VW powers up on the back of Power Day

Published 17-MAR-2021 12:46 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Volkswagen Group (VW) is usually a s steady performer on the sharemarket, but a combination of factors yesterday saw its shares rise to a record 13-year high.

On the back of its first ever 'Power Day' event and the release of its fiscal 2020 results, its shares reached a high of €309.40, its highest point since the €352.59 it hit just before the 2008 Financial Crisis.

The impact of Power day, certainly had a big effect for the world's largest automaker.

VW manufactures over 10 million cars per year and now has its sights set on electric vehicle dominance. Although sales revenue of €222.9 billion, was a decline of 12 per cent, this can mainly be attributed to falling volumes as a result of the global pandemic.

It is its EV focus, however that is all the buzz.

"Over the past year, Volkswagen has positioned itself as a threat to Elon Musk’s Tesla in the battle for EV market domination, launching a high number of Volkswagen EV models such as the ID3," says eToro analyst Josh Gilbert.

"As the largest selling car manufacturer in Europe, Volkswagen has nearly tripled its deliveries of EVs last year to over 212,000. In this recent report (Power Day), Volkswagen has laid out ambitious plans to deliver 1 million EVs this current year, investing more than €46 billion in EVs over the next 5 years."

In 2020, Volkswagen’s stock rose more than 121 per cent. Analysts believe thew upward trend will continue.

"This week, Volkswagen’s “Power Day” only added more fuel to the stock’s success, rising more than 7 per cent," Gilbert said.

"During the event, Volkswagen unveiled its roadmap to longer-range EVs, cheaper batteries, and better charging. The event was a hit with investors as it provided a glimpse of what can be expected from the company moving forward.

"Tesla will continue to dominate the EV sector over the short period, but will Volkswagen speed through as Tesla’s biggest rival?"

CEO Dr Herbert Diess has set VW on a €25 billion electrification program. So the rise in share price and market cap will be welcome as it looks to cover costs.

VW is on the attack in this market.

“Volkswagen has been all about boosting market capitalisation to cover the EV investment costs and vertical integration,” European Electric Car Report publisher and analyst Matthias Schmidt said.

“Walking the Tesla line and creating a vortex attracting retail investors and watch the institutional investors jump on board for the ride and vice versa in an upward spiral similar to Tesla.

“Even the move to social media to create some of that vortex is right out of the Tesla notebook.

“The difference is VW already has the scale in place required to leverage a profitable migration across to EVs almost from the off, or at least a lot sooner than perhaps earlier anticipated."

The VW Group is larger than you may think:

The key takeaways from Power Day include:

- the construction of four battery cell “gigafactories” by 2030, taking its European tally to six

- Volkswagen Group to be the world’s second largest cell producer

- 27 EVs will be on sale by the end of 2022 (as Forbes reports, "this equates to rolling over Tesla’s entire lineup every quarter for seven quarters").

- a new type of cell production will reduce costs by more than 50%, and will find its way into at least 80% of VW's models.

This could be game changing for potential resources suppliers surrounding VW.

For instance, there are some significant implications for Euro Manganese (ASX: EMN) and its Chvaletice Manganese Project.

VW will use high-manganese cathodes for the majority of its electric vehicles going forward, citing their lower cost and comparable range compared with today’s state-of-the-art technology.

Here, Frank Blome, head of Volkswagen's Center of Excellence for Battery Cells explains the role high-manganese batteries will play in Volkswagen electric vehicles.

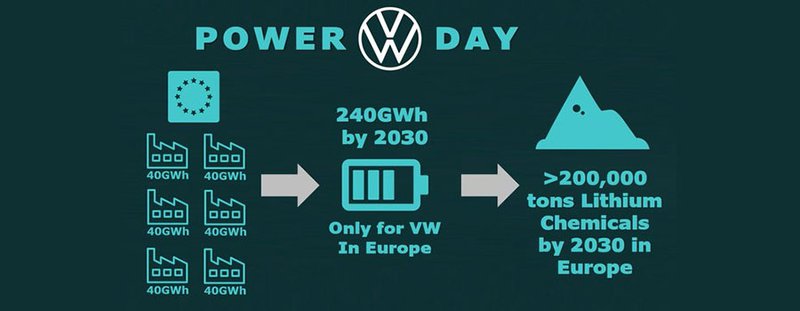

VW plans to increase battery production in Europe scaling to 240 GWH by 2030. The majority of those will be high manganese.

The factories will also use 200,000 tonnes of lithium per year, which would suit the likes of Vulcan Energy (ASX: VUL).

Vulcan has developed the world’s first and only Zero Carbon lithium process and plans to produce battery-grade lithium hydroxide from geothermal brines pumped from wells with a renewable geothermal energy by-product in Germany.

VW's Power Day upped the ante on the shift to electric vehicles and could well speed up the uptake.

Power Day is a challenge to Tesla, from the world's leading car manufacturer. However, to catch its $650BN market cap, a real change in culture is required.

VW's new generation of electric cars, anchored by the ID4 crossover, is going global this year.

Will it be the start of a war to determine who gains global EV dominance?

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.