Investment in renewables heads north, but who should you watch?

Published 08-FEB-2019 12:50 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With word this week that renewable power now accounts for one-fifth of all energy generated in Australia, it could be worth taking a look at one to watch and one to be wary of in 2019.

Wind and solar farms, along with solar roof panels continue to gain traction according to the latest Green Energy Markets report.

This trend has meant that over the past couple of years, investment in the sector has remained strong.

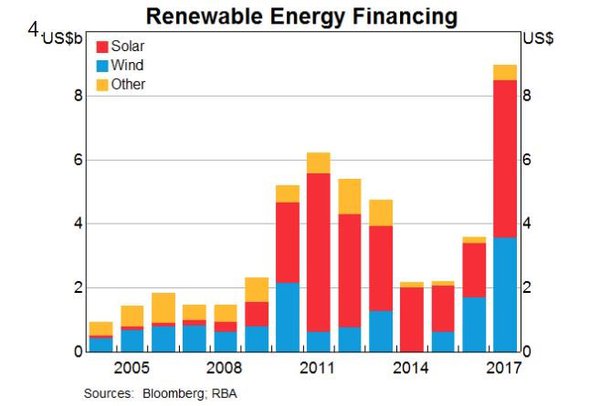

A report by Bloomberg New Energy Finance suggested there was a record $12 billion in investment in the sector in 2017. By late last year, the utilities sector had become a standout performer, driven by a surge in renewable energy investment.

Commonwealth Bank of Australia senior economist Kristina Clifton said of the sector’s performance, “Private capital spending in the utilities sector rose by around 75% in 2017/18.

“Investment in electricity projects has driven the increase. In particular, there has been a surge in investment in the renewable energy sector.”

The graph below illustrates the rising trend.

So, with private and public energy investment on the rise, are there any stocks on the ASX that stand out?

Here’s one to watch and one you may have to reconsider.

New Energy Solar (ASX:NEW)

Market cap: $485 million

A reasonably steady performer. New Energy Solar is an ETF with a current share price of $1.42 (as at COB 7 Feb), that invests in a diversified portfolio of solar energy assets.

Established in 2015, NEW owns and manages large scale solar generation facilities and may invest in other renewable energy assets including wind, geothermal, hydro-electricity, hybrid solutions.

It struck its first deal to buy a solar power project in Australia last year. In a $113 million deal, NEW took over operation of the 50-megawatt Manildra project in central NSW. The plant, formerly owned by major US player First Solar (NASDAQ:FSLR), has a 10-year power sales contract with EnergyAustralia and an offer to extend to 2030.

This acquisition followed that of several solar projects in the US, which fit the company’s criteria of low risk projects that offer attractive returns at competitive prices.

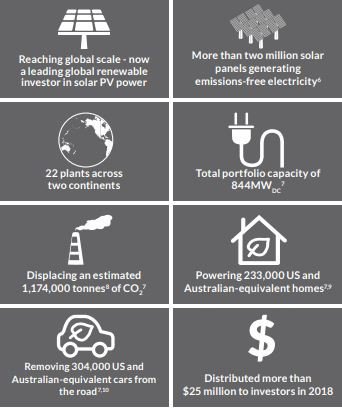

The fund has invested more than $1 billion in solar plants across the US and Australia and will achieve another milestone on home shores shortly with construction of the large Beryl Solar Power Plant and Mount Signal 2 Solar Power Plant on track to be completed later this year.

Here are some of its portfolio highlights as presented in its last quarterly:

NEW outperformed the Renewable Energy Industry which returned -38% over the past year, but underperformed the market in Australia which returned 1.7% in the last 12 months.

Analysis by Simply Wall St suggests that the fund is undervalued, based on future cash flows and its price relative to the market.

The fund has no debt and pays a higher dividend yield than the bottom 25% if dividend payers in Australia. However, it is below the top 25.

One to reconsider...

Carnegie Clean Energy (ASX:CCE)

Market Cap: $11.5 million

It has been a tough time for Carnegie Wave Energy. Just a day ago WA Premier Mark McGowan cast doubts over funding to keep its Albany wave project afloat.

The company has until later this month to prove it can come up with the funding to keep its project going. McGowan also laid part of the blame at the feet of the Federal Government’s R&D tax concession changes.

“It’s very unfortunate because the R&D tax concessions by the Commonwealth Government that are important to the business model for Carnegie were changed,” Mr McGowan said.

“That was outside our control.

“It’s gone before a Senate committee, the Senate committee is currently examining it, we’ll await the outcome of that and also await the outcome of Carnegie saying whether or not they can deliver before making any further decisions.”

Interestingly, shares in Carnegie were up 0.1¢ to 0.4¢ at COB yesterday, but still well below the recent high of 2.4¢ in July last year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.