Our Food Security Portfolio

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| MNB | 1598364000 26-Aug-2020 | $0.030 | 483% | 140% |

| Stocks |

Date of Initial Coverage

|

Initial Entry Price

|

Highest Point |

Performance from Initial Entry

|

|---|---|---|---|---|

| MNB | 1598364000 26-Aug-2020 | $0.030 | 483% | 140% |

Macro Outlook Food Security - 2023

The Russia/Ukraine conflict brought about a worldwide food crisis.

Russia and Ukraine together supply ~30% of the world's wheat supplies and Russia on its own is the world's largest exporter of fertiliser - a critical input in the agricultural supply chain.

While the conflict restricts direct exports of agricultural products like wheat, the shortages in the fertiliser supply chains impacts crop yields across the agricultural industry.

Without fertiliser, farmers simply can't produce enough crop to supply the world's food requirements.

And the world population continues to increase each year.

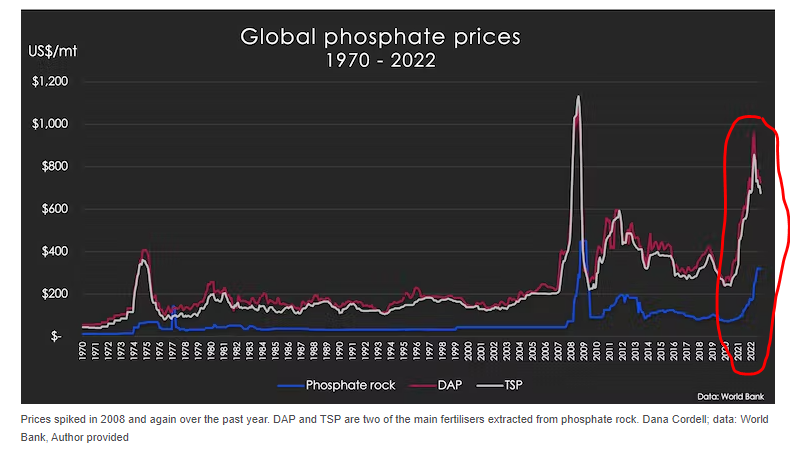

In response to these supply chain shocks, fertiliser prices are up over 300% from when the war broke out in early 2022.

Our view is that over the next 5-10 years we will see an irreversible shift to localise or at the very least diversify food and fertiliser supply chains.

We have already started to see this happen with Europe one of the first to move away from Russian supply and look south to Africa for supply.

What the analysts say

In a paper published in May last year US investment bank JP Morgan agricultural commodities strategist, Tracey Allen commented on supply chain issues raising “concerns for the consistent availability of corn and sunflower oil exports through the peak period of shipments in the second half of this year,”

JP Morgan's view is that disruptions to trade routes across the Black Sea coming out of Russia and Ukraine will continue to have an impact on food input costs.

JP Morgan also cite higher energy prices making the problem a whole lot worse.

Overall the analyst community don't see the food security crisis improving unless there is peace in Ukraine and much lower energy prices.

What about the bear case?

The bear case to our food security Investment Thesis would be a move back to globalisation.

Our view is largely centred around a medium term supply deficit caused by the required building out of new supply chains all around the world.

If the Ukraine/Russia conflict were to subside and the world shifts back into a position where globalisation is more accepted then supply constraints will be resolved.

This would mean demand for new investment into the fertiliser/agricultural supply chains is less required and the companies with exposure will likely see their share prices fall.

Our Commentary on Food Security

The War Begins, Cybersecurity, Food Security, Energy Independence and Precious Metals

Weekender

Feb 26, 2022

|Next Investors

|17 min

The Russian troop build-up had been happening for the last couple of months and we think the market had slowly been pricing in a potential conflict, especially one that could accelerate the “west versus east” tensions and all the ramifications that come with it.

The War Begins, Cybersecurity, Food Security, Energy Independence and Precious Metals

Next Investors

|Feb 26, 2022