US markets frolic in the face of COVID, futures point to a tough start

Published 31-AUG-2020 10:13 A.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

With reporting season nearly over, the S&P/ASX 200 index (XJO) gave up some ground on Friday, falling 52 points or nearly 0.9% to close at 6074 points.

With the ASX SPI200 futures index down 40 points to 6004 points, our market could be facing significant back to back declines.

Friday marked the end of a fairly lop-sided week where the IT sector dominated the gains as it put on 3.5% while utilities and energy stocks were down 4.8% and 3.4% respectively.

While the S&P/ASX 200 Consumer Discretionary sector finished close to par across the week, this represented a consolidation of an outstanding reporting season in which the index (XDJ) soared more than 10% from 2500 points to 2765 points before closing at 2721 points on Friday.

There are signs that our retailers are adapting better to differing trading conditions, and it would appear that we could see some come out the other side of coronavirus with a much improved digital marketing strategy and upgraded online sales platforms.

Overseas markets finished the week strongly, and on the commodities front gold had a strong run on Thursday/Friday, suggesting some of our companies in that sector may come back into favour after a round of recent profit-taking.

24 hours

With the exception of Japan, markets in the Asia-Pacific region generally performed well with the Shanghai Composite leading the way as it gained 1.6% or 53 points to close at 3403 points.

The Hang Seng rallied 141 points, closing at 25,422 points.

Moving against the trend, the Nikkei 225 fell 326 points or 1.4% to close at 22,882 points.

While most European markets finished in negative territory, the losses weren’t critical with the FTSE 100 being the worst casualty as it fell 0.6% to 5963 points.

The CAC 40 only came off 13 points, closing at 5002 points while the DAX fell 0.5% to close at 13,033 points.

In the US, it was once again the S&P 500 and the NASDAQ that starred.

The S&P 500 gained 0.7% or 23 points to make another record close of 3508 points, representing a gain of 500 points in two months, an incredible feat at a time when the country is in a state of disarray.

The NASDAQ also closed at a new high of 11,695 points, up 0.6%.

The Dow hasn’t quite hit the rarefied air experienced by the NASDAQ and the S&P 500, but Friday’s close of 28,653 points isn’t far off pre-coronavirus levels.

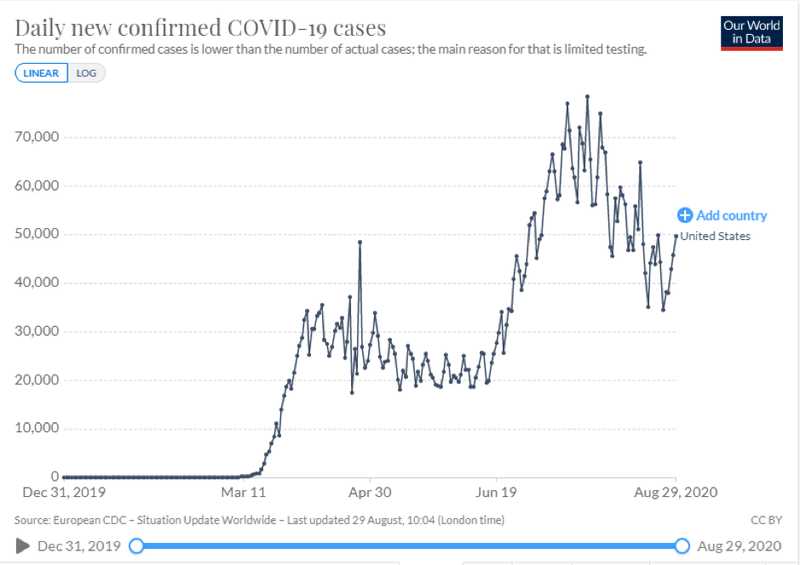

To put things in perspective, the Dow Jones last traded around this level of February 21, a day on which the US recorded one new COVID-19 case.

One week later, it was once again only one new case, but one month later the number of cases was approaching 20,000 per day.

The US still recorded approximately 50,000 new cases on Saturday, placing a huge question mark over the credibility of this rally.

Gold and base metals gain ground

Perhaps gold’s performance last week was some recognition that all is not right with the precious metal recovering from about US$1910 per ounce on Wednesday to touch US$1980 per ounce on Friday.

Oil recovered some of its mid-week losses to finish at approximately US$46 per barrel, up about 4% on a week-on-week basis.

Iron ore rallied strongly, increasing 1.8% to US$124.40 a tonne.

There were some strong moves on the base metals front with copper appearing to have consolidated its position at US$3.00 per pound as it put on another 1% on Friday.

Nickel also finished the week strongly, hitting US$6.92 per pound, leaving it only about 1% shy of the US$7.00 per pound mark.

Zinc rallied 3% during the week to finish at US$1.13 per pound, positioning it to press up towards US$1.20 per pound which would equate to a 12 month high.

Lead trailed off towards the end of the week to finish at US$0.89 per pound.

The Australian dollar has strengthened strongly in the last week, increasing nearly 3% from US$0.716 to US$0.736.

China manufacturing PMI numbers come out earlier in the week, and these can often impact base metal prices, as well as hard rock metals such as iron ore and coal.

There is a substantial amount of macroeconomic data due to be released this week with residential approvals, net exports, GDP and that RBA policy decision likely to impact the direction of the ASX.

The US will also be releasing its share of important data, headlined by manufacturing PMI for August, employment numbers and most importantly the Fed Beige Book, a reliable indicator of monetary policy decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.