Our Oil and Gas Portfolio

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| TEE | 1651759200 06-May-2022 | $0.113 | 77% | 77% |

| IVZ | 1600351200 18-Sep-2020 | $0.035 | 1057% | 106% |

| 88E | 1595426400 23-Jul-2020 | $0.007 | 129% | -29% |

| EXR | 1562767200 11-Jul-2019 | $0.041 | 424% | 217% |

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| TEE | 1651759200 06-May-2022 | $0.113 | 77% | 77% |

| IVZ | 1600351200 18-Sep-2020 | $0.035 | 1057% | 106% |

| 88E | 1595426400 23-Jul-2020 | $0.007 | 129% | -29% |

| EXR | 1562767200 11-Jul-2019 | $0.041 | 424% | 217% |

How to invest in oil and gas

Macro Outlook Oil and Gas - 2023

2022 was as good of a year for oil and gas stocks that we have seen for over a decade as the fallout from the Russia-Ukraine conflict pushed oil prices to ~15 year highs.

We expect to see this trend continue due to decades of underinvestment in new oil and gas supply, the shift to electrification taking longer than expected, and the importance of energy independence coming into focus.

We expect to see a short term dip in prices because of heightened recession risks from rising interest rates but think that this will provide entry points in fundamentally sound projects at attractive valuations.

If this scenario plays out we plan on increasing our exposure to stocks in our portfolio as well as adding new oil and gas stocks to our portfolio.

Below is a summary of the reasons we like Oil and Gas as a macro thematic:

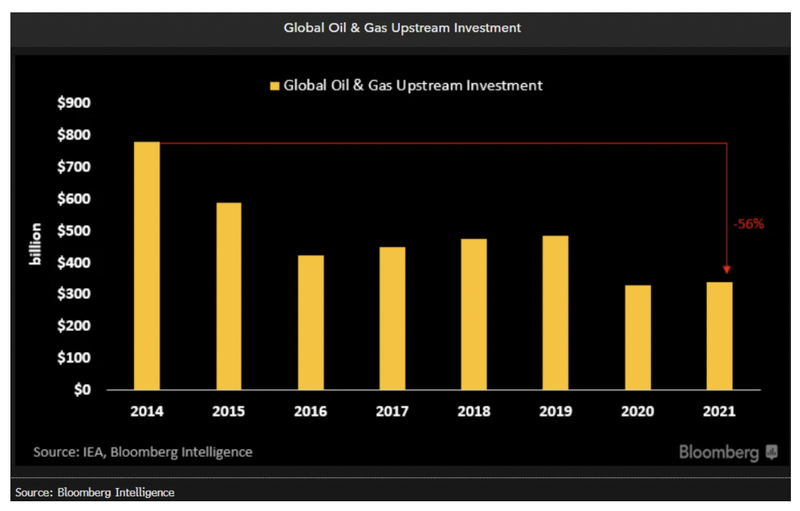

- 10+ years of underinvestment in new supply - The oil and gas markets have seen over 10+ years of underinvestment in new supply as the world focused on a shift towards electrification (source). For context, in 2021 global upstream oil and gas investment is down ~58% from 2014 levels.

- Energy security is now a real issue - The fallout from the Ukraine/Russia conflict has hit oil and gas supply chains. Russia is one of the worlds largest oil and gas producers and has become an “at risk supplier” with the European continent feeling the crunch the hardest. This means the world needs NEW supply to fill in this supply gap while also fulfilling increasing demand.

- Electrification of energy mix taking longer than expected - The rush to decarbonise has pushed capital towards more “green energy” technologies. The build out of new wind/solar/nuclear etc has been a lot slower than expected and so demand for oil and gas is still increasing.

What do the analysts say?

Some of the analyst community also shares our optimism for the sector, some of the notable bulls are as follows:

Dan Yergin, S&P Global Vice Chairman - Dan thinks the brent price for oil could go to >US$120 per barrel at some point in 2023. Dan’s view was primarily based around a China reopening spurring demand for oil and gas imports (source).

Reuters poll results - Reuters did a survey of 30 economists and analysts at the end of the 2022 and the consensus prediction was for a brent price of US$89.37 per barrel. While this is below the peaks we saw in 2022 it would still be over 10% higher than the current brent price (source).

JP Morgan analysts - JP Morgan in its 2023 market outlook publication cited a base case scenario where the US does enter a recession but maintained a US$90 per barrel prediction for the oil price over the next 12 months.

JP Morgan like us, think that the fundamental tailwinds are still strong for the oil and gas sector with the head of global commodities strategy (Natasha Kaneva saying the following: ““Despite more pessimistic expectations for balances over the next few months, we find the underlying trends in the oil market supportive and expect global Brent benchmark price to average $90/bbl in 2023 and $98/bbl in 2024.”

What about the bear case?

The key risks to our thesis:

- Recession risk - typically when the global economy slows demand for oil and gas falls leading to a fall in prices. This almost always leads to the share prices of junior explorers/developers being hit hardest. An example of this is March 2020 when the COVID induced slow down led to oil prices going negative.

- Supply chain risks - We also note that any improvement in the global geopolitical landscape (specifically Ukraine/Russia) would lead to a short term alleviation of supply issues. This could lead to oil and gas prices falling in the short-term.

While both of these are very real risks, we think the big learning from 2022 came after Russia invaded Ukraine.

We think governments all around the world have realised that energy security and energy independence are extremely important to their populations - the only way countries can solve this problem is through more investment in oil and gas for at least the next decade.

Our Oil and Gas Investments

Top End Energy (ASX:TEE)

Read Investment Memo →

Invictus Energy (ASX:IVZ)

Read Investment Memo →

88 Energy (ASX:88E)

Read Investment Memo →

Elixir Energy (ASX:EXR)

Read Investment Memo →

Our Commentary on Oil and Gas

What Happened?

Weekender

Mar 23, 2024

|Next Investors

|10 min

But first, is the commodities supercycle back on?

Surfing the commodities cycles

Weekender

Jan 27, 2024

|Next Investors

|15 min

Anyone who has been in the small cap markets for over 10 years has seen multiple commodity bull cycles. Iron ore, gold, lithium, uranium, nickel are examples of recent or current bull cycles.

How macro themes drive small caps

Weekender

Oct 28, 2023

|Next Investors

|16 min

In this weekender we look at what macro moves makes a small cap share price go up. Plus critical minerals such as Lithium, Graphite, Oil & Gas, and more...

What Happened?

Next Investors

|Mar 23, 2024

Surfing the commodities cycles

Next Investors

|Jan 27, 2024

How macro themes drive small caps

Next Investors

|Oct 28, 2023