Got the munchies? The startup that ate itself

Published 08-MAR-2019 15:05 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

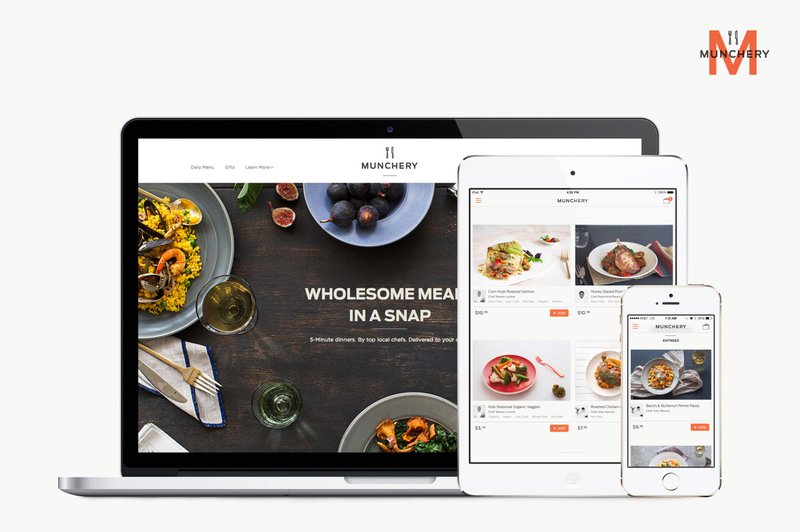

‘Dinner is solved.’ That was the motto of the online food delivery service, Munchery.

Everyone eats every day right? What could go wrong?

Unfortunately for Munchery, it turns out dinner is anything but solved.

Earlier this week the company filed for bankruptcy, citing increased competition, over-funding and failed expansion efforts as the reasons for its demise.

It owes a whopping US$3 million in unfulfilled customer gift cards and another US$3 million to its vendors, suppliers and various third parties.

Founded in 2010, the San Francisco business had raised some US$125 million in venture capital funding and had reached a valuation of US$300 million by 2015. It’s now thought to be the biggest on-demand food company to bust.

How did it go so wrong?

Despite its rich beginnings, the company struggled to find its true identity.

What originally started as a ready-to-eat meal delivery service quickly bolted on a meal-kit scheme, which offered subscription plans from just $8.95 a month.

During an interview with the SF Chronicle, Amy Machnak, who was Munchery’s content manager, said the company’s failure was not surprising, “The very first day I got there, I walked in and got the lay of the land, and was like: this is not going to last. The logistics were poor.”

To support its new product offerings, Munchery opened three industrial state of the art kitchens in Seattle, Los Angeles and New York, hiring chefs to meet the demand at each venue.

One such chef was Pascal Rigo, who worked with Munchery for five months, “I couldn’t understand why we weren’t just focusing on San Francisco and doing it right before going to Seattle, Los Angeles and New York,” he said in an interview with the SF Chronicle.

“I was not comfortable with the overall strategy. It really needed validation at the city level, at the concept level, before going anywhere else.

“It’s very complicated. You can be either a good food company or a good delivery company, but I don’t think anyone has been able to do both,” he continued. “The idea was very exciting and a big proposition.

“Not only Munchery but everyone in this category that wanted to manufacture and deliver their own food to customers had difficulties.”

It turns out Rigo was right.

By May 2018, the company had shut down its operations in the three cities. There was widespread concern that the company was not financially viable, but Munchery moved to dispel these claims.

At the time of the announcement, the company said it would double down on its biggest market, San Francisco. “[We will] achieve profitability in the near term, and build a long-term, sustainable business,” the company announced.

That never materialised.

In late 2018, Munchery laid off some 30% of its employees and by January 2019 it had ceased all operations, effective immediately.

The unfortunate demise of this once promising business is a timely reminder to others: it’s best to curb one’s appetite for expansion until the business model is proven.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.