Midway looking good at midpoint

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Midway Limited (ASX:MWY) Australia’s largest woodchip processor and exporter has delivered a strong interim result the first half of fiscal 2019.

This resulted in the company’s shares increasing 8% to an all-time high of $3.68 on Monday.

There was a significant uptick in underlying EBITDA, increasing 87.7% to $12.2 million, exceeding the top end of management’s guidance which was in a range between $11 million and $12 million.

Sales growth was also robust, surging 45.8% to $124.2 million.

As a backdrop, Midway has majority shareholdings in South West Fibre, Queensland Commodity Exports (Brisbane), Plantation Management Partners (Melville Island) and Softwood Logging Services (Bunbury, Western Australia).

The group’s diversified sources of supply are beneficial in terms of having multiple revenue streams and insulation against one-off factors such as extreme weather conditions that may impact certain locations.

Midway is primarily involved in the production, processing and export of high quality wood fibre to producers of pulp, paper and associated products in the Asian region.

Higher export prices contributed to the strong result, and Midway also benefited from exchange rate movements.

Management said that the strong operating performances that underpinned the group’s first half result are expected to continue throughout the remainder of fiscal 2019, positioning the company to deliver on ‘current analyst consensus.’

Analysts at Morgans noted that the group’s interim profit was ahead of its expectations, and taking into account the positive outlook, the broker increased its full-year earnings per share forecasts by 3.2%.

Earnings per share projections were also upgraded marginally in fiscal year’s 2020 and 2021.

Taking into account the revised metrics, Morgans increased its price target from $3.75 to $3.90, suggesting there could be more upside for Midway.

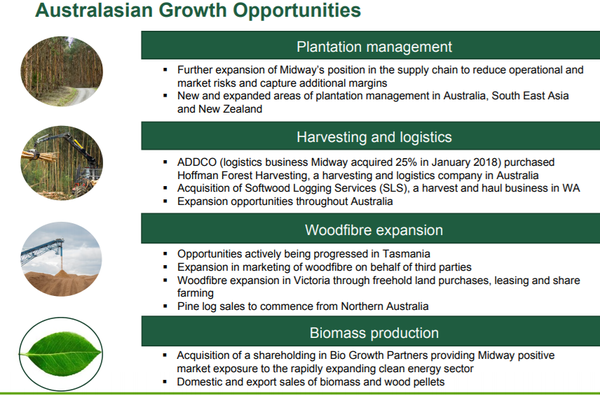

The following details the various options open to the company in terms of sustaining its growth momentum.

Acquisitions to provide momentum in 2020

Midway acquired Softwood Logging Services in October 2018, a harvest and haul business in Western Australia.

SLS provides Midway with access to equipment, management expertise and contracts for the harvesting and delivery of biomass and other forest products in the south-western region of Western Australia.

In the same month the company acquired 40% of Bio Growth Partners, a biomass procurement and marketing business which supplies woodfibre to the Western Australian biomass market.

Management noted that integration of the new acquisitions was well underway with some teething problems being addressed to ensure full benefits are realised in fiscal 2020.

Consequently, a full year contribution from these businesses should have a significant impact in fiscal 2020.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.