Morgans sees 60% upside in Central Petroleum

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

It was late last year that Finfeed ran the ruler across 20 ASX listed oil and gas stocks that appeared to have the scope to either trade above their valuations at that time, or gain medium-term momentum on the back of positive news.

One of those companies was Central Petroleum Ltd (ASX:CTP), an oil and gas explorer and conventional producer with a focus on supplying the Australian domestic gas market.

At that stage the company was the largest onshore gas producer in the Northern Territory, and it still holds that position as the operator of the only producing onshore conventional gas fields, Mereenie, Palm Valley and Dingo.

Central is in a position to pursue several reserve growth programs across what is regarded as the biggest package of proven and prospective oil and gas acreage that spans central Australia.

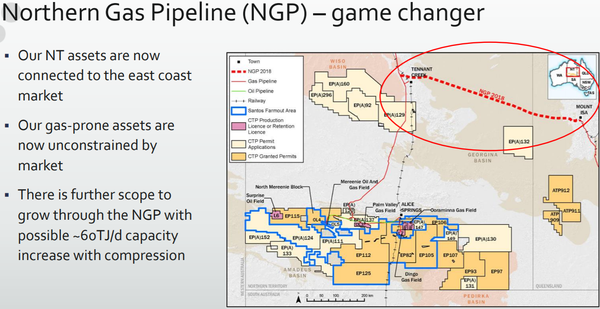

We noted at the time that the Northern Gas Pipeline (NGP) is under development and remained on schedule for gas to flow to east coast markets from 2018, with 60 TJ/d of pipeline capacity available for new sales.

The NGP was in a sense the ‘last mile’ for Central Petroleum as it provided the link between Tennant Creek in the Northern Territory and Mount Isa in Queensland where there was an established pipeline to the east coast.

At that stage, Central aimed to become a significant domestic energy player, having positioned itself to grow from current production of over 11 terajoules per day (TJ/d) of gas and 340 bopd (equity accounted).

The pipeline was completed on time, and Central is now supplying gas to lucrative east coast markets, but it could be argued that the group’s progress and its future prospects aren’t captured in the company’s share price.

Morgans initiates coverage as CTP ticks the boxes

Morgans resources analyst, Adrian Prendergast, has just initiated coverage of Central Petroleum, placing an add recommendation on the stock with a target price of 21 cents.

He expects the company to deliver a net profit of $24.3 million in fiscal 2020, representing earnings per share of 3.4 cents.

This places the group on an attractive PE multiple of 3.8 relative to its current share price of 13 cents.

Prendergast noted that following the commissioning of the NGP, Central Petroleum is selling the majority of its expanded gas volumes into the high-priced east coast market.

As the company completes its gas acceleration program (GAP), the analyst expects the group’s share of installed gas sales capacity will increase from 14.9 terajoules per day to 41.4 terajoules per day as part of a phase I expansion of its Amadeus operations.

There is the potential for Central Petroleum to increase its east coast sales with Prendergast saying that the NGP has current capacity of 90 terajoules per day, but could be expanded to 160 terajoules per day without compression.

While the company doesn’t have the capacity to meet added demand at present, it has nearly 230,000 square kilometres of gas prone ground in the Northern Territory including the Dukas prospect which is under a free carry agreement with Santos (ASX:STO) as the operator.

Central Petroleum has a 30% stake in this project, and exploration success at Dukas could be a game changer.

Given the company’s revenue predictability, near-term profitability and highly prospective assets with access to lucrative markets, its share price of 13 cents, implying a market capitalisation of $92 million seems inconsistent with the group’s investment profile.

Prendergast’s price target of 21 cents per share implies upside of approximately 60%, and it wouldn’t be surprising to see the company push up towards this level as it transitions to profitability in fiscal 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.