When start-ups & biotech collide

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Unlisted biotech start-up, Inflazome, which was founded on research from the University of Queensland and Trinity College Dublin in Ireland, has secured further investment of $63 million to continue its drug development program.

Launched in 2016, Inflazome is developing new drugs to block harmful inflammation, with this new round of Series B financing to be used to advance the company’s small-molecule inhibitors of the NLRP3 inflammasome to multiple clinical trials in 2019.

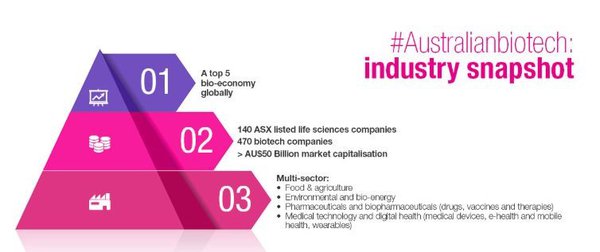

Inflazome is just one of many Australian companies that is at the forefront of biotech research. In fact, Australia has a burgeoning biotech sector, soundly supported by government policy.

On top of R&D incentives, there is also the A$500 million government-initiated Biomedical Translation Fund (BTF).

The fund is split between $250 million of Commonwealth capital and $251.25 million private sector capital, and supports commercialisation of biomedical discoveries in Australia. It also helps translate biomedical discoveries into high growth potential companies to deliver long-term health benefits and national economic outcomes.

Funding is available through three private sector venture capital (VC) fund managers, which are investing in companies with promising biomedical innovations with commercial potential.

Like Inflazome. Or Prescient Therapeutics (ASX:PTX), Immuron (ASX:IMC), Imugene (ASX:IMU), and others.

Australia has a history of support in this field.

Here’s a snippet from the article, 'The state of Australian biotech', explaining this history further:

"Biotechnology is a unique sector for the country and there are good reasons why it should be fostered through forward-looking government policy. For more than 100 years, there has been successive government policy focused on funding innovative medical research which has made Australia one of a handful of countries globally producing the very best medical research — Australia is routinely ranked in the top four countries in the world for our biotechnology capabilities.

"This strong foundation of excellence, combined with the ease with which clinical trials can be conducted, strong patient and regulatory laws and increasing access to capital, uniquely provide Australia with a generational chance to supercharge this already important industry."

Given this level of support, it is unsurprising that the Australian biotech industrycould reach $8 billion in revenue this year.

The Capital Network’s Lelde Smits spoke with Botanix Pharmaceuticals (ASX:BOT) founder and Executive Director, Matthew Callahan, about the opportunities in this sector.

This infographic provides insight into the industry’s growth:

Inflazome is one company that is currently supercharging the industry.

The work it is doing in chronic activation of NLRP3 is linked to various medical conditions associated with inflammation, including Alzheimer’s, Parkinson’s, inflammatory bowel disease (IBD), gout, osteoarthritis, liver, kidney and cardiovascular diseases – conditions often inadequately treated by current therapies.

Funding for Inflazome was welcomed by UQ Vice-Chancellor and President Professor, Peter Høj.

“This investment is a testament to the quality of the underlying research originating from a highly productive international collaboration,” he said. “It is the highest follow-on capital raise by any of UQ’s private startup companies, and brings the total capital raised by our startup portfolio to more than $700 million.”

Inflazome was founded on intellectual property licensed by UQ’s commercialisation company, UniQuest, based on work by researchers from UQ’s Institute for Molecular Bioscience (IMB) and Trinity College Dublin, including IMB’s Professor Matt Cooper, who is also the company’s CEO.

Professor Cooper said the potential of NLRP3 inhibitors as a drug target was incredibly exciting.

“We look forward to generating robust human proof of concept data with this financing, and making further progress towards developing a treatment to help millions of patients who are suffering with inflammatory diseases,” Cooper said.

Associate Professor Kate Schroder and her team have spent many years researching the NLRP3 inflammasome, a key biological pathway associated with chronic inflammation.

“The inflammasome plays a critical role in the immune system, but when improperly activated, it can cause a myriad of inflammatory diseases,” Schroder noted. “So we are thrilled about the potential for the development of NLRP3 inhibitors as drug candidates, as this could offer new treatments for many debilitating human diseases.”

You can read more about NLRP3 inflammasome here.

The financing round was led by life sciences venture capital firm, Forbion, with Longitude Capital and founding investors Novartis Venture Fund and Fountain Healthcare Partners also participating.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.