20 Crucial Investment Guidelines For Investing in Resources Part 2

Published 28-MAR-2018 09:08 A.M.

|

6 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Before you plunge into investing in the Resources Sector, take a look at our Pre-Investment Checklist, specifically designed to arm investors with all they need to know before they put their hard earned cash on the line. In this four part series, we detail 20 Crucial Investment Guidelines to help you embark on your investment journey. Last week we looked at Business Plan, Market Cap, Management, Strategy and Assets, this week we examine Company Lifecycle, Production, Cash, Liquidity and Capital Raising.

Let’s start with...

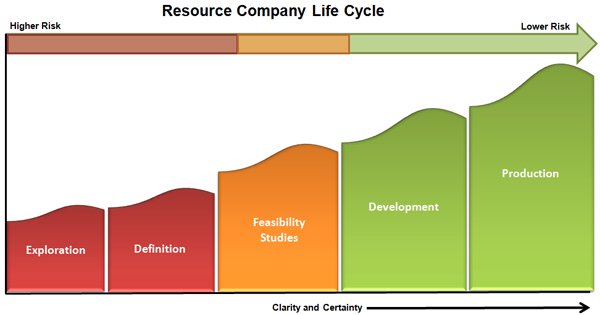

6. Company Lifecycle Stage

In what stage of the ‘resource company life cycle’ is the company in? Is the company a pure explorer or in development stage? Do they have resources or reserves? Have any feasibility studies been undertaken?

At what stage is your company at in the resource lifecycle?

The following diagram, tells you all you need to know:

7. Production

How long will it take until first production? How much capital is required to get the project up and running? What are the projected cash costs?

This is something that you need to know, but is not super important for exploration or ‘blue sky’ companies relying on drilling results. Generally companies that we invest in are in the pre-development stage as the biggest gains are made in this stage of a company’s life cycle.

If the company is in development, this is important as delays to construction or production will affect the share price. It is often the case that a company’s production schedule is pushed back as delays can occur for various reasons, some out of the company’s control.

Finfeed Handy Tip – Using company announcements and presentations, find out what your chosen company’s predicted production schedule is? Has this schedule changed significantly over the last 18 months – are the reasons for this shift in timing reasonable?

The costs of constructing a mine or developing a hydrocarbon field and associated infrastructure can be far ranging. There are many projects out there that require huge upfront capital expenditure that runs in the billions of dollars, whereas the actual market cap of the company is less than $200 million. Unless a partner comes in to assist funding the project, this is obviously going to be very difficult to get the project into development.

Look at lower capital intensive projects with lower capital expenditure required to get into production.

Finfeed Handy Tip – Has your company clearly identified the predicted capital expenditure for achieving production? Again, has this figure changes significantly over the last 18 months?

Cash costs and margins are key. High cash cost companies are clearly more reliant on the underlying commodity price than lower cash cost companies. If a gold company is running at $1500/oz. cash costs, it will become unprofitable to run if gold falls below this level. Clearly, a $400/oz. cash cost gold operation is in a better position and will be able to maintain their operation if gold falls to $1500/oz. We prefer stocks that are less susceptible to shocks in the underlying commodity.

Finfeed Handy Tip – What are the company’s predicted cash costs?

8. Cash

Does the company have cash in the bank? What is the rate of cash burn? Does the company have debt?

Obviously, the more cash the better. However, a lot of cash in the bank does not mean much if the company is burning through mountains of the stuff on a monthly basis.

You say you don’t like reading through pages of financial information? Do you skip over the ‘boring stuff’ in the annual report? Well start reading and understanding it because it is one of the most important tools in your research arsenal. The consolidated financial statement should be your best friend when running the ruler over these companies – it is a short, one page summary of the key categories the company was spending YOUR money on.

How much are directors getting paid? How much is spent on travel, office space, administration, and other expenses such as third party consultants? The more of these reports you look at, the better idea you will have of what is generally reasonable.

A company’s debt position is also something you need to look at. Although most juniors under $200 million market cap don’t have a lot of debt, excessive debt has clearly gotten a lot of companies in trouble in recent times.

A company’s enterprise value (EV) is seen as the true value of the company in the market. It is calculated as market cap plus debt, minority interest and preferred shares, minus total cash and cash equivalents.

In the event of a buyout, an acquirer would have to take on the company's debt, but would pocket its cash. Thus EV provides a much more accurate takeover valuation because it includes debt in its value calculation.

Finfeed Handy Tip – Refer to the company’s financial reports (Annual and Quarterly) and identify what your chosen company’s cash on hand is, including cash burn and time left at current cash burn.

9. Liquidity

There is a saying in the stockbroking industry about illiquid stocks. They are called ‘lobster pots’. Once you are in it is very hard to get out!

Loading up on a completely illiquid stock is ill advised. We want to be able to sell at a profit after all. If there is no buyer, well, you can’t sell now can you?!

So it is important to look at the weekly/daily/monthly volume of a stock to determine whether it will be easy enough to sell out of a stock once invested.

On the flip side, if a major catalyst occurs and people can’t get enough of a stock and it is illiquid, well, then you are sitting in an advantageous position.

In general liquid stocks are preferable.

Finfeed Handy Tip – Refer to the company’s stock charts available on the ASX website – how many shares are traded on a daily basis? What is the value of the shares being traded? Could you easily sell your planned position anytime you wished to?

10. Capital Raising

Capital raisings are part and parcel of junior resources companies.

Companies will need to raise money to fund drilling programs, working capital requirements etc., often at discounted rates to market. This is not a bad thing but it is something you will need to be aware of nonetheless.

A capital raising will affect the value of your shareholdings, and may suppress the stock price in the short term particularly if the market can see it coming from a mile away.

If a capital raising is oversubscribed, this is a reflection of the investor demand for that stock. People want in. If a capital raising is undersubscribed, this means the investor demand for that stock is low.

Finfeed Handy Tip – Review recent company announcements and financial reports: is a capital raising imminent?

In part 3 of 20 Crucial Investment Guidelines For Investing in Resources we cover:

- Backers

- Future Plans

- Hedging

- Market Sector and

- Infrastructure

Until next week...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.