Managing your portfolio in the information age

Published 28-SEP-2020 11:22 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

This is the third in a three-part series on self-directed investing from Navexa.

In Taking ownership of your investments, we covered what it means to take charge of your investment portfolio, as opposed to trusting your financial future to a money manager.

In Choosing a strategy & assets for your portfolio, we looked at the main types of investment assets and portfolio management strategies at work in the markets today.

In this post, we’re showing you how building wealth today is more dependent than ever before on technology and data.

You’ll see why the old ways of analysing your portfolio are now obsolete, and why we’re about to witness an explosion in software that helps investors harness the unprecedented amounts of financial data.

If you’ve not read parts one and two in this series, we encourage you to do so before reading this.

How big data has changed investing

“There’s no avoiding the realities of the Information Age. Organisations that continue to use 20th Century tools in today’s complex environment do so at their own peril.”

— Retired United States Army General Stanley McChrystal

This is the Age of Information.

We’re living in a time when we’re more connected to the world through technology than ever before.

We’re also generating and consuming more data than ever before.

Retail, advertising, medicine — you’ll be hard pressed to find a market or industry that hasn’t been disrupted or transformed by what we often refer to as ‘big data’.

Funnily enough, however, the world of finance has been a little slower than other sectors in its adoption of — and disruption by — technology and data.

Maybe that’s because the financial markets and banking systems are massive and deeply dependent on government for regulation and oversight.

But, things are changing for investors now. Fast.

According to Forbes:

‘Making money is no longer viewed simply as the result of the insightful decision making of market wizards. Rather, returns in markets are seen to follow from rigorous research. Investing and trading are becoming increasingly evidence-based.’

How, exactly, is big data transforming investing?

The biggest factor in the shift toward data-driven investing is that now there is nowhere to hide.

There’s so much information available about the historical and relative performance of stocks, sectors and markets...

That there is no longer any excuse for making decisions based on ‘a gut feeling’ or an opinion.

Everything you need to know about a trade or trend is available to you in the form of digital information.

Consider that more than $4.6 billion changes hands on the ASX alone each day.

That’s more than a trillion dollars a year.

Every single transaction is now a datapoint in a huge, ever-growing big picture which you can look at to determine how best to position your own investments.

If, that is, you have the tools to do so...

(And you’re not clinging on to the old spreadsheet, thinking the old ways of tracking your stocks will be good enough in the Age of Information.)

How to harness data in managing your portfolio

“To beat the market, you’ll have to invest serious bucks to dig up information no one else has yet.”

— American Economist Merton Miller

We like this quote from Merton Miller.

Knowledge, as they say, is power.

When you’re investing, the more information you can gather, the more knowledge you have.

And the more knowledge you have, the better you can understand a situation and take action.

The only thing Merton (who won the Nobel Prize in Economic Sciences in 1990) got wrong with this quote is that you have to invest serious bucks to dig up the information you need to beat the market.

Maybe 10 years ago, this was true.

But today, with a portfolio tracker like Navexa, you don’t have to invest serious bucks.

For zero cost (or for a meagre monthly payment, depending on your requirements), you can now access analytics tools that give you massive insight into how the markets — and your own portfolio — is behaving.

Here’s an example.

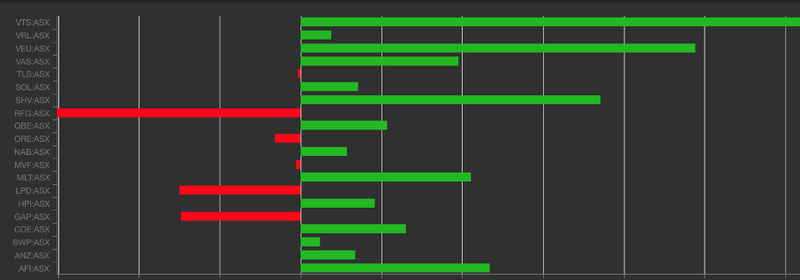

Portfolio contributions:

This is just one tool we’ve created to help our users see at a glance one vital thing about their portfolio:

Which stocks are pushing your total returns higher, and which are dragging the portfolio down?

Twenty years ago working this out would have been a painstaking, manual process open to human error.

Today, with our service, you can see in one click how each holding in your portfolio is contributing to your overall performance.

Make smarter decisions

Investing in the Age of Information, where big data makes it easier than ever to clearly see what your money is doing in the market, is arguably the best time ever to be building wealth.

The trends we’re seeing (and which we’re able to see because of data) show that more of us are ditching advisors and money managers to take ownership of our portfolios.

We have a huge number of assets and tactics to choose from on our wealth building journeys.

And by harnessing the power of data through modern portfolio tracking tools like Navexa, we can see more clearly the path to our financial future.

We hope this series on self-directed investing has been helpful to you.

For more articles on investing and fintech, check out the Navexa blog.

Navarre Trousselot is the Founder of Navexa — a portfolio analytics service made for Australian investors.

Navarre left a lucrative corporate developer job to combine two of his passions; investing and entrepreneurship. He created Navexa because he couldn’t find a portfolio analytics service that met his own high standards. Now, he’s focused on helping as many Australians as possible get more from their portfolios through the smart and creative use of data.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.