Europe set for new highs as world’s largest weed market

Published 25-JAN-2019 13:57 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

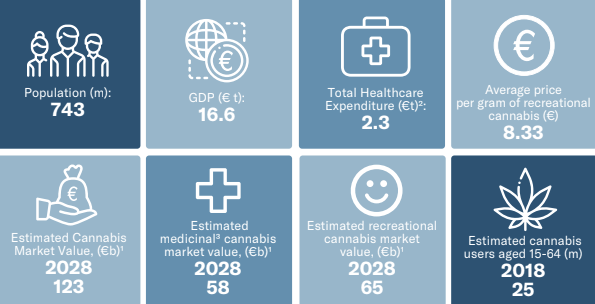

Home to more than 740 million people — a population more than double that of the US and Canada combined — Europe is set to become the world’s largest legal weed market over the next five years.

A new report launched at Davos by legal cannabis expert, Prohibition Partners, maintains that steeply rising patient numbers and legislative progress have created a "transformative" backdrop for medicinal cannabis use in Europe.

The European Cannabis Report 4th Edition reveals that the region is poised for record-smashing growth over the coming years.

According to its findings, Europe’s cannabis market is estimated to be worth up to €123 billion by 2028.

Of that total market, the market for medicinal marijuana specifically could reach €58 billion during that time.

The report also identifies sweeping legislative change and increasing awareness of the potential health benefits elicited by cannabis-related products as key growth drivers.

Over the last 12 months, the European pot industry has grown more than it has in the last six years. Six countries have announced new, positive legislation, and over €500 million has been invested in European cannabis businesses.

Throughout 2018, a crop of European countries introduced, reviewed or announced future legislation to advance the legal weed movement, and there are now 14 European countries where prescription pot is legal. The UK, Portugal and Malta have legalised medical cannabis products, and the Netherlands, Denmark and Germany have either issued cultivation licences or plan to introduce a tender for global cannabis producers. Even conservative governments in France and Ireland have proposed new cannabis bills or committees to review the legal status of medical marijuana.

The versatility of the plant could also have significant implications across multiple sectors, including textiles, beauty and wellbeing, leisure, manufacturing, and food and beverage.

The report forecasts patient numbers will grow from 130,000 in the region’s three largest markets — Italy, the Netherlands and Germany — to 225,000 in 2019.

The lion’s share of growth will come from the German and Italian markets. The German market is currently worth an estimated €133 million and is set to be worth more than €1 billion by 2020.

Germany legalised medicinal cannabis in 2017. One of the most progressive bills, the list of eligible conditions is quite broad, and this led to an immediate jump in the number of registered patients from 1,000 to over 40,000. Germany is also the first country in the world to cover the cost of medical cannabis (for any therapeutic application approved by a physician) through its national health insurance system.

Stephen Murphy, Prohibition Partners co-founder, explains: “The European cannabis market is undergoing a transformative moment, driven by skyrocketing demand. This has pushed national governments across the continent into action and Europe is poised to become a hotbed for medicinal development.”

Murphy also believes that political event-driven change can act as a catalyst for further growth.

“Most countries base their legal status on WHO/UN Drug Conventions. WHO is now reassessing the legal status of cannabis, and EU Committees are looking at how to regulate cannabis usage internationally. This will fuel rapid growth in the coming years.”

While the report maintains that patient demand is high, it notes that access is still restricted in many countries.

Murphy says: “While medicinal cannabis has been legal in several European countries for a number of years, the report shows very few countries have the infrastructure or proper legislation in place to supply patients. Except for the Netherlands and Israel, they rely on cannabis imports to deal with patient demand.

“While we understand cannabis can treat over 60 conditions, we lack the clinical data that is key to unlocking full market potential. Reliable, replicable research will be vital to persuading conservative governments to enact reform; shrinking the gap between political legislation and healthcare regimes and leading to eventual mainstream adoption.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.