Temple & Webster delivering strong revenue and margin growth

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Leading Australian online furniture and housewares retailer, Temple & Webster Group (ASX:TPW) could well go on to be the stock of the month after taking out stock of the week.

While the S&P/ASX All Ordinaries index (ASX:XAO) spent most of October plunging from 6300 points to a recent low of about 5900 points, shares in Temple & Webster have gained ground, increasing more than 20% from $1.03 three weeks ago to hit a high of $1.25 this week when the broader market slumped to its lowest point.

It is worth noting that the company’s strong share price performance wasn’t just a function of it being in the traditionally buoyant e-commerce sector.

For example, the share price of carsales.com (ASX:CAR) fell from $14.50 to $12.70, and since the start of October shares in online real estate company REA Group (ASX:REA) have plunged from $86.00 to a low of $70.40.

Check out TPW’s outperformance against the big names like REA and CAR on a 12 month basis and you can see that the company is more than just a ‘here now, gone tomorrow’ prospect.

This chart also clearly demonstrates the company’s resilience went broader market conditions are difficult with it gaining ground September/October while the blue chips went into meltdown mode.

Temple & Webster’s resilience has been performance driven with investors now realising that the company has developed the necessary scale to generate strong returns in a niche market.

And it isn’t just the speculative retail punters coming on board, with well-regarded Auckland based funds management group, Pie Funds Management Limited recently emerging as a substantial shareholder with a stake of 9.2%.

Recent momentum has been driven by positive trading updates and an announcement in August which flagged a strong fiscal 2018 result.

This was topped off at the start of the week when the company once again provided support for its projections of a strong fiscal 2018, announcing a robust September quarter trading performance.

July sales up 34%

The trading update at the start of August really got the ball rolling with the company’s shares increasing from 66.5 cents to 79 cents, before a second wave of buying occurred as the fiscal 2018 result was announced, pushing the company’s shares to what was an all-time high at that stage of $1.09.

Just as important in terms of drawing investors to the company was its commentary regarding trading in July and August.

July sales were up 34% on a year-on-year basis and this trend was said to have continued into August, in management’s mind providing the platform for the company to deliver its maiden full-year profit in fiscal 2019.

Sure enough, the company delivered with the September quarter featuring 39% year-on-year growth and the level of active customers increasing 30% to 214,000.

Furthermore, there were a record number of first-time customers added during the quarter.

Reaffirming the company’s attractive product offering and substantial market presence was the 45% increase in orders from repeat customers.

As we have seen in the past, e-commerce companies usually take some time to move to an earnings positive stage, but from that point they traditionally demonstrate high levels of growth.

TPW recorded EBITDA of $200,000 in the September quarter as it continues to transition from a capital intensive start-up to a company that is now benefiting from scale off a relatively fixed cost base.

Looking to the future, management said that it will continue to strengthen its core offering and that it will increasingly be investing in growth opportunities.

Addressing the issue of uncertainty in the housing market, chief executive Mark Coulter said, “The 2019 financial year has started strongly with a record 39% year on year growth.

“Our focus on providing customers with exceptional value and a convenient and hassle-free shopping experience is resonating in this softer housing market.”

Sector growth to provide momentum

From a broader perspective, chief executive Mark Coulter said “The next phase of our journey is all about growth, and it is great to see that our revenue growth has accelerated into the new financial year.

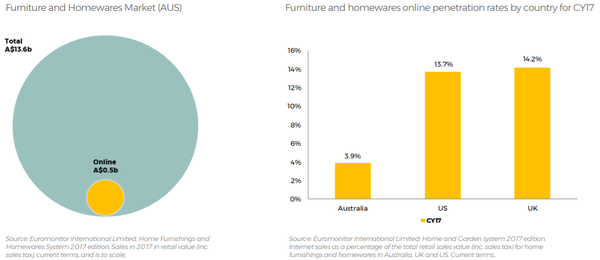

“With only circa 4% of furniture and homewares being currently purchased online, we are well placed for strong growth for years to come.”

Indeed, top line growth is central to the success of e-commerce businesses, and as Coulter said the migration to online shopping in the furniture and homewares sector is at an early stage.

It is testament to the company’s business model that it has been able to harness such strong growth despite nominal proportionate consumer activity in that sector.

The following graphic provides an insight into the industry as it currently stands, but importantly it also shows overseas trends, perhaps a guide as to the potential growth of the furniture and homewares e-commerce sector.

Extensive product offering and large digital footprint

Temple & Webster has a strong online presence as one would expect, and while this is paramount in terms of generating sales, it is also an endorsement of the company’s ability to offer a product range that appeals to a wide range of consumers.

The company has 1.1 million monthly website users, 1.6 million weekly email subscribers and 198,000 active customers.

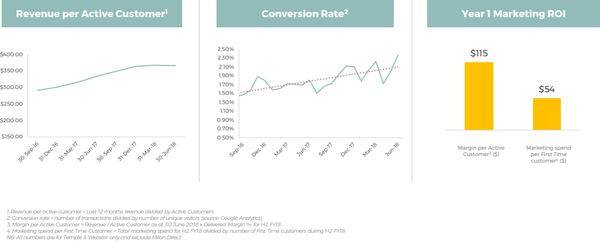

Temple & Webster continues to refine its marketing strategy, adding more first-time customers at the lowest cost per first time customer during the September quarter.

When you combine these metrics with the strengthened margins being achieved and higher average order values, customers are profitable during their first year with the group.

This has allowed the company to accelerate its marketing spend beyond digital channels.

Growth strategy gaining traction

In terms of the group’s product offering, it has 125,000 product listings across 185 categories.

Management has a strong handle on the logistics side of things with the average time to despatch being two days.

As you run the ruler across the company’s statistics, one of the most impressive features is that the business is growing exponentially on a half by half basis.

For example, while full-year revenue growth in fiscal 2018 was 12.6%, revenue grew by 25% in the second half.

Having now delivered 39% growth in the September quarter, there is increasing confidence in the company’s ability to maintain a high growth trajectory in the near to medium term.

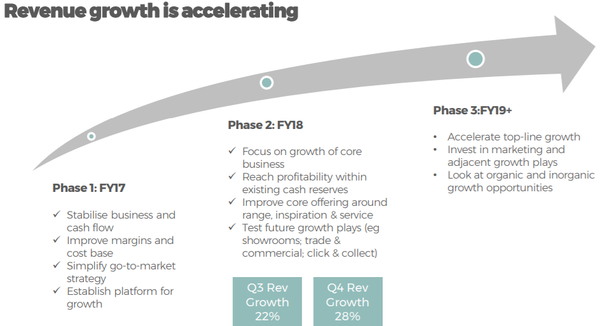

It is worth noting that the accelerated growth can also be attributed to a change in strategy which was first implemented in 2016-17.

That plan involved simplifying the business by moving from a multi-brand to a single-brand strategy, with all sales now made through templeandwebster.com.au.

Not only has this resulted in higher sales, there have been significant improvements in the group’s cost base and gross margins, resulting in a fiscal 2018 EBITDA loss of $0.6 million, a 91% improvement on FY17’s EBITDA loss of $6.8 million.

This also reflects well on management as it indicates a proactive approach and an ability to tweak its strategy where improvement is required.

Meeting milestones

Temple & Webster entered fiscal 2019 with a strong balance sheet, providing the flexibility to execute on its growth strategy.

The company was debt free and finished fiscal 2018 with cash of $9.9 million.

It has improved this position with $600,000 in cash flows providing cash of $10.5 million at the end of the quarter

Analysts at Bell Potter expect the company’s cash position to be in the order of $11.8 million by June 30, 2019.

Of course, this could be put to work on management’s stated growth initiatives, and while tempering the broker’s end of year cash projections, it could be argued that any developments of this nature would be welcomed by shareholders.

Apart from launching a mobile app to capitalise on the continued growth of mobile as a primary device, management is embarking on an international expansion program through a New Zealand pilot, as well as entering new categories such as home improvement with further investment into the business to business trade and commercial sector.

Share price upside of 20%

Bell Potter analyst, TS Lim highlighted several positive features in the September quarter result, resulting in him increasing revenue forecasts between fiscal 2019 and fiscal 2021 inclusive by 5.5%, 8.7% and 12.4% respectively.

Lim sees TPW as well-positioned to benefit from structural trends including migration to online, online savvy millennials now entering the company’s core demographic, faster internet/mobile speeds, new logistics entrants and Amazon accelerating its online shopping take up.”

In response to the quarterly result, Lim reaffirmed his buy recommendation and substantially lifted the company’s 12 month price target from $1.36 to $1.50.

He is forecasting earnings per share growth of 32.8% and 105% in fiscal years 2020 and 2021 respectively.

Consequently, while the company’s shares have run strongly since August there could be more to come with Lim’s price target implying upside of approximately 20% to its current trading range.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.