IVE Group provides healthy mix of growth and yield

Published 12-OCT-2018 12:32 P.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This week’s Stock of the Week hasn’t been selected on its share price performance, but it is worth noting that it has lost little ground despite the S&P/ASX All Ordinaries index shedding 270 points between Monday and Thursday.

This may be because the company has certain attributes that provide insulation against both market and individual industry volatility.

The company pays an excellent dividend, and perhaps this accounts for its resilience in the last week as investors look to target stocks with earnings visibility and secure returns in the way of ongoing dividends.

However, more on the whys and wherefores later - the company is IVE Group Ltd (ASX:IGL) and it has a market capitalisation of approximately $320 million.

IVE is a vertically integrated marketing and print communications provider.

The company’s services include creating, managing, producing and distributing content across multiple channels, providing it with the capacity to generate multiple revenue streams from offering an end to end solution, one of the key benefits of the vertically integrated model.

IVE holds leading positions across a number of sectors with some of its key brands being Kalido (creative and marketing services), Pareto Group (fundraising specialists- NFP sector), Blue Star Group (which includes Blue Star PRINT, Blue Star WEB, Blue Star DISPLAY, Blue Star DIRECT, Blue Star CONNECT, Blue Star PROMOTE and Franklin WEB).

Diversification provides resilience

We talked earlier about the company’s diversification of revenues and how that may be seen as beneficial should certain industries come under pressure.

Some of the more resilient areas that IVE services are healthcare, financial services, communications, utilities and education.

Others sectors that are more cyclical in nature are retail, manufacturing and property with some signs that the latter may be slowing.

However, it should be noted that even with its exposure to the retail sector, IVE shouldn’t be all that disadvantaged as its digital focused services are in strong demand from the e-commerce sector.

IVE is also diversified by geography with operations in China, Singapore and New Zealand.

Understanding what IVE does

Companies involved in the IT and marketing space often have difficulty in articulating what they do and how they make money – one of the first things I want to know.

At times this is a function of the complex nature of their business, but all too often it is a case of “let’s keep the investors in the dark and use a few buzzwords and the share price will take care of itself.”

Unfortunately, investors are sometimes attracted to such investment propositions, but sadly when the rubber hits the road and management has to explain the group’s financial situation it all comes tumbling down.

As we said, IVE has a number of different divisions servicing various market areas in different ways so it takes a little more time to understand.

In brief, the Blue Star division has a strong presence in the retail sector, providing an integrated print, point-of-sale, personalised communications, promotional products warehouse and logistics services.

In July 2017 the group’s existing Victorian Blue Star DISPLAY operation was relocated and merged with Franklin WEB’S retail display business into a dedicated facility.

This coincided with a significant investment program to provide more capacity to better service national retailers for their retail display requirements.

IVE’s Kalido division has operations in Australia and Asia, providing omni-channel solutions to enhance the customer’s experience.

Omni-channel refers to entities that recognise the need for both and in-store and e-commerce sales and advertising platforms, a little like JB Hi-Fi for example.

Shoppers can scan for products online and/or visit stores with the ability to purchase laptops and the like through either channel.

In IVE’s case, a working example is Kalido’s partnership with Craveable Brands (Red Rooster, Oporto and Chicken Treat), which transformed the customer experience by leveraging leading marketing cloud platforms to enable a customer centric omni-channel automated solution.

The Pareto division focuses on providing data that assists companies in understanding and forecasting trends across the not-for-profit sector.

It has developed and implemented a new big data platform that will enable all client fundraising data to be automatically uploaded and integrated to provide sophisticated reporting and an enhanced level of insights.

This addresses an increasingly important issue for not-for-profit organisations where there is now a much greater emphasis on accountability.

Organisations that can demonstrate an advanced level of accountability are much more likely to receive funds from potential donors or through government packages.

IVE included in the ASX 300

Such has been the quality of the company’s progress that it was included in the S&P/ASX 300 Index as at September 24, 2018.

This should result in added interest from fund managers who for the best part are mandated to only invest in stocks that fall within the ASX 200 and/or ASX 300.

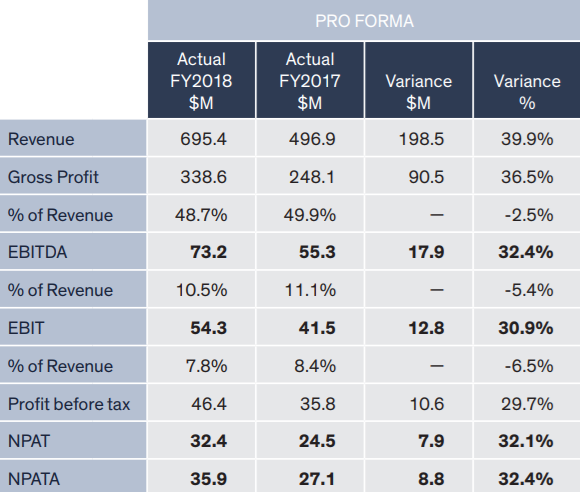

This occurred after the company delivered an impressive fiscal 2018 result as indicated below.

While IVE generated strong growth from its established businesses, the top line also benefited from the acquisitions of Franklin WEB, AIW and SEMA.

During fiscal 2018 the company experienced one-off costs due to the integration of new businesses, indicating that management’s expectations of year-on-year revenue and profit growth in fiscal 2019 appears well founded.

While the company didn’t place a figure on the extent of growth anticipated in the coming year, analysts are forecasting earnings per share to increase nearly 15% from 22.7 cents in fiscal 2018 to 26 cents.

Fundamentals look strong

This places IVE on a forward price-earnings (PE) multiple of 8 relative to its current trading range of approximately $2.10.

Consequently, the company appears undervalued on a PE basis relative to its earnings profile.

Importantly, it also presents as an attractive yield investment at current levels.

Consensus forecasts point to a full year dividend of 18 cents, implying a yield of 8.6%.

IVE’s dividends are fully franked, and as such the grossed up dividend would be 23.7 cents, implying a yield of 12.5% relative to a share price of $2.10.

This is far better than yields on offer from the usual chestnuts that yield seeking investors often chase such as the big four banks, Telstra and most Property Trusts, with the majority of the latter delivering unfranked dividends.

Share price impacted by dividend stripping

On the score of dividends it is worth noting that IVE’s recent share price weakness could be attributable to the company going ex-dividend.

The practice of dividend stripping is not unusual for companies that pay sizable dividends, and the fact that the company’s shares fell from $2.26 on the day prior to it going ex-dividend (September 17) to a low of $2.16 on September 18 tells the story.

It is often the case that stocks prone to dividend stripping take a little time to regain their momentum.

With regards to IVE it has had the double whammy of running into a downturn in the broader market.

However, this may present a buying opportunity for patient investors who believe in the story.

The consensus 12 month price target is $2.78, implying share price upside of more than 30%.

This information is general financial product advice only and you should consider seeking professional advice before making any investment decision. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.