Aurora Labs ready to roar

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

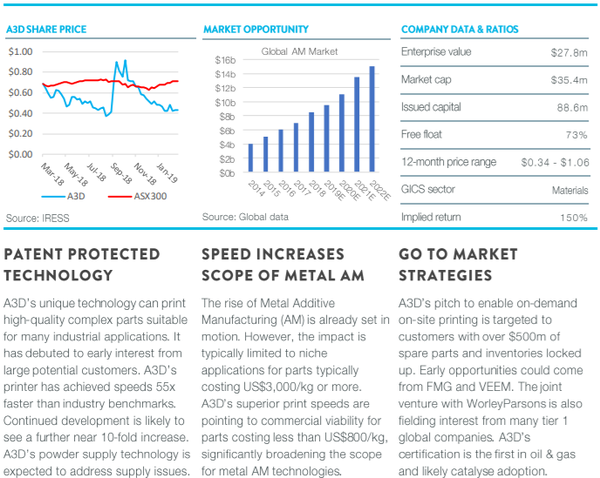

On Monday, Blue Ocean Equities initiated coverage of Aurora Labs Ltd (ASX:A3D), an industrial technology and innovation company that specialises in the development of 3D metal printers, powders, digital parts and their associated intellectual property.

Analyst, Justin Pezzano, is bullish on the stock saying, “Aurora Labs’ (A3D) proprietary technology is set to improve cost economics and could lead AM (metal additive manufacturing) into the $4 trillion large-scale metal manufacturing market.

"Early validation is underscored by partnerships with Fortescue Metals Group and WorleyParsons.”

Pezzano has placed a speculative buy recommendation on the stock with a price target of $1.00.

In the last 12 months, Aurora has made significant progress on the development of its proprietary 3D printer and powder technologies in pursuit of its aim to transform how metal parts and products are manufactured.

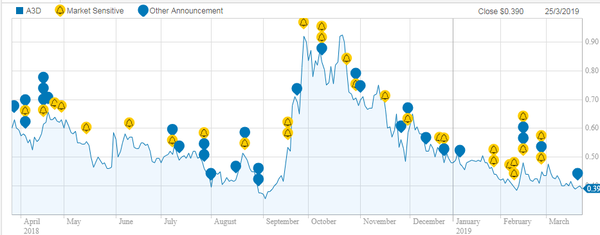

As indicated below (in yellow), Aurora Labs hasn’t been short on market moving news flow, but many of the positive developments coincided with the sell-off in equities that occurred in the second half of 2018.

Consequently, the company’s share price is struggling despite its apparent merits.

Pezzano’s price target implies upside of approximately 150% to yesterday’s closing price of 39 cents.

Significant progress has been made with Aurora’s Rapid Manufacturing Technology (RMT) which recently achieved speed increase to 113 kilograms per day or 55 times faster than Market Speed and proving scalability of RMT using its proprietary Multilevel Concurrent Printing (MCP) process.

Features of Aurora’s technology

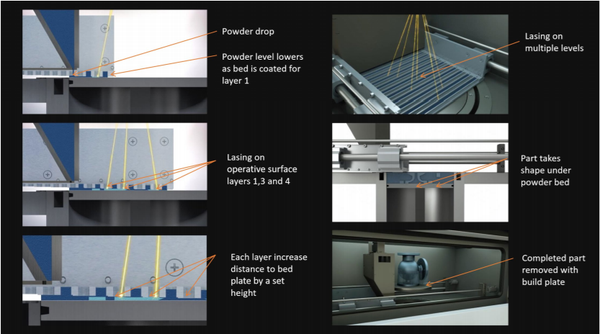

The MCP varies from traditional 3-D printing in a number of ways.

Primarily though, with traditional 3D printing, a digital part (3D model) is run through software which slices the digital part up into a series of very thin layers.

The printer puts down a layer of powder on the print bed and then the first “slice” of the part is fed digitally to the printer and an energy beam (laser, e-beam or other) scans the surface of the powder bed, melting and fusing the powder in the exact shape and dimensions of the slice.

This process is repeated and the next layer fuses to the previous one, forming a homogenous part.

This process is repeated until all the slices have been printed. Once printed, what is left is a complete replication of the digital part that has now been printed out of metal.

By comparison, in Aurora’s unique MCP process, multiple layers of powder are laid down at the same time.

During the powder laying process there is an area behind each individual powder gate where printing can take place (operative surface), meaning that printing can occur on these multiple operative surfaces simultaneously (Multilevel Concurrent Printing).

By using a number of gates, MCP printing can be significantly faster than traditional 3D printing processes.

In other developments, the finalisation of a 50/50 Joint Venture (JV) AdditiveNow2 will provide additive manufacturing services to the oil and gas and major infrastructure sectors.

There has been further expansion to Aurora’s Industry Partner Program with the signing of preliminary non-binding agreements with VEEM Ltd and subsidiary members of Fortescue Metals Group (ASX:FMG).

This is a snapshot of Pezzano’s take on Aurora Labs, highlighting its proprietary technology, diversified applications, scalability of its technology, competitive advantages and early stage collaboration agreements with blue-chip players.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.