This Australian start-up wants your dirty laundry

Published 06-DEC-2018 09:39 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The $2 billion dry-cleaning and laundromat industry in Australia is being quietly disrupted by a New Zealand-founded start-up.

Laundromap is a tech-first, on-demand dry-cleaning and delivery service that operates through a mobile app in Sydney, Perth, Auckland, Wellington and Christchurch via a network of traditional retail businesses.

As with the widespread uptake of Deliveroo or UberEats — businesses that have shaken up previously tech-static industries through smart apps and the sharing economy — Laundromap aims to meet an old, established need with a game-changing upgrade in convenience and ease of access.

The theory is that there’s a significant group of high-income people who need and want their clothes laundered, yet struggle with the traditional system of dropping off and picking up their clothes from these businesses (while also being confined to particular opening hours).

In response, Laundromap’s mission is to minimise the hassle around life’s less fulfilling but necessary domestic chores, so time can be better spent by its customers. It helps time-poor clientele by picking up their laundry directly from work or home and then dropping it off 48 hours later — clean, pressed and folded.

Laundromap was launched in Perth and Auckland early last year, but it’s now in the process of expanding nationally by buying a selection of under-used dry-cleaning and laundry businesses in capital cities.

CEO, Vlad Mehakovic, told Finfeed that while Laundromap is aiming to change the customer experience, the dry-cleaning business is “very old-school”. As such, the solution it offers is actually “pretty simple”.

"None of this stuff that we're doing is ground-breaking in terms of the tech itself,” said Mehakovic. “We’re essentially applying modern practices to an antiquated industry."

Effectively, Laundromap is bringing the dry-cleaning industry into the 21st century.

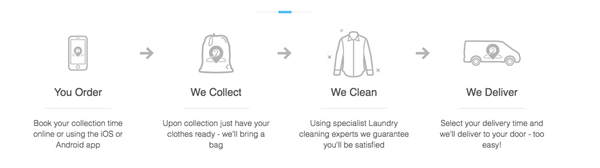

What the company offers in a nutshell:

“Our founder, who came up with the idea, was late to laundry on a Saturday and in trouble with his wife,” Mehakovic said. “They both had worked quite a bit in Pizza Hut. And it was a pressing question — if you can deliver pizza to a door, why can't you do it with dry-cleaning?”

From the customer’s point of view, Laundromap’s app works as follows:

Something else to bear in mind here is because this is an old-school market, it also relies heavily on old-school relationship building, wherein trust and quality are of critical importance.

“One thing that we always wanted to be very careful of is the customer experience,” Mehakovic pointed out. “What you find is that it's very difficult to get people to leave a good dry-cleaner. They stay very loyal to that business because there's a lot of trust with giving them your $500 coat or $1,000 suit or whatever it is.

“So, it's very difficult to get people away, and if you do get their business and you mess it up, then you're never going to get them back.

“And that's what we found to a certain degree with some of our suppliers. There’s a lot of dry-cleaners out there; there's some very high-quality ones. But even if they're very high-quality and they've got a solid customer base, their catchment area is only two to five kilometres.”

This is where Laundromap’s aggressive acquisition strategy to snap up several bricks and mortar businesses across the country comes into play.

It’s looking to expand its network of consolidated businesses which can be used via its streamlined app — and all within an industry that has been held back by low technological investment.

The initial focus is on acquiring a single business in each capital city, and then to tap into smaller cities and regions through an additional affiliate partnership model that will provide it access to a network of separately owned businesses.

The company has recently bought a business in Sydney, as well as Perth’s oldest dry-cleaner — the 104 year-old Stannards in Subiaco — as part of this expansion.

This purchase gives Laundromap a second site in what it hopes will be a national network of dry-cleaners and laundries to support its on-demand business. Stannards comes with one of the city’s most modern facilities, an 800 square metre site, and 25 employees.

Mehakovic said that the company is in negotiations with just under ten other such acquisition targets. “We're looking to get very high-quality dry-cleaners in high-traffic, expensive areas, and then expand the reach through our customer experience.”

As our modern lives become more and more hectic, lifestyle-centric, convenience-driven services like Laundromap’s are in considerably high demand.

With that mind, Laundromap’s growth trajectory is set to take a major upswing in the months to come.

An ASX listing in H3 2019 is now on the cards to help expand its footprint.

Laundromap is readying itself to IPO with half a year of healthy earnings ($2-3 million EBITDA annualised), as well as an acquisition pipeline that will bring in $5-8 million EBITDA for fiscal 2020.

Note: If the Laundromap ASX IPO is undertaken, the relevant offer document will be made available when the securities are offered.

Potential investors should consider the offer document in deciding whether to acquire the securities. Anyone wishing to acquire the securities will need to complete the application form that will be in or will accompany the offer document once released.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.