Instagram co-founders block Facebook

Published 27-SEP-2018 17:03 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

If you can’t beat them: buy them.

That’s been the ‘status’ quo for Facebook under his Zuckerbergness, where competitors in the way are bought out and ‘merged’ into Facebook’s growing collaborative umbrella.

Once a respected acquirer, the departure of Instagram co-founders Kevin Systrom and Mike Krieger this week has reignited the blowtorch on Mark Zuckerberg.

Systrom and Krieger flourished for six years with Facebook, but reports of a ‘directional change’ for Instagram originating from the Facebook CEO led to the duo’s departure.

Much like the giant boulder in Indiana Jones and the Raiders of the Lost Ark, Facebook is gathering steam and nothing will slow it down. This aggressive mentality has seen it finalise over 60 acquisitions and/or mergers.

You can’t blame the social network for protecting its global empire, but will it come at an eventual cost?

While Instagram has flourished financially under the guidance of Facebook, it’s not the first company to clash heads with the incumbent.

WhatsApp –

WhatsApp was founded by Brian Acton and Jan Koum in 2009.

The instant messaging app held one key difference over its peers: no ads.

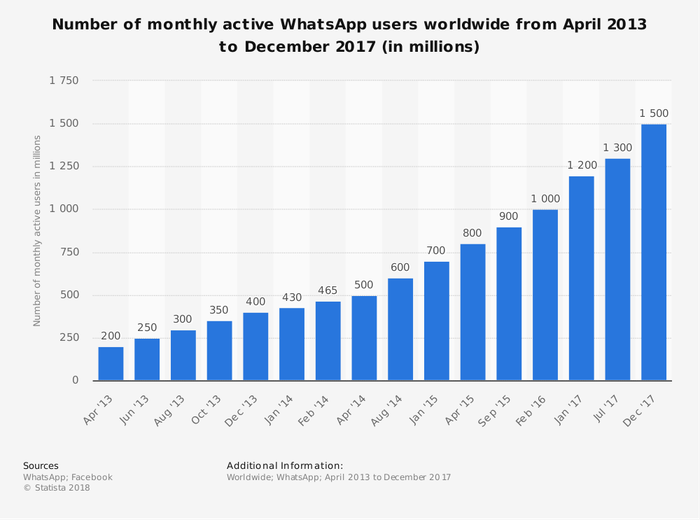

The freeware cross-platform messaging service has enjoyed swift global adoption, reaching 1.5 billion monthly users in December 2017.

WhatsApp was acquired by Facebook for a whopping US$19 billion in 2014.

But there was just one small problem: at the time of the acquisition, aside from piecemeal annual subscription fees (around US$0.99) WhatsApp didn’t really make any money.

Something had to give.

“WhatsApp is on a path to connect 1 billion people. The services that reach that milestone are all incredibly valuable,” Zuckerberg said upon completion of the deal.

“WhatsApp had every option in the world, so I’m thrilled that they chose to work with us. I’m looking forward to what Facebook and WhatsApp can do together.”

Unfortunately from the outside looking in, Acton and Koum didn’t know what they signed up for when they ‘chose to work’ with Facebook.

The duo were at constant loggerheads with key members at board level, and Facebook’s sustained push to launch advertising on WhatsApp and concerns over user privacy was the key factor behind their exit earlier this year.

Acton has since accused the company of using him to mislead EU regulators and claimed he lost considerable creative input on the platform’s future.

“At the end of the day, I sold my company. I am a sellout. I acknowledge that,” he said in an interview with Forbes.

Koum has maintained a lower profile since the acquisition. Maybe his impassioned post on the WhatsApp blog in 2014 is why:

“Here’s what will change for you, our users: nothing.

“WhatsApp will remain autonomous and operate independently. You can continue to enjoy the service for a nominal fee. You can continue to use WhatsApp no matter where in the world you are, or what smartphone you’re using.

“And you can still count on absolutely no ads interrupting your communication. There would have been no partnership between our two companies if we had to compromise on the core principles that will always define our company, our vision and our goal.”

Fast forward five years, and Facebook has confirmed that the first ads will make their way onto WhatsApp 'shortly.’ The announcement, which came in August, suggested that ads will be rolled out onto WhatsApp statuses (where user stories are featured).

When you combine this announcement with the recent launch of WhatsApp Business, WhatsApp for Business API and P2P payments, the writing is on the wall.

In a statement, Facebook reaffirmed its commitment to monetising the app.

"Facebook fosters an environment where independent-minded entrepreneurs can build companies, set their own direction and focus on growth while also benefiting from Facebook’s expertise, resources and scale. This approach is working well with Instagram, and WhatsApp will operate in this manner."

Lightbox –

Lightbox was an Android photo sharing app which allowed users to curate and share images.

Founded by Thai Tran (a former product manager at Google) and Nilesh Patek, the app released on June 5 2011. By December of the same year, Tran indicated that the app was approaching one million downloads, and was featured in PC World’s 100 Best Products of 2011.

Oh yeah. I remember that! That was so cool.

Was.

Lightbox’s mercurial rise caught the attention of Facebook, which promptly acquired Lightbox for an undisclosed amount on May 5 2012.

Barely one month later on June 15, Facebook shut down Lightbox.

While I don’t have specific details on why Facebook killed Lightbox just one month after acquisition, the below picture is probably an accurate summation.

2018 has unfriended Facebook

It’s been a nightmare year for Facebook. In isolation the departure of Systrom and Krieger is an inconvenience, but we’ve all heard about the infamous Cambridge Analytica scandal and that’s just the beginning.

Where there’s smoke, there’s fire.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.