20 Crucial Investment Guidelines For Investing in Resources Part 4

Published 13-APR-2018 12:26 P.M.

|

7 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Before you plunge into investing in the Resources Sector, take a look at our Pre-Investment Checklist, specifically designed to arm investors with all they need to know before they put their hard earned cash on the line. In this four part series, we detail 20 Crucial Investment Guidelines to help you embark on your investment journey. You can check out the first three instalments in the series by clicking on the links below:

20 Crucial Investment Guidelines For Investing in Resources

20 Crucial Investment Guidelines For Investing in Resources Part 2

20 Crucial Investment Guidelines For Investing in Resources Part 3

In this week’s instalment we cover political risk, price catalysts, takeover potential, change and chat room hype.

Let’s start with...

16. Political Risk

Country/sovereign risk is the risk that an investment's returns could suffer as a result of a changing political landscape or instability in a country.

Instability affecting investment returns could stem from a change in government, legislative bodies, local ownership, other foreign policy makers, or military control. Even the mention of a possible introduction of a ‘mining tax’ or the introduction of ‘local equity ownership’ can have a very detrimental effect on a junior miners share price.

We recommend doing your research and finding out about the local ownership conditions and mining tax rules and the possibility of the introduction of mining nationalism prior to investment.

Finfeed Handy Tip – Where does the country in which your company operates rate on the sovereign risk ladder? Can you find any news articles about any potential sovereign risks for this country i.e. tax rises, regime changes etc.

Canadian think-tank. The Fraser Institute, conducts an annual survey of metal mining and exploration companies to assess how mineral endowments and public policy factors affect exploration investment. Survey results represent the opinions of executives and exploration managers operating around the world. Results are free and can be found at www.fraserinstitute.org

17. Price Catalysts

There will be situations where the stock price will spike up, or even just gradually creep up based on a genuine upcoming event that is expected by the market. These events are called price catalysts.

An example of a catalyst can be the approaching target depth when drilling for oil, or an approaching forecast date for a joint venture with another company.

Although the market expects these announcements, the price will still creep up as the forecast date approaches. The price might then spike up when the news is announced, and will usually drop back down straight away. The trick here is to sell a small portion of your stock (more on this later) either just before the news is released, or as soon as the news is released.

Remember this is predominantly about junior stocks.

If you don’t watch many junior stocks, then start watching now!

Add 10 stocks to your watch list and starting observing how they behave over time, and in relation to material news.

Catalyst events offer a great opportunity to reclaim some or all of your initial investment by selling a portion of your stock at a profit. Watch out for companies who have a consistent stream of news.

The market usually knows about impending news flow, so check out chat rooms and company presentations

Finfeed Handy Tip – Referring to the company presentations and researching chat rooms, can you uncover or verify any upcoming catalysts that would potentially warrant a significant rise (or fall) in share price?

18. Takeover potential

Is there takeover potential? Does the company have a Joint Venture? Is there “nearology”? Who is operating in the surrounding area?

The holy grail of your investment strategy is the takeover or acquisition.

When looking at a potential investment, it is always important to identify if there is potential for a takeover by a bigger player. This is quite difficult to do, but when considering the oil and gas or resources sectors, a small company will generally take the risk to drill an exploration well\hole and if a discovery is made, a bigger player (with deep pockets) will come in to develop the discovery to commercial production.

This is when a takeover offer may be made by the bigger company, and a substantial stock price increase on the target company will follow. The idea would be to have already “top sliced” during the higher risk exploration phase, and the stock left for the takeover will be majority “free carry”.

Almost as good as a takeover is teaming up with a bigger company in a joint venture. This will usually involve farming out a percentage of the project, and having a portion of future or past costs paid for. This also will usually result in a price spike and a good chance to top slice if you have not already done so. A good joint venture will involve an experienced operator who takes over running the asset so that the small company can happily take a back seat and watch them do all the hard work and spend all the money!

Have you seen companies with operations surrounding nearby discoveries share price rise on the back of these discoveries? This is called “nearology”; the potential that a similar discovery will be made due to the company’s proximity to a precious discovery. Although a similar discovery is potentially unlikely, it is something experienced players look at.

You should generally look straight away at who the neighbours are of a company, and whether these neighbours have made a recent discovery.

Finfeed Handy Tip – Check Google, chat rooms and the company presentation and find out who is operating in the same area – is there a major nearby with potential synergies?

19. Change

What if there is some sort of material change after you have invested?

Many things can happen while you are waiting to top slice your investment. For example, these include (but are not limited to) a surprise capital raising, a new director appointment, or a problem with one of the company assets.

When a surprise material change occurs, re-evaluate the change against ALL of the investment guidelines set out here.

Finfeed Handy Tip – IF IN DOUBT – GET OUT!

If something doesn’t smell right, don’t just sit there and take it – SELL! If you are invested and the circumstances change and it breaks your confidence in any of the guidelines, it is time to get out.

20. Chat Room Hype

Is there internet chat room hype? Has the “dumb money” arrived?

This is one of our personal favourites. Have you ever noticed how some stocks on internet chat forums receive hundreds of posts, and others have barely any posts in a whole month?

The "Smart Money" (experienced investors) invest in a stock BEFORE the stock becomes active on internet chat forums.

When the price is spiked up on eventual chat room hype and promises of massive profits and big news, the smart money comes out at a profit and is replaced by “Dumb Money”.

“Dumb Money” refers to those inexperienced investors who read about big promises on the internet, and buy in on the price spike, and will often be left holding on to a falling stock for months praying that it will recapture its highs.

You will find all sorts of characters on stock chat forums when hype is in full swing, but there are generally a few key types to look out for. Learn to identify them and you will be able to see the true agendas of those who post with an amazing new clarity, and be able to avoid getting caught in the hype.

Conclusion

We hope you have found this series useful as you prepare to start investing. Remember at all times, investing is a gamble so you want to make sure you have done your research before you take the plunge.

These articles have been designed to pass on some of the knowledge we have collectively learnt in our small cap investment careers.

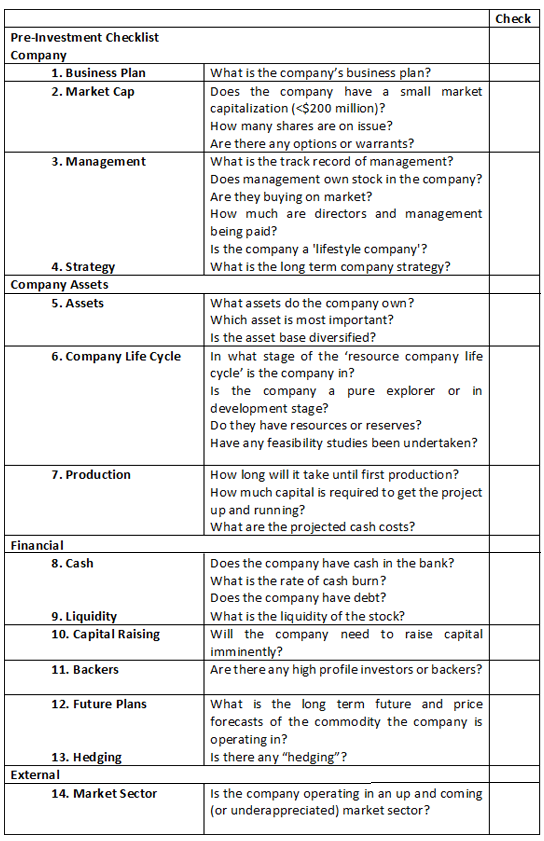

As a bonus, here’s a practical checklist for you to use when considering your investment options:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.