Contract success drives Envirosuite to new levels

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Envirosuite Limited (ASX:EVS) appears ready for a strong run on the back of multiple contract success with recent share price momentum similar to that which occurred in mid-2018 when the company’s shares more than doubled from about 5 cents to 13 cents.

Envirosuite’s proprietary technical platform is used worldwide by government regulators and a range of clients in the mining, water and waste management, heavy industry, ports and agricultural industry sectors.

The company has a leading position in the burgeoning water and waste management industry, and it has had significant contract success in this area, including the award of an important contract on Wednesday resulting in the company's shares rallying 13% to close at 13 cents..

From an operational perspective, Envirosuite has performed well since it came under the microscope in 2018, but it was caught up in the equities sell-off in late 2018, arguably providing a buying opportunity as its share price retraced to approximately 6 cents in November.

However, the award of contracts in December and January, a positive sales update at the start of February and a half yearly result later that month featuring year-on-year revenue growth of 300% have revitalised investor interest.

On Wednesday, Envirosuite chimed in with the award of another important contract by multinational steelmaking group, Tata Steel Ltd resulting in the company’s shares revisiting their 2018 high of 13 cents.

This represented the group’s first win globally in the steel manufacturing sector and marked its entry into the European industrial manufacturing industry.

By adopting Envirosuite’s technology, Tata will see approximately 60 existing real-time air quality sensors and three weather stations around the facility feeding data directly into a platform that will provide vital data in terms of managing air quality.

Builds on strong position in water management

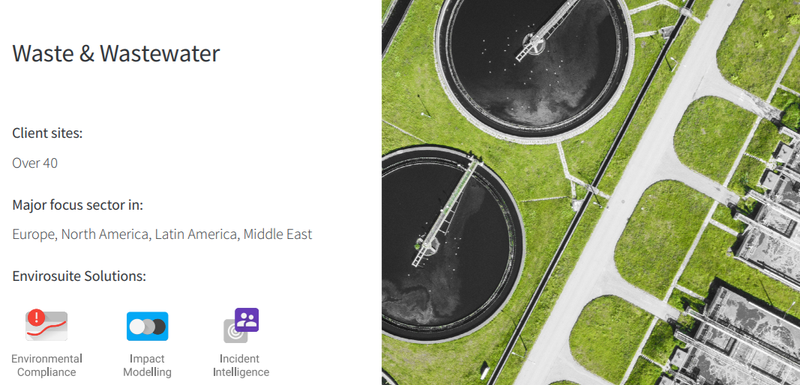

The group has also been active in the wastewater management industry segment.

In mid-January Envirosuite was awarded a contract by UK water utility, Southern Water which involves the implementation of the group’s technology at three sites, representing the first multi-site win for the company.

Envirosuite is already in use at seven sites operated by three other water utilities in the UK.

Southern Water is a private water utility company responsible for public wastewater collection and treatment in Hampshire, the Isle of Wight, West Sussex, East Sussex and Kent, as well as being the major operator in the public water supply and distribution in those regions.

Southern Water’s decision to use Envirosuite’s technology was an endorsement of its effectiveness given it involved a four-month commercial trial prior to the contract award.

On this note, Envirosuite, chief executive, Peter White said, “We welcome Southern Water to the growing number of water utility clients in the UK now using the Envirosuite platform.

“It is a very significant step in our growth as a company and industry recognition of our world-leading platform to move from site-by-site sales to multi-site implementations.”

Recurring revenue provides financial predictability

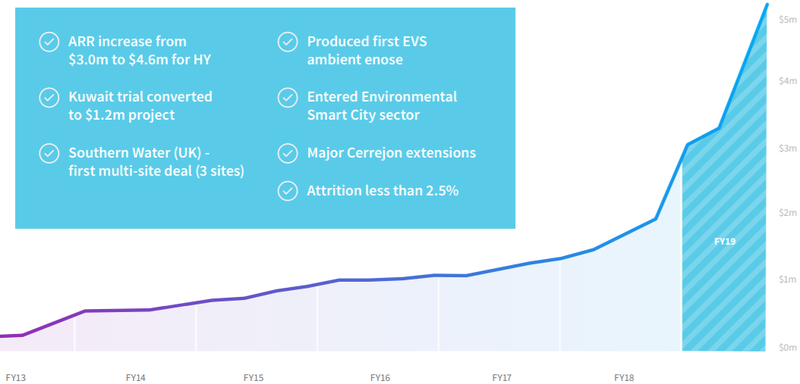

Management has taken a measured approach, looking to grow recurring revenues in order to provide earnings predictability as the company goes through a rapid period of growth.

During the period, the consolidated group recorded revenues of $4.81 million, compared to $1.67 million for the same period last year.

The recurring revenue for the first half totalled $1.75 million, and the significantly higher proportionate annual recurring revenue (ARR) is a particularly compelling attraction for a smaller company given that it provides financial predictability.

The ARR which is deemed as revenues that are anticipated to continue for longer than 12 months was $4.6 million as at December 31, 2018, up substantially from $1.85 million as at 31 December 2017.

Cashed up for acquisitions and expansion

Envirosuite also had a particularly strong balance sheet as at December 31, 2018 with cash of $9.2 million.

This facilitates bidding for new contracts on a global basis, as well as providing the capacity to make earnings accretive acquisitions which management said are always under consideration.

The company is also generating revenue growth from geographic expansion.

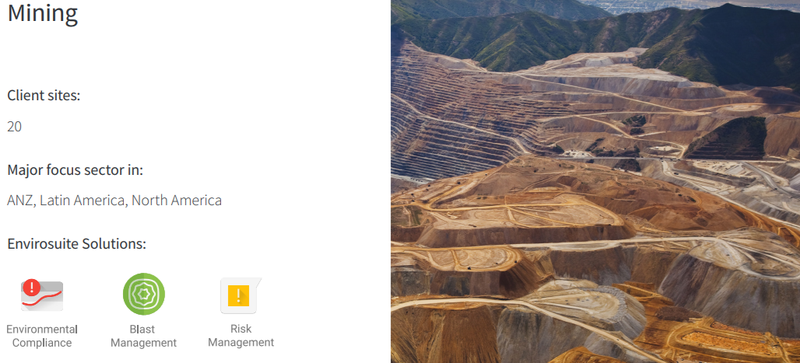

In addition to its South American hub in Chile, management has established an office and entity in Colombia.

This is strategically focused on the group’s largest mining client Cerrejon.

Envirosuite noted that it had experienced considerable success in selling new solutions to Cerrejon.

White said, “As a joint venture involving three global miners, (BHP Billiton, AngloAmerican, and Glencore), this client is becoming the key reference site for our work in mining and “Smart Mines” in general.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.