P2P is going places under industry consolidation

Published 15-OCT-2018 16:45 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Speculate aims to target stocks that tend to fly under the radar, perhaps due to the fact that they don’t suit the risk-averse investor, or simply because they are small, emerging, potentially next big thing stories where the market moving news is yet to break. Finfeed will be looking to uncover such stocks on a weekly basis.

This week Speculate runs the ruler across P2P Transport Ltd (ASX:P2P), a company that experienced a sharp share price decline in August after providing and earnings update which represented below prospectus forecast metrics.

The company only listed in December 2017, taking advantage of the emergence of Uber and challenging conditions in the traditional taxi industry.

With regard to the downgrade, it wasn’t a substantial variance and the reasons were easily identifiable as one-off items that shouldn’t impact the company’s fiscal 2019 performance.

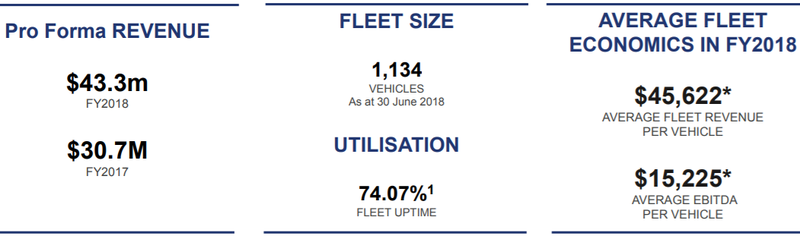

In the pre-result earnings update management downgraded its prospectus forecast pro-forma fiscal 2018 EBITDA from $12.7 million to a range between $10.1 million and $11.1 million.

The company went on to deliver at the top end of this range with EBITDA of $10.9 million representing an increase of more than 330% on the pro-forma fiscal 2017 result.

Importantly, P2P is forecasting EBITDA in a range between $16.1 million and $16.8 million, representing a year-on-year increase of about 50% at the mid-point of that range.

Building off an already strong base

It has been an active year for P2P as the company made important acquisitions that have provided it with a sizeable market share of the taxi industry.

Some of these were flagged in the company’s prospectus, while others that have been undertaken throughout 2018 will have a significant impact on earnings in the coming 12 months.

Consequently, it would appear that the focus should be more on the fiscal 2019 guidance rather than 2018.

As a useful means of comparison though it is worth weighing up what the company set out to do when it listed on the ASX against how it is currently positioned.

Before fleshing that out, it is a good idea to get a feel for the business because it isn’t just a cab operation that aims to aggregate various brands under the one banner.

Also, while the name may be new to many people, P2P Transport traces its origins to 1987 as a Victorian based taxi fleet management company.

Since then, it has significantly grown its presence in the point-to-point passenger transport industry, through acquisitions and organic growth.

Founders have plenty of skin in the game

The company is led by its founders who hold key management roles and have a track record of driving consolidation in the point-to-point transport industry.

Furthermore, the founding shareholders have maintained a stake of approximately 35% in the company with a voluntary escrow period of two years from date of listing.

This sees their interests closely aligned with retail shareholders.

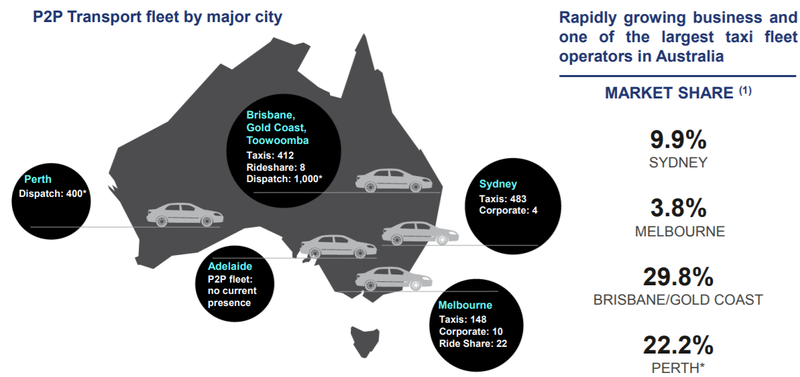

When P2P listed on the ASX it had a rapidly growing fleet of approximately 720 taxi, corporate and ride-share vehicles managed from 8 sites situated in Victoria (Melbourne), NSW (Sydney) and Queensland (Brisbane, Gold Coast and Toowoomba), positioning the company as one of the largest fleet management operators of its kind in Australia.

Adversity breeds opportunity

Obviously the emergence of Uber and other online enabled platforms and smart phone applications that connect passengers and drivers has changed the industry.

However, rather than focusing on the negatives P2P sees the new environment as presenting opportunities to expand in the taxi space and complementary areas.

There is no doubt that some of the best businesses have been built around an “adversity breeds opportunity” approach.

P2P recognised that a combination of increased competition and the highly fragmented nature of the industry provided an opportunity for a large experienced player to undertake a growth by acquisition strategy with a view to building a scalable consolidated business.

The emergence of Uber underlined the fact that there were a large number of firms owning small taxi fleets, and this resulted in smaller fleet operators experiencing increasing costs and competitive pressures.

With limited opportunity to generate scale efficiencies, a number of these fleet operators left the industry or sold their businesses to larger operators.

P2P’s large and growing fleet size, integrated business model and east-coast reach ideally positioned the company to participate in ongoing consolidation, delivering scale efficiencies and fleet network opportunities.

Multifaceted growth strategy

Importantly, management isn’t relying solely on aggregating taxi businesses as it looks to leverage off the benefits of having a large fleet.

As evidenced by the likes of Retail Food Group (ASX:RFG) and Slater and Gordon (ASX:SGH), there comes a time when you have to do more than just buy cafés or law firms and hope that at the end of the day one plus one equals three.

Growth by acquisition is a real balancing act between taking advantage of opportunities and not putting the balance sheet under duress.

P2P is looking to generate revenues from avenues such as rooftop signage on its vehicles.

While this type of advertising is already being employed in a less consumer engaging format, doing business with a firm that can offer a high level of market saturation across a wide range of regions in a variety of targeted demographic areas would be an attractive form of advertising, arguably more effective than having a few billboard signs dotted around the city.

Funding has been secured for the deployment of 900 Adflow digital tops through a major telecommunications company.

Combined, initiatives and acquisitions related to the Adflow division are expected to deliver additional EBITDA of approximately $2.8 million in fiscal 2019, which on an annualised basis equates to $5.4 million.

Maximising asset utilisation

Other initiatives include Zevra, a national fully integrated fleet management business for the taxi and executive higher car market.

Australia Wide Chauffeur Cars is self-explanatory, but from P2P’s perspective it takes advantage of the company’s large fleet and its ability to cater for areas such as corporate and special services, tours and airport transfers.

The company’s Hub business provides a one-stop shop in-house servicing, maintenance and accident repair operation.

Costs associated with these areas have the ability to place a considerable drag on earnings for small fleets and independent operators.

Time off the road is revenue down the drain and the likes of mechanics and panel beaters knew that they were the price makers when a cabbie walked through the door.

The environment is vastly different for P2P where maintenance and accident repair can be done quickly, efficiently and at a reasonable cost.

Similar to renting hotel rooms or heavy equipment, the fleet management industry is all about having that fleet working at full capacity or as close as possible to it, and P2P has flagged utilisation of more than 80% in fiscal 2019.

Through initiatives such as Adflow, P2P is increasing its return on assets, another crucial metric.

Fleet expansion

As at June 30, 2018 P2P had 1134 own vehicles representing an additional 843 vehicles since the IPO.

The acquisition of Black & White Cabs (BWC) added an additional 1500 third-party vehicles operating under the BWC despatch network.

BWC has a strong east coast presence, including regional areas such as Toowoomba and the Gold Coast, and it is also represented in Perth.

Management expects utilisation rates to increase from about 75% in fiscal 2018 to a mid-range target of 82.5% in fiscal 2019.

Quantitative guidance aside from the EBITDA projection of between $16.1 million and $16.8 million included anticipated annual cost savings of circa $2 million to be achieved through national buying relationships and systems and process improvements.

The company is well on the way to achieving this goal with $800,000 in cost savings already recognised through wages, plate lease reduction and reduced procurement expenses due to national supplier agreements.

Analysts must be reasonably confident of the company achieving its projections with the consensus price target of $1.60 implying upside of about 100% to Thursday’s closing price.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.