Acquisitions to accelerate growth at EGL

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Environmental Group Ltd’s (ASX:EGL) wholly owned subsidiary Total Air Pollution Control (TAPC) has been awarded a $12.9 million contract for the design and supply of the Gas Scrubbing Plant for a project in Western Australia.

This resulted in EGL’s share price surging 10% on Friday, but there could be more upside to come as the microcap (market capitalisation: $12 million) company receives more recognition for its consistent financial performance which included earnings before interest and tax of $2.1 million in fiscal 2018.

With regard to the size of the contract, this is an important development for the group as it equates to more than the company’s revenues for the full six months to December 31, 2018.

It is also an endorsement of management’s targeted acquisition strategy which has seen the company grow in a measured way without placing undue strain on its balance sheet.

Compound annual growth of 17.6% over five years

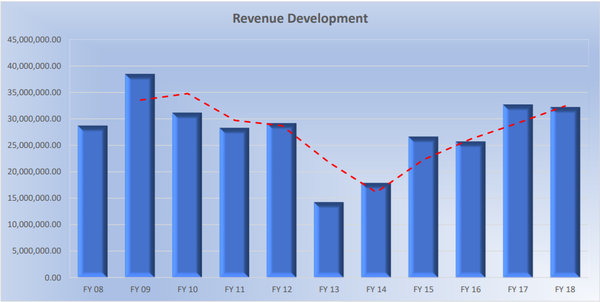

The revenue growth achieved by the company is evidenced in the following chart.

Growth over the last five years has been particularly impressive as the company has generated compound annual growth of 17.6%.

TAPC and its subsidiary Baltec Australia, which was purchased by EGL in October 2018, have worked collaboratively to produce a unique technical solution to manage the treatment of the waste gas generated by the Acid Baked Rotary Kiln to ensure environmental emission compliance.

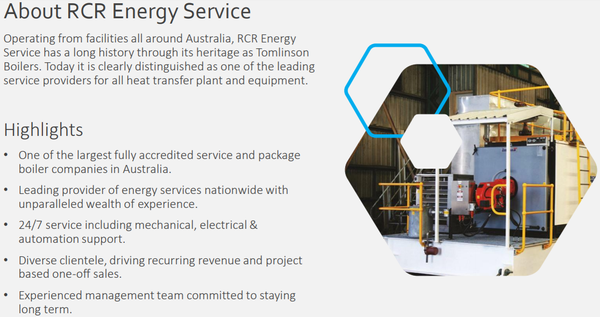

It has been a productive six month period for the group on all fronts, having completed the acquisition of the assets of RCR Energy Services from the administrators of RCR Tomlinson Group (ASX:RCR).

Acquisitions to drive medium term growth

The acquisition was consistent with the group’s strategy to pursue new growth and acquisition opportunities that are a fit with its environmental platform.

Another area of its business is Baltec IES which produces inlet and exhaust systems for gas turbines used to complement and augment solar and wind energy production, without the use of rare mineral battery resources.

Baltec IES was awarded its first offshore project in December by an international oil and gas group operating in North Australia.

While this is a new division of EGL’s business, Baltec has established a strong reputation over three decades of servicing this industry, and its experience was instrumental in being awarded the contract.

Another arm of the group’s operations, EGL Water, is developing patented technology in collaboration with Victoria University to reduce water pollution leading to an improved environment through low cost technology solutions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.