Australian investors don't buy Trump’s Rose Garden hype

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

While the Australian stock market responded positively to the strong lead from Wall Street after the Dow surged more than 2000 points or 11% overnight, the gains were nowhere near those experienced in the US.

The S&P/ASX 200 (XJO) was up 3.2% at midday, well short of the Dow’s increase and dragging the chain behind markets which are currently trading such as Japan and China.

In those countries, the Nikkei 225 and the Hang Seng were both up by about 4.5%.

It would appear that the ‘rose coloured glasses’ Trump address - ironically delivered in the iconic White House Rose Garden - resonated better with US investors than it did throughout the rest of the world.

In terms of individual sectors, this was the lie of the land at midday.

As you can see, the big winners were some of the heaviest sold down sectors including Industrials (XNJ), Financials (XFJ) and Materials (XMJ), with the latter including the large mining companies.

Two of the more resilient sectors during the recent sell-off have been Healthcare (XHJ) and Consumer Staples (XSJ) as companies in those sectors were expected to benefit from the provision of products and services in relation to health needs and food respectively.

Consequently, there are no surprises in terms of where the money is heading today.

Though, after the strong lead from Wall Street, some investors were no doubt hoping for a bigger kick.

Our reaction was no doubt tempered by the much more pessimistic albeit seemingly more realistic commentary from our leaders than the message delivered by Trump.

It was also accompanied by a significant uptick in regulatory restrictions, further emphasising the gravity of the problem.

One of the interesting sub-sectors that came under the spotlight was the S&P/ASX Gold Index (XGD) which has a mix of large and smaller stocks, with a substantial contingent not in the broader ASX 200.

Consequently, there were some big moves from smaller more speculative groups, but one of the companies that surprisingly didn’t features so strongly in terms of percentage gains was ASX 200 stock Regis Resources (ASX:RRL).

It could be one to watch, particularly if the rally in the gold price is sustained as it has a very robust production, earnings and dividend profile.

In fact, of all the companies in the gold sector Regis’ dividend yields relative to its current share price would be close to the highest on offer.

Furthermore, with zero debt and cash and bullion of about $170 million and strong production growth tipped in coming years there could be even more dividend growth.

Analysts at Bell Potter ran the ruler across the company as recently as February 17, reaffirming their buy recommendation and upgrading the price target from $5.61 to $5.72, representing a sharp premium to the midpoint of this morning’s trading range, which was in the vicinity of $4.00.

As we have outlined below, Regis has strong financial metrics as it trades on a low PE multiple relative to its growth profile, as well as being an attractive yield play.

Regis Resources Ltd - ASX:RRL

Exactly one month ago, Regis was trading at $4.72, but it hit a low of $2.90 last week.

However, it has outperformed the S&P/ASX 200 Gold Index (XGD) over the last week, and on Tuesday shares in the company surged more than 10% to close at $3.84.

Regis is an Australian-based producer which on a global basis is one of the lowest cost producers, while also benefiting from the low AUD:USD exchange rate which now implies an Australian dollar gold price of about $2800.

Regis has consistently generated strong cash flows, minimising debt and maintaining a balance sheet with the capacity to fund new projects that have gradually increased gold production.

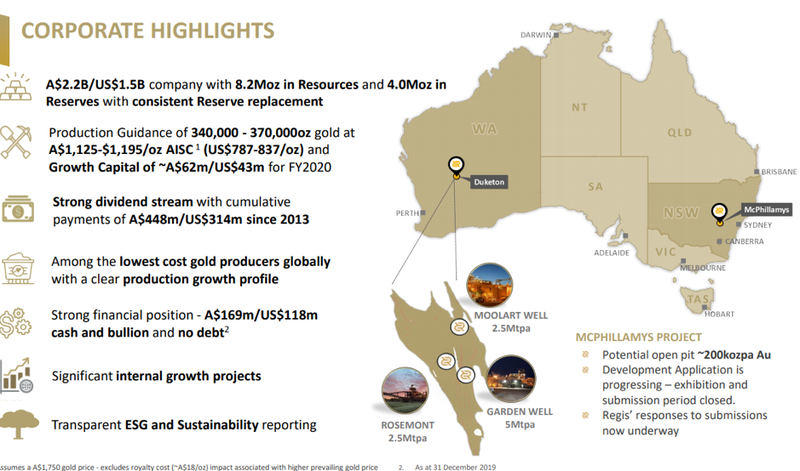

As the following map shows, the company’s producing mines are in Western Australia, but the McPhillamys project in New South Wales will be central to the company’s future.

A development application is currently being assessed, and management anticipates that a potential open pit mine could produce at a rate of 200,000 ounces per annum.

The company has 8.2 million ounces in resources and 4 million ounces in reserves, leaving it well-placed to maintain strong levels of production in the near to medium-term.

Analysts are generally projecting production to range between 370,000 ounces per annum and 400,000 ounces per annum over the next three years with costs to hover in the vicinity of $1120 per ounce, in line with the bottom end of management’s guidance for fiscal 2020.

This leaves a hefty margin of approximately $1700 per ounce based on the current Australian dollar gold price.

Analysts are forecasting strong earnings and dividend growth in fiscal 2021 with earnings per share increasing from 42 cents per share to 54 cents per share and the dividend increasing from 18.2 cents per share to 22.6 cents per share.

Based on a share price of $4.00, this implies a forward price-earnings multiple of 7.4 and a dividend yield of nearly 5.6% relative to 2021 projections.

Given Regis’ dividends are fully-franked, this implies a grossed up yield of 8%.

As we mentioned, don’t expect the dividends to dry up anytime soon given the company is debt free with cash and bullion of approximately $170 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.