Clean’ sources of hydrogen are widely considered to become a key ingredient in the transition to a low carbon economy. HZR’s technology also produces synthetic graphite, a key ingredient in lithium-ion batteries.

Over eight years was invested into developing what is now the ‘HAZER® Process’. Andrew Cornejo earned a PhD at the University of WA looking at improved ways to produce hydrogen. Now he’s the CTO and second-biggest shareholder of HZR.

OK, a bit of context to grasp what this green energy play is actually doing.

The “cracking” of natural gas (methane) into hydrogen and carbon dioxide produces about 95% of the world’s hydrogen, but the process also produces dirty greenhouse gases. Alternatively, electrolysis uses electricity to split water into hydrogen and oxygen, but consumes a lot of energy and so also comes with the same greenhouse problem. That is, unless renewable energy is used in the electrolysis to do the splitting.

HZR’s solution involves splitting methane into hydrogen and graphite, resulting in a material that’s in demand for lithium batteries, as opposed to the by-product of carbon dioxide. Intriguingly, the process uses iron ore as a catalyst.

Last year, the small cap’s biggest shareholder, Mineral Resources, agreed to fund the development of a large-scale plant in WA to produce ultra-high-purity graphite, in exchange for HZR’s technology.

HZR already has an existing pilot plant in Sydney with a production capacity of almost 30kg of graphite per day. This plant that will be relocated to MinRes’ Perth WA site.

The plan is for Hazer’s fluid bed reactor (FBR) plant to be situated next to MinRes’ paddle tube reactor (PTR) pilot plant, providing the two companies with operational synergies including cost sharing.

With its fast-paced developments, and plenty of talk around about the increasing importance of hydrogen (which Green Keeper covered here and here) in a low emissions future, it’s no wonder HZR’s share price is up ~20% in the last six months.

As we’ve come to expect, these exciting and fascinating low emissions developments in the business world are totally outpacing any climate-related initiatives being undertaken by government — who seem to be taking this kind of approach about the whole 'impending climate catastrophe' hotchpotch...

The question is whether the combined effect of these efforts can help stem climate change fast enough to avoid the catastrophic 3 degrees of warming that scientists are desperately warning us about.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.