Netflix and Ads

Published 13-SEP-2018 17:40 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This is why we can’t have nice things.

There’s nothing worse than when you are watching YouTube videos and some clunky, unrelated ad assaults your ears and eyes.

Skip video in 5, 4, 3, 2 – SKIP.

Remember when Foxtel was ad free? Yeah me neither, but apparently it was.

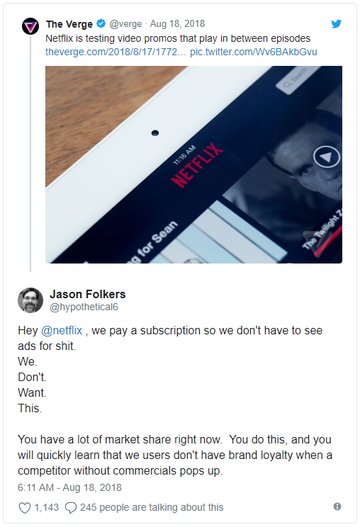

It’s looking increasingly likely that Netflix and ads will overtake the infamous Netflix and chill, as the streaming pioneer rolled out its first iteration of ‘recommendations’ in August.

You may be wondering what on earth that actually means: after all, the platform already offered recommendations to users based on their previous viewing history. So what’s the difference?

It turns out that Netflix’s definition of what a recommendation is = ads.

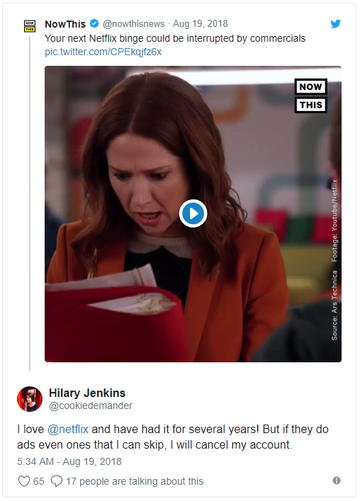

For now the ads can be turned off (phew), but that hasn’t stopped users voicing their displeasure.

When requested for comment by Ars Technica, Netflix made the following statement on the ‘recommendations’.

"We are testing whether surfacing recommendations between episodes helps members discover stories they will enjoy faster.

“A couple of years ago, we introduced video previews to the TV experience, because we saw that it significantly cut the time member spend browsing and helped them find something they would enjoy watching even faster,” it said.

Oh okay, you just want to help us find something else for me to watch? That’s cool I guess.

Except it’s not, because that’s what the navigation sidebar, search function and the existing recommendations are already for.

Is this really about the user, or Netflix’s bottom line?

Unfortunately this move is likely a means to an end. A way to soften up consumers for the inevitable.

Logically, the move to experiment with ads is the perfect segue into selling premium ad space on in demand series, and considering that Netflix now boasts over 130 million subscribers – advertisers would salivate at the prospect of paid commercials.

Subscribers V Advertisers

A recent report conducted by Hub Entertainment Research suggests that Netflix could be in for a mass exodus if it implements ads full time.

Of the 1,612 US TV consumers (16-74) that were polled over Netflix ads, around 25 per cent indicated that they would cancel their subscription to the platform.

Jon Giegengack, who authored the report, spoke on the results.

“I think there are ways that they could arrange it so they retain as many customers as possible, but I think if they add ads at all, even at price reduction, there will be some people who leave.

“The question is, do the economics work out for them?”

Giegengack poses a challenging question.

Perhaps Netflix already knows user subs will drop in the mid to short term, but what if the adoption of advertisers cover this drop off and then some?

In addition, considering that its direct competitors are still well behind, it’s feasible the incumbent believes it can reclaim a large slice of that 10-20 per cent in time.

Netflix, you and I have shared some wonderful times, but it looks like I’ll be sailing back to the Pirate Bay.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.