Why Tesla is in trouble

Published 29-AUG-2018 16:12 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Welcome to the inaugural edition of Ctrl Alt Del, a weekly exploration of what’s highlighting the global tech and IT space.

Tesla Inc. (NASDAQ:TSLA) is under the pump.

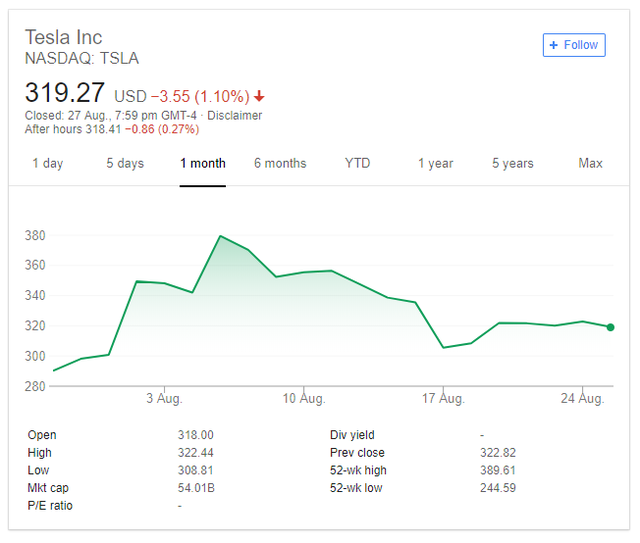

CEO Elon Musk’s propensity to cause controversy looks to be coming at the expense of the EV carmaker. Most notably, Musk’s vision to take Tesla private at a proposed US$420/share – a plan, which Musk tweeted to the world on August 7 – suffered immediate backlash.

While Tesla did have US$2.2 billion in cash at the end of the June quarter, its unsteady financial situation resulted in the collapse of the go-private plan.

The company has already churned through US$1.8 billion through two quarters this year, having registered a near US$2 billion loss last year.

Musk announced that Tesla would stay public on August 24 via blog post, “Given the feedback I’ve received, it’s apparent that most of Tesla’s existing shareholders believe we are better off as a public company.”

He also noted that reluctance from significant shareholders played a significant role in remaining on the NASDAQ.

“Although the majority of shareholders I spoke to said they would remain with Tesla if we went private, the sentiment, in a nutshell, was please don’t do this.”

Investors didn’t hesitate to punish Tesla upon Musk’s announcement, wiping up to 18% off its value this month.

“Now that the go-private transaction isn’t happening, we think it’d be wise for Tesla to protect the downside and at least try to raise significant new equity capital sooner rather than later,” Citi Research analyst Itay Michaeli said on August 26.

The go-private plan failure is the latest red flag for Tesla and Musk, with persistent concerns over build quality and slow production uptick threatening to dissolve any headway it claimed over key competitors.

On borrowed time?

Traditional carmakers sluggish transition into the EV space has worked in Tesla’s favour, but what’s going to happen when they shift into gear?

One such carmaker is Audi, which is promising big things with its patented e-tron® technology.

According to the German behemoth, e-tron® will be the most efficient form of brake regeneration seen:

‘A one-of-a-kind regeneration system. Regeneration helps the e-tron recapture energy from 90% of braking applications and is designed to contribute up to 30% of the vehicle’s range. The e-tron has variable regeneration modes via the steering wheel paddles that allow the driver to optimize their range on where they’re driving and the efficiency they want from the vehicle.’

The conceptual tech will feature on the e-tron quattro, Audi’s first fully electric vehicle.

Audi has put 250 e-tron quattro’s through their paces across four continents, in the strongest sign yet that their entry into the EV market will be a far smoother one than Tesla’s.

While details surrounding its price tag remain secret (for now), the stylish SUV boasts a range of more than 500km (311 miles) and is powered by a large 95 kWh battery that reaches 80% charge in just 30 minutes.

Considering that in just 21 days you can reserve your own e-tron quattro for US$1,000, why would you buy a Tesla?

I wouldn’t.

This article is General Information and contains only some information about some elements of one or more financial products. It may contain; (1) broker projections and price targets that are only estimates and may not be met, (2) historical data in terms of earnings performance and/or share trading patterns that should not be used as the basis for an investment as they may or may not be replicated. Those considering engaging with any financial product mentioned in this article should always seek independent financial advice from a licensed financial advisor before making any financial decisions.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.