Xenith IP poised for a recovery

Published 07-SEP-2018 10:50 A.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Speculate aims to target stocks that tend to fly under the radar, perhaps due to the fact that they don’t suit the risk-averse investor, or simply because they are small emerging potentially next big thing stories where the market moving news is yet to break. FinFeed will be looking to uncover such stocks on a weekly basis.

Stocks don’t have to be penny-dreadfuls to be labelled speculative, and in some cases even profitable companies are shunned by risk-averse investors.

In such cases, it is often negative sentiment towards a sector which places downward pressure on the share prices of most stocks in that market segment.

This has been the case with the intellectual property (IP) services sector over the last two years.

These companies generally provide end to end services in terms of IP identification, registration, management, valuation, commercialisation and enforcement of IP rights.

There are three key ASX listed players in this sector in IPH Ltd (ASX:IPH – market capitalisation: $1.1 billion), QANTM Intellectual Property Ltd (ASX:QIP – MC $185 million) and Xenith IP Group Ltd (ASX: XIP – MC $123 million).

It is the smallest of these, XIP that interests me most, mainly because of its attractive valuation relative to its peers.

Of course it remains a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Industry conditions on the improve

When sectors have been out of favour it is quite common for the larger stocks to lead the recovery, with the smaller players that have often fallen off the radar taking longer to respond.

The negative sentiment behind the IP services sector mainly revolved around industry conditions and regulatory changes.

In the last few months, the management of each of the three companies along with analysts that cover the sector have all suggested that the challenges encountered in recent years have abated and that the outlook for the sector is promising.

Just in recent weeks, analysts at both Morgans and Bell Potter said that the IP services markets were continuing to normalise and that the impact of changes in legislation that had affected certain areas had abated.

In discussing the improved conditions, QANTM’s managing director Leon Allen said, “The second half improvement in Australian patent applications and the Patent Cooperation Treaty (PCT) and rest of world application levels are potentially favourable trends for future prosecution and advisory revenues.”

While the following chart demonstrates the sustained downturn which affected all three stocks between 2016 and 2018, it also shows the recent rebound.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

While IPH (black line) and QIP (red) have rallied strongly, there has also been good support for Xenith (yellow).

In the last month the company’s shares have increased nearly 20%, briefly touching $1.40, a level it hasn’t traded at since February. However, the company is still trading well shy of its 12 month high of $1.89, and when one considers that it was trading close to $4.00 just over two years ago, this rally could deliver significant upside.

The past performance of this product is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

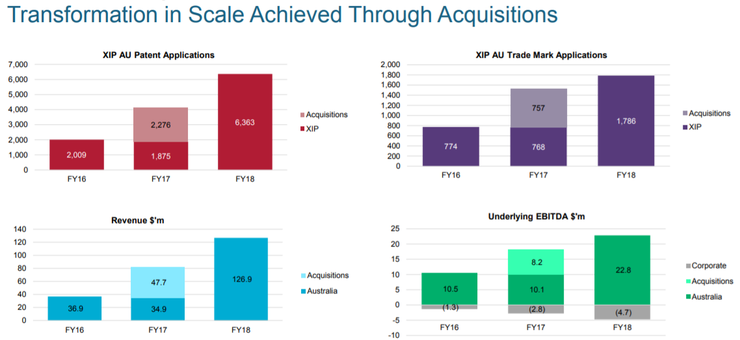

This is particularly the case when you consider the earnings trend over the last three years with EBITDA increasing from $9.2 million in fiscal 2016 to $15.5 million in 2017, leading up to the company announcing underlying fiscal 2018 earnings of $18.1 million last week.

Enterprise Value to EBITDA (EV/EBITDA) is a common means of attributing valuations in these sorts of sectors.

Earlier, I referred to Xenith’s valuation as being one of its compelling attributes, and it is this ratio that undoubtedly stands out in a peer comparison.

Based on fiscal 2018 earnings, Xenith’s EV/EBITDA multiple is 7.5.

This compares with IPH’s and QIP’s multiples of circa 14 and 10 respectively.

Even if Xenith were to trade at the bottom of that range it would imply an enterprise value of circa $180 million, implying a share price of $1.87.

Interestingly, Bell Potter recently upgraded Xenith’s 12 month price target from $1.20 to $1.80 broadly in line with our EV/EBITDA implied valuation.

Putting fiscal 2018 into perspective

Xenith’s fiscal 2018 result was within management’s guidance which helps in terms of reassuring investors regarding performance predictability, but it also implied robust year-on-year growth of 17%.

On the score of earnings predictability, the following graphic demonstrates the company’s ability to grow across its various operations even in a challenging environment.

The other factor to take into account is that IP management and protection has always been deemed a resilient industry because its revenues are driven by non-discretionary spending.

Enterprises won’t risk millions of dollars of investment in proprietary property and the potential for loss of substantial returns by failing to adopt a robust IP management strategy.

Returning to Xenith’s underlying fiscal 2018 net profit of $10.4 million, it represented earnings per share of 11.7 cents which implies a PE multiple of 11.8 relative to the company’s current share price.

Given that the group is forecast to generate compound annual earnings per share growth of circa 15% over the next three years, its PE would appear conservative.

If one applied a PE multiple of 15 relative to consensus forecasts for fiscal 2019, the company’s shares would be trading in the vicinity of $2.20.

The full year dividend in fiscal 2018 was also robust at 7.5 cents per share, representing a yield of 5.4% based on a share price of $1.39.

Analysts at Bell Potter are forecasting a dividend of 9 cents per share in fiscal 2019, implying a yield of 6.5%. The broker anticipates that a combination of benefits from cost restructuring and an improved performance from one of its acquired businesses, along with a broader industry recovery will result in strong earnings growth in 2019.

Bell Potter is forecasting revenues of $129 million and a net profit of $12.7 million in fiscal 2019, representing earnings per share of 14.3 cents, implying a forward PE multiple of less than 10.

It should be noted that broker projections and price targets are only estimates and may not be met. Those considering this stock should seek independent financial advice.

Xenith has its eye on Asia

In an industry that has undergone recent swift consolidation, Xenith IP is now well placed to further build its presence in the Australian and Asian markets, as well as pursuing opportunities which would deliver sustained growth.

Analysts are in accord with companies operating in the sector in identifying Asia as a key growth market.

Xenith has made substantial progress in developing the firm’s Asian growth strategy, which encompasses both traditional IP services and the extended complementary service lines associated with its Glasshouse Advisory business.

Management is actively exploring both near and medium-term strategic options across the region, with discussions at various stages.

On this note, Bell Potter analyst Sam Haddad said, “We believe XIP will likely look to pursue expansion into South East Asia with the aim of providing a one-stop shop IP service offer for the Asia-Pacific region.”

Consequently, aside from potential share price upside from investors rejigging their valuation metrics, developments such as acquisitions or the establishment of greenfield operations in Asia or other regions are potential share price catalysts.

Also, don’t be surprised if yield seekers target the stock.

Even if the company’s share price fell in line with the $1.87 EV/EBITDA based valuation that we extrapolated earlier, this would still imply a dividend yield of circa 4.8%.

Xenith’s dividends to date have been 100% franked, and assuming that would be the case in 2019, the grossed up yield would be approximately 6.9%.

This is an attractive return in a low interest rate environment.

Former senior writer for AFR, Trevor Hoey provides incisive commentary on ASX developments, particularly focusing on the emerging companies market segment.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.