Your definitive guide to the top 20 ASX listed oil and gas stocks

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

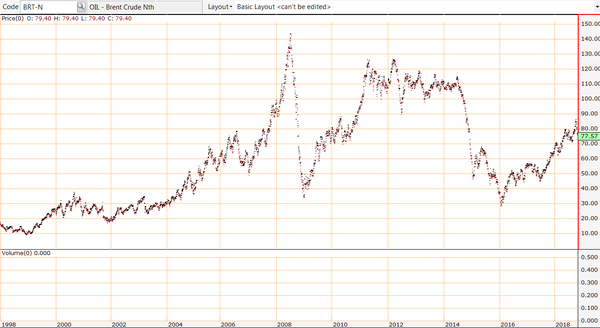

While the oil price and energy stocks generally have had a strong run over the last three years if one uses historical data as a means of comparison, the oil price and stocks within the sector are hardly in boom/bust territory.

Step back ten or so years when mining and energy stocks were in full flight you will see that the oil price increased from approximately US$30 per barrel to peak at an all-time high of more than US$140 per barrel in mid-2008.

That was a boom/bust bubble, and the fact that it plunged about US$100 per barrel to around the US$40 per barrel mark in the space of six months was partly a function of the bubble bursting, as well as the broader impact of the global financial crisis.

Even with the GFC fresh in everyone’s minds the oil price had rebounded to more than US$120 per barrel by early 2011, and it hovered in a range between US$100 per barrel and US$120 per barrel until the second half of 2014.

Consequently, when one considers that the oil price has taken close on three years to move from about US$30 per barrel to recently push past the US$85 per barrel mark it presents as a fairly measured rise.

If we look at the performance of ASX listed stocks over this period a similar trend is evident.

The S&P/ASX 200 Energy Index (XEJ) increased from about 6700 points close to three years ago to hit a recent high of 12,667 points.

Bear in mind the index hit a high of 20,250 points at the peak of the mining boom, and only for a brief period between the GFC and 2014 did the index fall below 12,000 points.

The flipside has applied in the recent market rout with the index and share prices of many companies in the sector falling far more than the percentage retracement in the oil price.

While the oil price fell roughly 10%, the XEJ plunged 16%, effectively losing about two thirds of the gains made in the last 12 months.

This could mean it is buy time for bargain hunters who have perhaps missed opportunities, particularly over the last 12 months.

In this sort of environment it is often smaller stocks that are knocked around the most, and that is where you’re most likely to find some value rather than the blue chips which tend to fall to a lesser extent and are quicker to rebound.

Of course, in targeting smaller companies particularly in the resources sector that generally comes with greater risk so it is always important to weigh up the risk/reward dynamics.

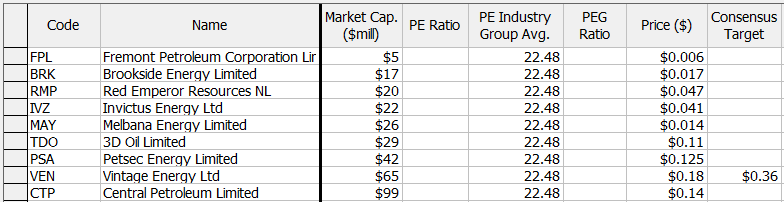

To provide an insight into some of the stocks that may be worth examining FinFeed has run the ruler across 20 companies with market capitalisations ranging from $5 million to $700 million.

We have mainly focused on companies that have quality assets and in many cases those that are either in production or have advanced stage projects, aspects that sometimes help to temper the degree of risk.

Today, in our two part feature, we bring you the first nine of those companies with market capitalisations in a range between $5 million and $100 million, with the remaining 11 that feature companies capped between $100 million and $700 million to follow on Thursday.

Fremont Petroleum Corporation Ltd (ASX:FPL)

Market Capitalisation: $5 million

Fremont Petroleum Corporation is an oil and gas production and development company founded in 2006 and headquartered in Colorado, USA.

The company has operations in Colorado and Kentucky with the primary focus being the development of the second oldest oilfield in Fremont County, the 21,500 acre Pathfinder Field which was discovered in 1881.

With new technology, the Pathfinder Field is one of the most economic fields in the US, and much larger and more prolific than first understood.

In order to gain further understanding of gas capacity potential, Fremont tested three wells for gas flow rates.

The cumulative flow rate for the wells – the Pathfinder C11-12, the Columbus #1 and the Marco Polo #1 was an impressive 4.13 Million cubic feet/day.

Fremont’s production is averaging 120 barrels of oil per day (BOPD), having increased 20% over the last month, and with over 500 drilling locations, Fremont has the capacity to deliver significant production growth.

Approximately 80% of production is sourced from Colorado with the remaining 20% coming from its Kentucky operations.

Pathfinder’s gas is currently flared and awaiting a gathering system and pipeline so the gas resource can be monetized.

On the back of recent successes, Fremont’s oil and gas reserves and resources were substantially upgraded in 2018.

The P90 C1 gas resource increased by 145% to 540 BCF and the oil resource increased by 55% to 55 million barrels.

This increased production to 120 BOPD, yielding valuable additional cash flow to Fremont with the company benefiting from favourable WTI (West Texas Crude) pricing of approximately US$70.00 per barrel. Production is funding all corporate costs, excluding new drilling.

Given its robust resources and cash generating operations, Fremont appears to be punching above its weight with a market capitalisation of $5 million.

A potential near-term share price catalyst is the imminent spud of Vespucci #1 where site construction can begin immediately following permit issuance.

Analysts at PAC Partners initiated coverage of the stock in late September with a speculative buy recommendation and a 12 month price target of 2 cents. There is of course no guarantee this will eventuate.

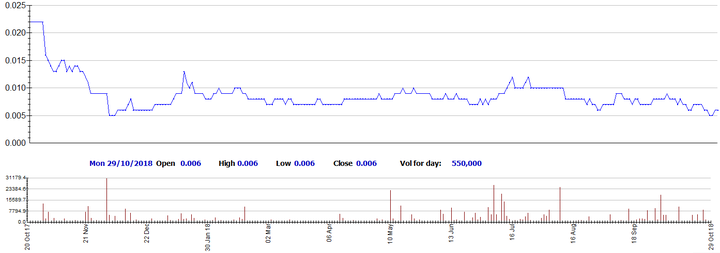

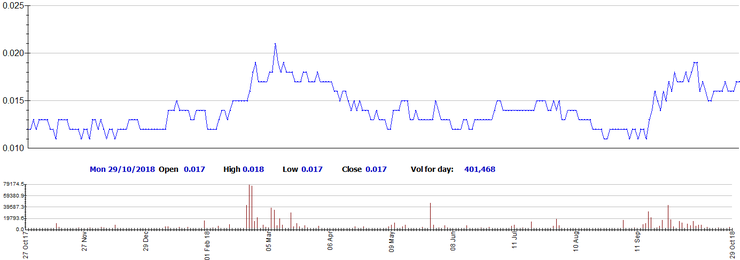

The following chart shows trading activity in FPL over the last 12 months (all share price charts are courtesy of Lincoln Indicators).

Brookside Energy Ltd (ASX:BRK)

Market Capitalisation: $17 million

Brookside Energy is focused on the mid-continent region of the US with the company aiming to build value through the acquisition and development of producing oil and gas assets, as well as the leasing and development of acreage opportunities.

To date it has been successful in executing on this strategy, and similar to Fremont the company’s market capitalisation doesn’t appear to capture the value of the company’s assets, its current production profile and associated cash flow and the potential for future exploration success in areas adjacent to producing wells.

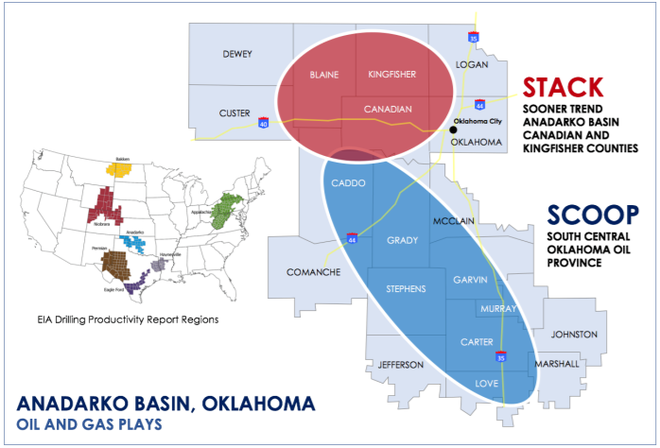

The company’s non-operated working interest wells in the world-class Anadarko Basin plays continue to deliver excellent production rates, providing further support for the quality of the acreage that Brookside has been able to secure within the Anadarko Basin plays in Oklahoma.

As we will go on to discuss, the company has numerous minor interest in producing wells, but the exciting news that emerged this month was in relation to the Bullard 1-18/7H well.

This is the largest working interest well drilled to date with Brookside having a 20.57% stake.

The well produced approximately 73,000 barrels of oil equivalent (69% oil) in its first 60 days of production.

Importantly, results from this ‘parent well’ will enable Brookside to book significant proved undeveloped reserves in this development unit.

Unfortunately, this news broke as the oil price and equities markets came under pressure, but it is worth noting that other positive news that emerged in mid-September has resulted in the company’s shares still being up more than 50% over the last seven weeks.

Across its other assets, the Triumph Energy, LLC operated Dr. No. 1-17-20XH well (Brookside 3.7% working interest) achieved 1,769 BOE/day (IP24) (64% oil) and an IP30 of 1,060 BOE/day.

IP24 and IP30 indicate initial production rates in the first 24 hours and 30 days respectively.

The Devon Energy Corp. (NYSE:DVN) operated Ladybug 27_22-15N-13W 1HX well (Brookside 2.2% Working Interest) achieved an IP30 of 3,200 BOE/day.

The company has now participated in the drilling and completion of sixteen horizontal wells within the Anadarko Basin, including both STACK and SCOOP plays (acronyms explained below).

Production has been established in fourteen of these wells, achieving an average IP24 of approximately 2,400 BOE/day and IP30 of 2,050 BOE/day.

Importantly, the company now has sufficient production history on this suite of wells to estimate time to payout, indicating the time taken for a well to recover 100% of drilling, completion and operating costs from sales revenue.

This analysis points to an average time to payout of approximately thirty months for the working interest wells in this area.

The production data behind these estimates and the resulting time to payout estimates provide support for the effectiveness of Brookside’s drilling joint venture structure as a source of development capital.

The relatively short time to recover 100% of the drilling and completion capital enabled management to “reinvest” capital in new wells and grow Brookside’s oil and gas reserves without having to raise additional equity capital.

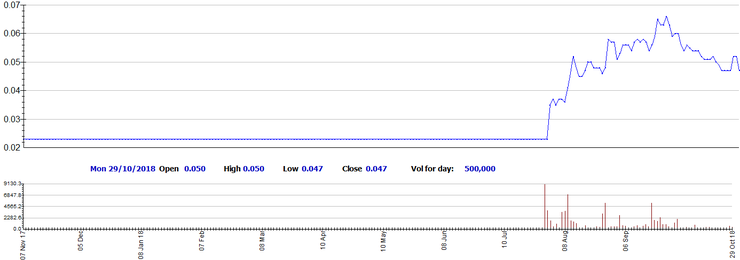

As can be seen below, shares in the BRK have been relatively quick to recover from the short bout of selling that occurred as a result of broader market conditions.

Red Emperor Resources NL (ASX:RMP)

Market Capitalisation: $20 million

During the September quarter Red Emperor, along with 88 Energy Limited (ASX:88E) and Otto Energy Limited (ASX:OEL) executed formal “Definitive Agreements”, including a Participation Agreement, with Great Bear Petroleum Ventures II LLC (“Great Bear”) to acquire the majority of Great Bear’s working interest in four leases on the western flank of the Alaska North Slope, specifically ADL#s 391718, 391719, 319720 & 391721.

Collectively these are referred to as the Western Blocks.

An important upcoming development is the drilling of the Winx Prospect, located on the Western Blocks, North Slope of Alaska.

Execution of the rig contract at this time allows for a steady and measured permitting process and provides ample time for all rig preparatory work to be completed prior to rig mobilisation and drilling in the March quarter of 2019.

A rig walkthrough is tentatively planned by the operator for the end of October.

The permitting process is proceeding on schedule with the operator regularly interfacing with the regulatory bodies.

A joint Technical / Operating Committee Meeting was held by the consortium to discuss well planning, permitting, rig preparation and mobilisation.

All aspects of the process are on schedule with drilling of the Winx prospect still anticipated to commence in the March quarter.

The Winx Prospect is a 3D seismic defined oil prospect in the successful Nanushuk play fairway with a gross mean unrisked prospective resource of 400MMbbls (126MMbbls net to Red Emperor) and a geological chance of success estimated to be in a range between 25% and 30%.

Given the relatively low cost of drilling wells in that region, Red Emperor is well-placed, finishing the September quarter with cash of $8 million.

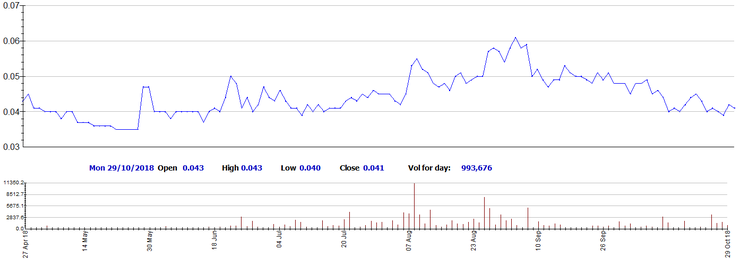

The following chart shows RMP’s strong share price performance since it was reinstated to official quotation on July 30, 2018, and announced the joint venture acquisition of Western Blocks, North Slope of Alaska.

Invictus Energy Ltd (ASX:IVZ)

Market Capitalisation: $22 million

The last 12 months has been a transformational period for Invictus Energy with the company entering into a binding sale and purchase agreement to acquire 100% interest in Invictus Energy Resources Pty Ltd in April.

This effectively provided it with an 80% interest and operatorship in the SG4571 Permit (Cabora Bassa Project) located in Zimbabwe.

The acquisition of Invictus and the interest in the Cabora Bassa Project, which contains the Mzarabani prospect, represents an opportunity to secure first mover advantage and a dominant acreage position covering potentially the largest, seismically defined, undrilled hydrocarbon structure onshore Africa.

The Cabora Bassa Project encompasses the Mzarabani Prospect, a conventional gas-condensate target in excess of 1 trillion cubic feet (tcf).

The prospect is defined by a robust dataset acquired by Mobil in the early 1990s that includes seismic, gravity, aeromagnetic and geochemical data.

Invictus successfully completed a heavily oversubscribed $4.5 million capital raising led by Ashanti Capital to fund the SG4571 exploration program.

The capital raising which was well supported by company directors was completed in June.

The company subsequently received the Zimbabwe in-country approvals from the Reserve Bank of Zimbabwe Exchange Control Authority and Zimbabwe Investment Authority (ZIA) to subscribe for new shares representing 80% of Geo Associates (Private) Limited (Geo Associates) which holds 100% of SG4571.

The receipt of the Zimbabwe Investment Licence formalises the approval of the Company’s entry into Zimbabwe as a foreign investor.

Geo Associates and Invictus also received letters supporting the transaction and Cabora Bassa Project from the Ministry of Mines and Mining Development and the Ministry of Energy and Power Development which underlines the potential importance of this project to the Zimbabwean economy.

The new government in Zimbabwe has implemented substantial reforms to attract foreign investment into the country and has declared itself “open for business” once again.

Invictus is embarking on its technical work program to re-evaluate the extensive legacy dataset acquired by Mobil, utilising the latest seismic processing techniques which have significantly improved since the data was acquired over 25 years ago.

This work program will provide the company with a much clearer picture of the subsurface, the Mzarabani prospect and the greater Cabora Bassa Basin area.

Management believes that it can apply new and evolved exploration concepts that have been successful in this type of rift basin setting in East Africa and Australia.

There is likely to be significant news flow as the company progresses its work program to de-risk and add value to the Cabora Bassa Project.

The results of the technical work in year ahead including an independent maiden prospective resource estimate could provide share price momentum, as would the negotiation of a farmout agreement.

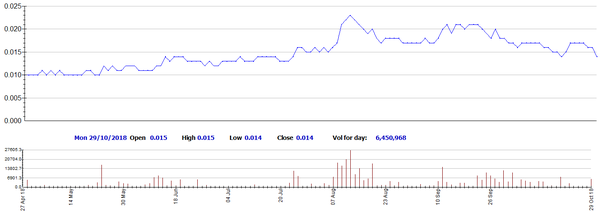

As can be seen in the chart below, IVZ’s shares nearly doubled post the acquisition of the Cabora Bassa project, but market volatility has seen a retracement in recent months, a trend that could be reversed as the company continues its basin modelling technical work.

Melbana Energy Ltd (ASX:MAY)

Market Capitalisation: $26 million

The September quarter was an important one for Melbana Energy as it marked the completion of an independent assessment of the company’s prospective resources by a group with significant experience in Cuba where the company has its most valuable assets.

The report was commissioned by Melbana to assist primarily as a complying Competent Persons Report for a potential AIM listing, but also to assist with farmout marketing efforts, which was timely given that the company has just completed a farmout agreement relating to its flagship project, Cuba Block 9.

With regard to this asset, the assessment identified an increase in best estimate Oil in Place of 24% to more than 15.7 billion barrels and an increase of recoverable Prospective Resources of 13% to 718 million barrels of oil equivalent from three prospects and 16 leads.

The assessment included a 17% increase in the aggregate of best estimate prospective resources to 236 million barrels of oil from the four targeted objectives contained within Melbana’s preferred initial two-well program of Alameda and Zapato.

The assessment also confirmed the giant potential of the Beehive Prospect, with best estimate Prospective Resources of 388 million barrels of oil equivalent with a significant improvement in Chance of Success to 20% (from 16%).

The negotiation of a farmout agreement is an important development involving the execution of a Letter of Intent with Anhui Guangda Mining Investment Co Ltd (AGMI).

AGMI is a private company that reports its assets as in excess of US$1 billion, operating through its subsidiaries over 13 exploration and exploitation blocks globally.

The terms of the farmout are that AGMI will replace the existing bank guarantees releasing US$2.27million of cash to Melbana and, at zero cost to Melbana, drill the three best targets, testing a best estimate of 270 million barrels of oil and providing the company with 12.5% of the profit oil in the event of success.

AGMI will also fully carry Melbana for all the appraisal and development costs in the Block.

Importantly, Melbana will be entitled to cost recover its back costs of circa US$3.5 million from any future oil production.

The company also received all remaining key regulatory approvals for the Alameda-1 exploration well, the first of the two-well programme it has planned for Block 9.

The Office of National Mineral Resources will issue the Drilling Operations Permit for the Alameda-1 exploration well once Melbana notifies it of the drilling rig to be contracted and the confirmed drilling timing window.

The Drilling Operations Permit is the final administrative permit required for drilling to proceed.

Elsewhere, the Beehive 3D Seismic Survey was completed, providing coverage over the newly identified lead (Egret) that is partially within the boundary of WA-488- P.

The Beehive 3D Seismic Survey, including the extension over the Egret lead, was fully funded by Santos and Total.

The 3D Seismic Survey data is currently being processed and a final dataset is expected to be received no later than early 2019.

Total and Santos have an option (exercisable together or individually) to acquire a direct 80% participating interest in the permit in return for continuing to fully fund the costs of all activities until completion of the first well in the WA-488-P permit.

The option is exercisable by either Total or Santos at any time but no later than 6 months from the receipt of processed seismic survey data.

Consequently, a number of share price catalysts are on the horizon which could see Melbana recover some of the recent lost ground as indicated below, particularly given that the upbeat news coincided with negative industry sentiment and weakness in equities markets.

Analysts at Hartleys ran the ruler across MAY as recently as mid-October, placing a speculative buy recommendation on the stock with a 12 month price target of 2.5 cents, implying upside of 80%.

13D Oil Ltd (ASX:TDO)

Market Capitalisation: $29 million

Shares in 3D Oil Ltd are up more than 50% in the last six months with the company not too badly affected by recent volatility.

There were two key market moving events in July and August which resulted in the company’s shares increasing more than three-fold as they touched on 20 cents.

Of significance is the fact that the catalysts for this rerating remain relevant, underlining that recent share price weakness has been a function of market pressure rather than company performance and/or the value of its assets.

Interestingly, the company’s shares spiked more than 10% last week after management provided an update on exploration permit WA-527-P, located in the Bedout Sub-basin, approximately 80 kilometres north-east of the large Dorado-1 oil discovery which sparked a substantial share price rerating in Carnarvon Petroleum (ASX:CVN).

While management acknowledged that the data is sparse and of varying vintage and quality, it has been able to identify a potential erosional channel system within the western side of the acreage, similar to that which was encountered in the Dorado oil discovery.

Elsewhere, the company has the 100% owned T/49-P permit in the offshore Otway Basin containing one prospect and five leads for a total prospective gas resource of 10 TCF (best estimate).

This is immediately south-east of Thylacine, the largest producing gas field in the Otway Basin.

The Otway Basin is a north-west trending rift basin, approximately 500 kilometres long extending along the southern margin of South Australia and Victoria to north-west Tasmania, covering an area of 150,000 square kilometres.

The basin has been an important supplier of gas to the east coast of Australia since the 1980s.

In the event of a discovery, the T/49-P permit will be optimally placed to contribute much needed additional gas to this market in coming years.

The previous 3D seismic survey confirmed the Flanagan Prospect in the northern portion of T/49P with Prospective Resource of 1.4TCF (Best Estimate).

The Dorrigo project will target a series of significant leads across the central and southern portion of T/49P with the intention of maturing several of these to prospect status.

3D Oil intends to combine insight gleaned from the new data with that from existing seismic to determine the location of the exploration well planned for 2020, subject to funding and securing a suitable exploration partner.

Exploration data would be an obvious share price catalyst, however formalising funding or attracting an exploration partner would be good news for the group.

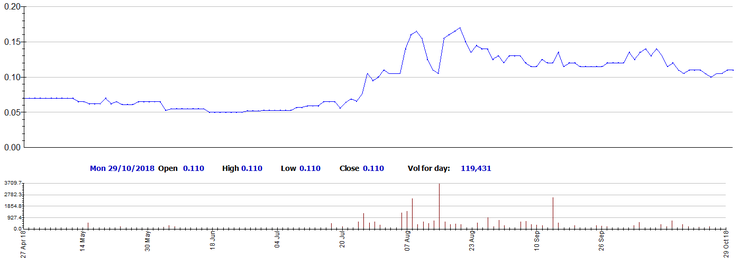

As can be seen in the following chart, TDO’s share price is holding up fairly well given that it has mainly traded in a range between 10 cents and 15 cents since the sharp spike in July/August.

Petsec Energy Ltd (ASX:PSA)

Market Capitalisation: $42 million

It has been a tale of two halves for Petsec Energy with the company’s shares doubling to a high of 20 cents in the six months to June 30, but since then they have gradually trailed off, currently hovering in the vicinity of 12 cents where they are starting to look oversold.

There was some interesting buying just last week with over one million shares traded, the highest daily volumes since July.

This resulted in the company’s shares touching 13 cents which could suggest that there is some rejuvenated interest in the stock.

The rally coincided with the release of Petsec’s September quarter results which featured a year-on-year increase in gas production of 154%.

Net production increased from 67 million cubic feet equivalent (MMcfe) in the September quarter of 2017 to 170MMcfe in the three months to September 2018.

This increase was reflected in the company’s strong revenue growth which increased from US$251,000 to US$622,000.

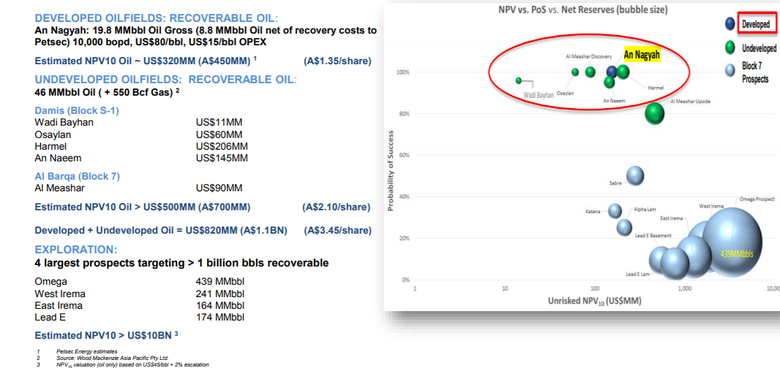

However, arguably of more are Petsec’s high quality assets in the US and Yemen, with net oil and gas audited reserves (2P) of 9.4 million barrels of oil equivalent as at January 1, 2018.

The company’s NPV10 audited reserves (2P) are valued at US$189.8 million, implying a share price of 80 cents per share.

Production in the September quarter was hampered by hurricanes in the Gulf of Mexico.

Petsec has operated in the Gulf of Mexico and Louisiana since 1991, having drilled 190 wells with a 74% success rate, generating earnings before interest tax depreciation and exploration costs (EBITDAX) of US$548 million.

The company also has a substantial asset base in Yemen which it expects to be able to capitalise on after a lengthy period of government resistance.

Since the beginning of 2018, the Saudi coalition has stated its intention to support the Yemen oil industry by providing increased security, as well as securing the port of Hodeidah and the Ras Isa oil terminal.

The Yemen Government declared in late December 2017 a new Minister of Oil and Minerals, Mr. Aws Al-oud who has engaged with the oil industry and has encouraged restart of production in the Marib and Shabwah Basins, and sent all operators letters of directive to restart production as soon as possible.

Petsec Energy is engaged with the Minister, the Oil Ministry, Block S-1 staff and sub-contractors , local tribal and administrative leaders, which are generally all supportive of the restart.

However, management acknowledges that as a new operator in Yemen, the administrative review process is slow.

Notwithstanding these hurdles, the substantial value of these assets can’t be understated as indicated below.

Note the attributable value per share of these assets and it is hard to argue that PSA is undervalued at around 12 cents per share as reflected in the following chart.

Vintage Energy Ltd (ASX:VEN)

Market Capitalisation: $65 million

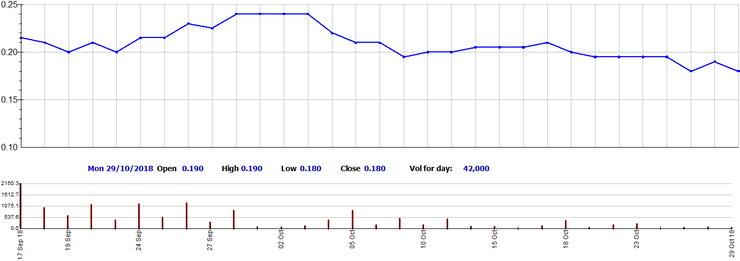

Vintage Energy is a new entrant having listed on the ASX in September.

The company raised $30 million in an oversubscribed IPO with local and overseas institutions acquiring more than 60% of the shares at 20 cents per share.

Demand for the company’s stock was evident from the outset and within a matter of weeks the share price hit a high of 25 cents.

It has only been in the last week that the share price has consistently traded below the IPO price.

While Vintage Energy is yet to prove itself on the exploration front, the early signs are positive with the company having acquired data at a cost-effective price which should provide management with valuable information regarding its PEL 155 licence in the Penola trough, onshore Otway Basin in South Australia.

With former Beach Energy (ASX:BPT) managing director, Reg Nelson providing valuable direction as chairman, don’t expect the company to sit on its hands for too long.

Nelson was extremely active on the acquisition and exploration front when he was at the helm of Beach Energy, and interestingly he is eyeing off opportunities to take advantage of the Eastern Australian gas crisis.

He was instrumental in transitioning Beach from exploration to production in the early 2000’s by successfully bringing on stream a range of assets in the Cooper Eromanga Basin.

Since then, Beach’s market capitalisation has increased from about $40 million to $4 billion

This provided the cash flow for the company to move on to larger projects, both offshore and onshore.

Nelson’s aim is to build a revenue stream quickly so that Vintage can target even larger assets and build a company of a size and substance to take advantage of high value acquisitions.

In the lead up to Vintage’s IPO the company increased its portfolio substantially through entry into new joint ventures and acquisitions.

Each has strong potential for new gas discoveries and most importantly, the potential for early gas production supply Eastern Australian energy markets.

Interestingly, the Nangwarry prospect is only eight kilometres from the Haselgrove gas field, owned by Beach Energy.

The Haselgrove field produced gas from the Pretty Hill Sandstone from 1994 to 2011.

The field (and therefore, likewise, Nangwarry) is close to processing facilities, local markets and the SEAGAS pipeline connecting Melbourne and Adelaide.

Beach drilled Haslegrove-3/ST-1 to test the hitherto untested Sawpit Sandstone beneath the Pretty Hill Sandstone and reported results in January 2018.

Nelson and the management team were buoyed by Beach’s production test that flowed gas at a tubing constrained rate of 25 MMscf/day from the Sawpit Sandstone.

This was a prospect that had been identified some years earlier and was the group’s rationale in pursuing the joint venture with Otway Energy.

Consequently, the company’s upcoming drilling program at Nangwarry will be watched with interest.

Funds raised through the pre-IPO offer enabled Vintage to address the gas potential of the sandstone formations of the highly prospective Galilee Basin in Queensland by satisfying the conditions precedent for its farmin with Comet Ridge Ltd (ASX:COI).

The area involved is extensive, allowing for large scale follow up in the event that commerciality is established.

Having completed the initial stage of the farmin, Vintage now looks forward to booking its first contingent (2C) resource, a potentially market moving development.

Indeed, analysts are expecting a sizeable rerating with the consensus 12 month share price target of 36 cents reaffirmed as recently as October 3.

The following chart shows that VEN hasn’t been knocked around too much by industry volatility, but given the catalysts on the horizon one could expect a recovery to levels upward of the IPO price.

Central Petroleum Ltd (ASX:CTP)

Market Capitalisation: $99 million

Central Petroleum Ltd (ASX:CTP) is an oil and gas explorer and conventional producer with a focus on supplying the Australian domestic gas market.

Central is the largest onshore gas producer in the Northern Territory and operator of the only producing onshore conventional gas fields in the Northern Territory at Mereenie, Palm Valley and Dingo.

Being conventional fields, they are not caught within the moratoria on fraccing for unconventional exploration announced by the recently elected Northern Territory Government.

Central is in a position to pursue several reserve growth programs across what is regarded as the biggest package of proven and prospective oil and gas acreage that spans central Australia.

The company’s exploration permits cover nearly 230,000 square kilometres, 88% of which is gas prone and 47% of which has received native title clearance.

Central’s assets and the timing of their development couldn’t be better.

There is an onshore exploration moratorium in New South Wales, Victoria and Tasmania, and a moratorium in the Northern Territory on unconventional shale fraccing.

The Northern Gas Pipeline (NGP) is under development and remains on schedule for gas to flow to east coast markets from 2018, with 60 TJ/d of pipeline capacity available for new sales.

Central aims to become a significant domestic energy player and has positioned itself to grow from current production of over 11 terajoules per day (TJ/d) of gas and 340 bopd (equity accounted).

In addition, the company has substantial existing uncontracted gas reserves and identified gas exploration and appraisal targets.

Central’s significant gas resources can be explored and developed for sale into the east coast market subject to appropriate pricing signals.

Alternatively, the company may commercialise its gas resources through sales into the domestic Northern Territory market and/or the growing Northern Territory LNG export market.

Central has a strong balance sheet with cash of $22.1 million at the end of the September quarter leaving it well-positioned to continue to develop its assets.

The company’s fiscal 2018 result was also impressive with sales revenue and underlying earnings increasing by 41% and 395% respectively on a year-on-year basis.

Central had recent success with its Palm Valley 13 well encountering encouraging gas flows, and this will be tied into production facilities in early 2019.

The Mereenie expansion project continues to progress towards a completion date in early December.

The Palm Valley restart and optimisation project has a prospective restart date of late October / early November.

As COI continues to meet these milestones one would expect its share price to gain momentum and at least push up towards the early October high of 17 cents as indicated below.

Stayed tuned for part two on Thursday...

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.