$15 billion capped Pinterest's shares rise by 15%, but what exactly do they do?

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

I have a confession to make.

I know nothing about Pinterest (NYSE:PINS). I don’t know what it’s about. I don’t know how to use it. I don’t know who uses it or even why it’s used.

Of course, that won’t stop me from writing about it.

I do so as someone who looks at market caps every day and financials and numbers, which once upon a time, would have confused the arts grad out of me.

Now, I find financials interesting.

It interests me that Pinterest has a market cap of $15.3 billion, just a few billion more than the ASX small caps I usually write about... just a few billion!

It interests me that in Q2 its revenues grew by 62% year-on-year to $261 million.

“The momentum we have seen over the past several quarters continued as more advertisers recognise the power of our platform to reach consumers," said Todd Morgenfeld, CFO.

"We remain encouraged by trends in U.S. ARPU and by user growth in international markets. While our net margin declined due to RSU expense related to our IPO, our strong revenue performance and focus on execution allowed us to expand Adjusted EBITDA margins by 10 percentage points year-over-year."

It interests me that Pinteret's share price gained 15% on the back of the quarterly.

“The digital pinboard posted revenues of $202 million on losses of $41.4 million for the three months ending March 31, 2019. This surpassed revenue estimates of roughly $200 million and represented significant growth from Q1 2018 revenues of $131 million. Losses in the first-quarter of 2019, however, came in roughly three times higher than estimates at 32 cents per share,” reported Tech Crunch.

Meanwhile, its MAUs (monthly active users) hit 300 million at the end of the quarter up from 231 million at the same time last year.

"We constantly aim to make Pinterest more personal, relevant and useful to our users. Our MAUs hit 300 million at the end of Q2 as we built and expanded products to support this vision," said Pinterest CEO Ben Silbermann.

"We also continued to grow and diversify our advertiser base and improve advertisers’ ability to measure the effectiveness of their ad spend. This is part of our larger and ongoing effort to create value for businesses on Pinterest."

These are great numbers, so no wonder the company is seeing consistent growth. However, I’m still not sure what they do. That’s more ignorance on my part than anything else. As far as social media is concerned, I sometimes use Facebook for personal and business use and Twitter and LinkedIn professionally - but that's where I draw the line.

Apparently, Pinterest is also useful for professional reasons

Here’s an explainer about how to increase site traffic to grow your business:

I found out what Pinterest is when Jeff Kaplan of Allison PR sent me a press release. Thanks Jeff.

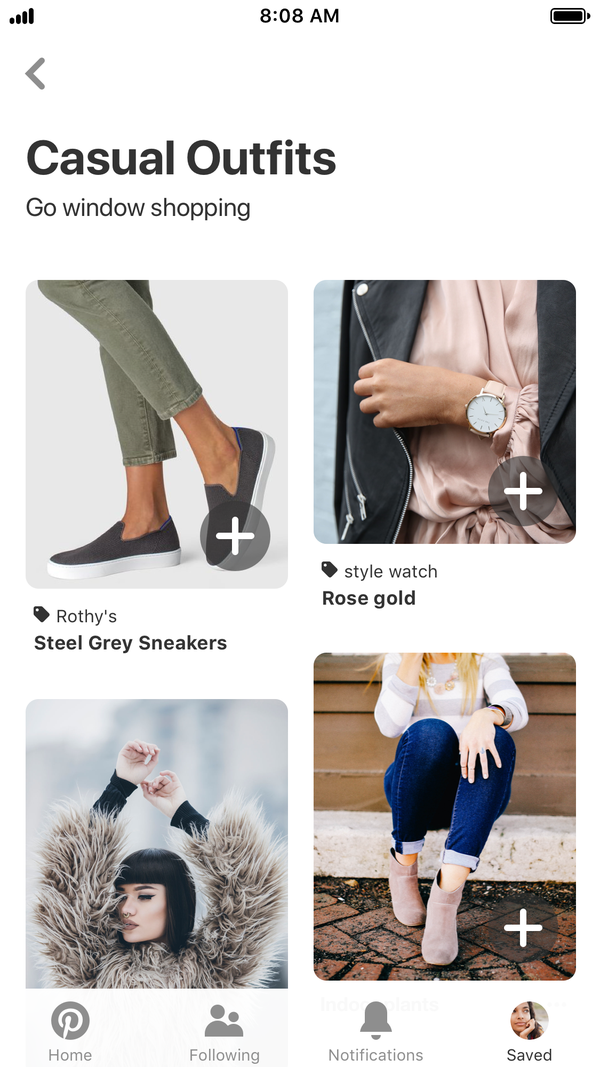

For those like me who have been in the dark, Pinterest is a visual discovery engine that helps people discover new ideas, from what to cook for dinner to how to decorate your home to what products to buy or where to go for your next holiday.

Pinterest has more than 200 billion Pins saved and serves billions of personalised recommendations each day. In Australia, more than 3 million ideas are saved each day (as pins).

It’s a sharing platform. Sharing is caring.

And anyone can use it.

There are bikers looking for motivation. ‘Biker quotes inspiration’ searches are up +123%, business owners growing their businesses looking for “entrepreneur inspiration motivation” have raised the bar +47%, “branding inspiration” is +231%, and women planning to propose are also heavily searching for “women proposing to men” ideas – +334%.

There’s a lot going on.

As alluded to above, this week Pinterest announced that more than 300 million people go to the platform every month.

To mark the occasion, researchers at Pinterest commissioned a survey with TalkShoppe to ask more than 2,000 Pinners about their attitudes around Pinterest and look at how it is tracking on its mission and helping people find the inspiration to create a life they love.

Some of the key findings were:

- More than 91% of Pinners say that Pinterest is a positive place.

- More than 9 out of 10 Pinners say Pinterest inspires them, gives them ideas for their life and helps them achieve their goals.

- 89% of Pinners say that Pinterest leaves them feeling empowered.

- 83% of Pinners say that Pinterest helps them build their confidence, compared with 49% of people saying that about social media platforms.

Pinterest is a good news finance story. I'm still unlikely to use it, but at least I now understand it because... numbers really do matter.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.