Write off lithium at your own peril

Published 09-APR-2019 10:25 A.M.

|

9 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Global media group, AFP reported on Friday that “German car behemoth Volkswagen AG (ETR:VOW3) had secured 10 years' worth of lithium for electric car batteries from Chinese manufacturer Ganfeng, ensuring supply of a key ingredient for the vital components.”

The two firms are reported to have signed a memorandum of understanding (MoU) on long-term lithiumsupplies for battery cells.

Commenting on this report, Dr. Stefan Sommer, Group Board Member for Components and Procurement at Volkswagen Aktiengesellschaft said, “Over the next ten years the Volkswagen Group will be launching 70-plus new pure electric vehicles.

“That means approximately a quarter of the vehicles we deliver in 2025 will be powered by electricity.

“Consequently, there will be a rapid increase in our raw material demand for cell production in the coming years, and we must make sure we cover this demand at an early stage.

“Long-term agreements like the one for lithium, a key raw material, that we have just concluded with Ganfeng are therefore of crucial strategic significance for implementing our electric offensive.”

Lithium laggards could languish

While talks of an ‘offensive’ sounds like Volkswagen is preparing to go into battle, the fact of the matter is there is going to be a rush on commodities and components required for the manufacture of electric cars.

This is going to occur sooner rather than later, and manufacturers who are slow off the blocks will be paying more in an environment where demand is increasing and supply is contracting.

AFP noted the harsh European Union emissions limits set to bite from next year and toughen further by 2030, just another catalyst that will drive growth in electric vehicles across all manufacturers.

AFP said that the new electric offensive is pushing the limits of battery production,music to the ears of explorers and producers in the lithium space given they have had to contend with commodity price headwinds over the last 12 months.

Lithium demand isn’t just being driven by manufacturers of electric vehicles, high-volume commodity items such as smart phones and other electronic gadgets will also account for a significant proportion of global production.

Each smart phone battery contains 3 grams of lithium, a laptop around 30 grams and an electric car battery more than 20 kilograms.

Innolith tecnology could increase demand for EV’s

However, electric vehicles remain the big ticket item, and on this front there was further positive news to accompany Volkswagen’s announcement.

It was reported by Clean Technica on Thursday that Swiss startup Innolith AG, has developed the world’s first 1000 Wh/kg (watts per hour/kilograms) rechargeable battery.

Under development in the company’s German laboratory, the new Innolith Energy Battery would be capable of powering an Electric Vehicle (EV) for over 1000 kilometres on a single charge.

Importantly, Innolith’s new technology claims to have replaced the organic and highly flammable solvents used in lithium-ion batteries with inorganic substances that are more stable and less flammable.

In explaining how the new technology works, Innolith co-founder Alan Greenshields said, “We take the organic materials out and replace them with inorganic or basically salt-like materials, and that does two things for you.

“One is it gets rid of your fire risk, so, of course, there’s nothing to burn.

“And the second part is you’ve also got rid of the most reactive components in the system, which makes it easier to build a battery where you can pack in a lot of energy without the thing becoming unstable.”

In terms of what this is likely to mean for electric vehicle demand, Innolith chief executive Sergey Buchin, hit the nail on the head in saying, “Consumers want an adequate range on a single charge in an affordable EV, and confidence that it is not going to catch fire.

The Innolith Energy Battery is the breakthrough technology that potentially can meet all these needs.”

Guaranteed safety, along with improved performance and convenience is likely to accelerate the transition to electric vehicles, effectively increasing demand for lithium, and also potentially bringing forward the frenzy of activity as those EV manufacturers caught short look to secure sufficient supplies of the commodity to meet their needs.

Australian stocks with lithium exposure

Australia has quite a number of lithium producers and explorers with operations at home and overseas.

Some of the better-known ones are Pilbara Minerals Ltd (ASX: PLS), Galaxy Resources (ASX:GXY) and Altura Mining Ltd (ASX:AJM).

Analysts at Macquarie ran the ruler across these stocks in January, and at that stage Pilbara Minerals had recently negotiated an agreement with Ganfeng, supplier to Volkswagen as indicated in the aforementioned MoU.

The agreement entailed supply of 50,000 tonnes per annum of 6% spodumene concentrate from Pilbara’s stage III expansion.

The group also entered into a non-binding MoU with POSCO to lift the proposed downstream chemical processing facilities capacity by an additional 75,000 tonnes per annum of 6% spodumene concentrate feed.

Initiatives such as these aren’t going to be undertaken unless the margin between the cost of production and the selling price is attractive.

It could be argued that this is the key metric that should be monitored rather than volatile commodity price movements.

At the time of review, Macquarie upgraded Galaxy Resources from neutral to outperform, while maintaining its outperform recommendation on Pilbara Minerals.

The broker attributed an underperform recommendation to Altura Mining.

Galaxy update has implications for Galan

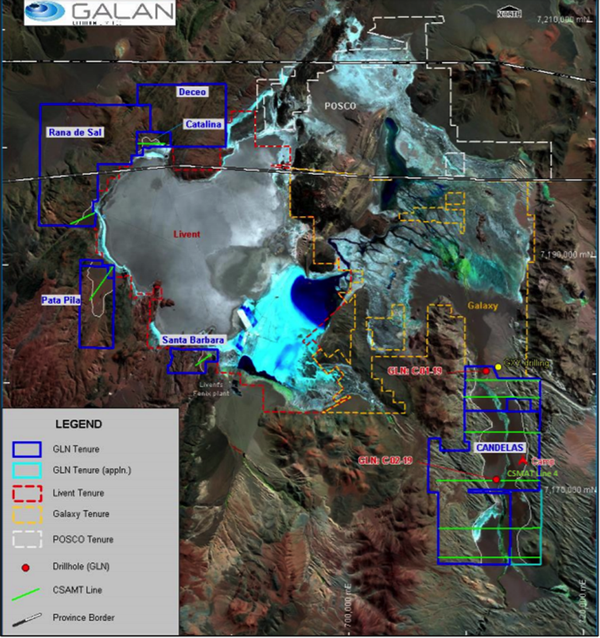

Macquarie provided some interesting commentary on Galaxy, which is pertinent for the neighbouring Galan Lithium Ltd (ASX:GLN), a company that has had recent exploration success in areas in close proximity to the former’s Sal de Vida project.

Commenting on Sal de Vida, Macquarie said, “Following a recent update from GXY on Sal de Vida we have taken a longer-dated view of the asset.

“GXY has received multiple bids from prospective partners with GXY extending the evaluation timeline.

“We push back our development assumption for Sal de Vida approximately 6 months with first production now expected in late-2022.”

The fact that it is receiving interest from multiple parties is encouraging for an emerging player such as Galan, particularly given the group’s early drilling success as it lays the foundations for fast tracking a lithium carbonate production project in South America’s lithium triangle.

On April 4, Galan confirmed field measurements indicated that the upper levels of a brine bearing aquifer had been encountered in the third drillhole from depths of approximately 280 metres to the current depth of approximately 310 metres.

This is particularly significant given that the drillhole is approximately 2.5 kilometres south-east of the maiden drillhole which provided outstanding results including an intercept of 192 metres at 802 mg/l lithium with low impurities.

Commenting on the latest success, Galan’s managing director, Juan Pablo Vargas de la Vega said, “The discovery of further brines within the Candelas channel reinforces our view that the project has the very real potential to host a significant lithium resource in one of the world’s premium salars at Hombre Muerto.”

ABR potential ten-bagger says Francis

American Pacific Borate and Lithium (ASX:ABR) is another highflying emerging player in the lithium space.

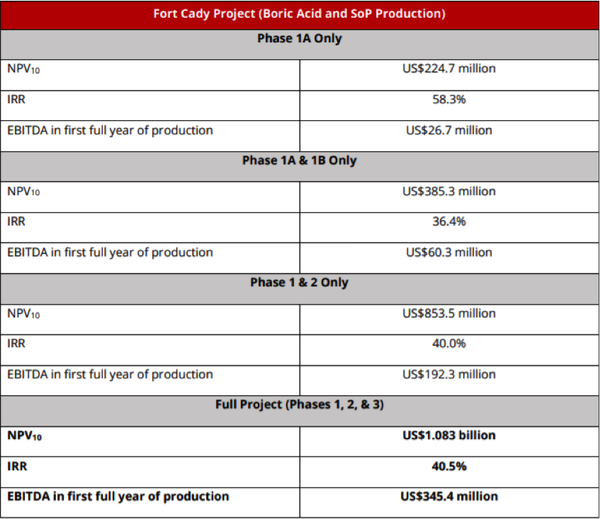

In late-January the company announced enhancements to its Canadian-based Fort Cady definitive feasibility study (DFS) which included a low capital expenditure starter project that works on a standalone basis.

This effectively reduced pre-production capex to US$36.8 million, providing a pathway to Phase Three that has an annual EBITDA in the first full year of production of over US$340 million.

It has also made the Fort Cady Project easier to finance, whilst limiting likely share dilution and preserving a massive EBITDA target in full production.

This is a significant development for a smaller company given raising capital is one of the most difficult hurdles to overcome, particularly without diminishing its stake in the project or issuing new capital which substantially dilutes earnings.

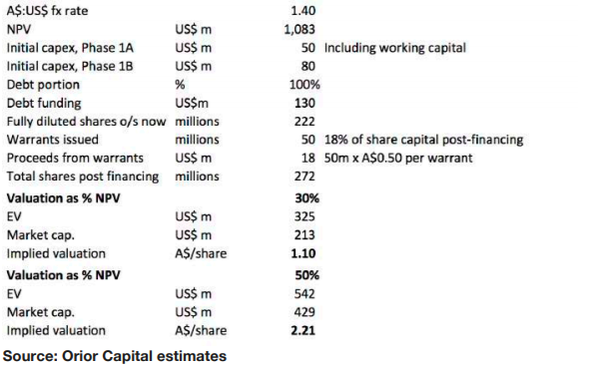

Recent developments have seen the company’s shares nearly double since December, but former Macquarie and HSBC resources analyst, Simon Francis, believes there is substantial share price upside to come.

He has identified the company as a potential ten-bagger on the back of its impressive DFS.

Francis’ ten-bagger projection implied a share price of $1.60 when he made the call.

Putting this in enterprise value (EV) terms, Francis crunched the numbers on a mix of financing scenarios, projecting that ABR could attract an EV in a range between US$325 million and US$542 million within 12 months.

This would equate to a valuation of between $1.10 and $2.21 per share, representing multiples of between 6.9 and 13.8 relative to a share price of 16 cents.

The following is a valuation based on the January 2019 DFS base case.

Near-term production places ABR in upper echelon

While being able to boast a US$1 billion project is headline-grabbing in its own right, arguably one of ABR’s most compelling investment metrics is its relatively near-term production outlook.

In many cases, large-scale projects involve long lead times, but ABR expects first production from Phase 1A to occur in the December quarter of 2020.

Francis noted that ABR will become only the second major producer of calcium-based borates globally, and only the second producer of salt of potash SOP in the US.

Also working in ABR’s favour is the fact that few new projects are in the pipeline, and the borates market is essentially a duopoly with Turkish state-owned Eti Maden and Rio Tinto (ASX:RIO) controlling 80% of global demand.

Boron and borates are used in many modern applications from abrasives to water treatment, and from soap to nuclear power plants, as well as being a product of need for emerging new age technologies such as devices requiring lithium-ion batteries and hydrogen fuel cells.

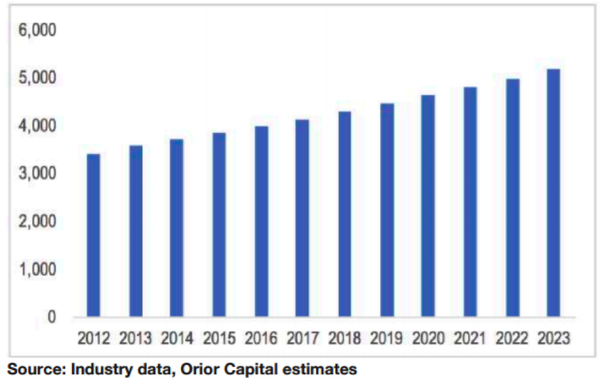

The global market for boric acid (H3BO3) reached 3.9 billion tonnes in 2017, with the market expected to continue growing at approximately 4% per annum.

Borates demand is being driven by the ‘big picture’ trends of urbanisation, energy efficiency, and food security.

To put the value of the borates market into perspective, Francis said that it is about the same size as the US$3 billion lithium market.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.