China moves to support growth

Published 24-JAN-2019 11:26 A.M.

|

1 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The People’s Bank of China injected a record amount, CNY257.5 billion (~US$37.9 billion), into the money market yesterday in an attempt to support businesses.

The government then announced a series of measures to spur growth, including increased spending and plans for large-scale tax cuts and reductions in social security fees paid by employers. This is consistent with past monetary and fiscal moves by Chinese authorities aimed to maintain a steadily growing economy.

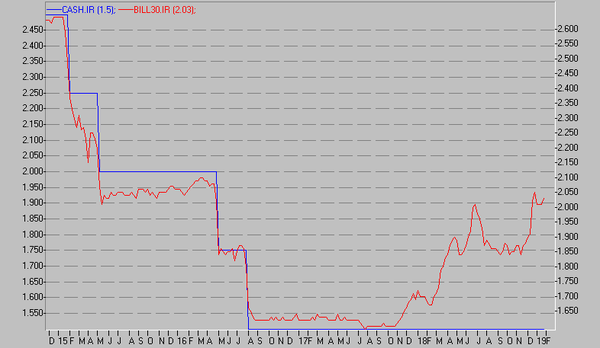

I'm perplexed as to why shorter dated bank bills are trading so far above the cash rate — note the chart below (the blue line is the interbank rate and the red line the 30 day bank bill rate). It suggests that funding in the money market is tight (supply and demand) and should therefore be reflected in bank lending rates such as mortgages, which it is not. Does it mean that we are likely to see some margin compression when the banks next report?

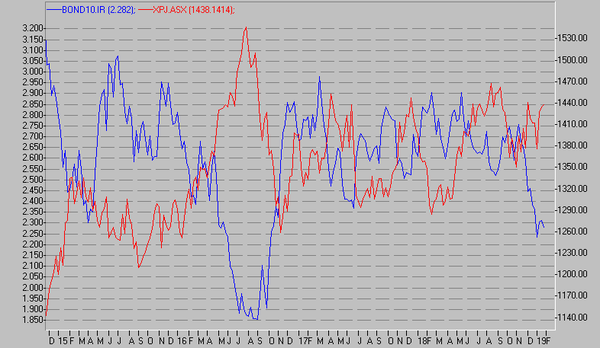

Another relationship of interest is that between the listed property trusts (red line below) and the Government 10 year bond rate (blue line) — note the general inverse correlation. Of late, though, the spread between the two has markedly widened and looks under pressure to start to reverse with bonds having rallied very strongly.

I've also considered the yield on the 30 day bank bills at 2.03% against the yield on the 10 year government bond at 2.28% and wondered if, at a spread of just 25 basis points, it is telling me we are headed for a period of very slow economic activity, a fall in inflation, or both.

Markets were mixed overnight with the UK and Europe all down and heading into their close. The Nasdaq is down, while the S&P and Dow are up. Our index futures are down three points and the Australian dollar is at US$0.7146.

Alex Moffat is a director at Joseph Palmer & Sons.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.