Why are the world’s wealthiest people buying gold?

Published 23-JUN-2016 12:11 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Seen as a wealth preservation asset during hard economic times and used as a monetary metal for thousands of years, gold is once again on the radar for the world’s elite.

Gold is seen as a low risk safety asset and investors tend to shift their portfolio into gold during times of economic and political uncertainty. Case in point: the super-rich buying up ‘Italian Job’ style gold bars.

Whilst many people are unable afford the 12.5kg bars, which at time of writing would be worth around A$693,700 a bar (at a gold price A$1700 per ounce), we can gain exposure to the precious metal in the stock market through gold stocks.

Soros, Druckenmiller and Rothschild issue economic warnings favouring gold

Legendary investor and billionaire George Soros is one of the members of the upper echelon moving his investments into gold by acquiring a $264 million stake in bullion producer Barrick Gold.

The former hedge fund manager believes a hard landing in China is inevitable, adding that such a slump would worsen global deflationary pressures.

Fellow billionaire investor Stanley Druckenmiller, is also bullish on gold and sees it as the obvious investment in response to central banks around the world moving interest rates into negative territory, labelling the monetary policy as ‘absurd’.

From left to right: George Soros, Lord Jacob Rothschild, Stan Druckenmiller

Member of the most powerful banking dynasty known to man, that largely built its wealth on gold, Lord Jacob Rothschild penned an op-ed Reiterating the message of his billionaire comrades above.

This follows on from Rothschild’s warning issued to investors late last year in his half yearly statement that expressed caution in markets going forward due to numerous of factors including:

- Quantitative easing slowing down, less liquidity in the market.

- Chinese, US and European economies producing disappointing numbers.

- Middle East tensions escalating, outbreak of potential war.

- Immigration crisis, placing strain and divide on many European nations.

- Socio-political unrest and economic turmoil growing as seen with Venezuela, Greece and Brazil.

To date, none of the hotspot areas mentioned in Rothschild’s report have been resolved, rather many have worsened.

Should these spot fires continue to gain in size and momentum we could see the economic turmoil that Soros, Druckenmiller and Rothschild are all warning about, increasing the argument for having gold in ones portfolio.

Demand for gold at all-time highs

With uncertainty brewing in markets around the world, we have seen a flight to safety with global gold demand up 21% in the first quarter of 2016 compared to 2015, according to the World Gold Council.

This has been led by the central banks of China and Russia who have been acquiring the asset hand over fist in recent years to bolster their reserves.

Due to its perceived safety we tend to see demand, along with the gold price, spike in times of uncertainty.

With the EU referendum date drawing near, the potential for a Brexit has seen demand for gold surge yet again. Gold sales at the UK Royal Mint are up 32% from last month and still coming in hot.

Gain leverage through gold stocks

Whilst some investors buy the physical metal itself, many prefer to gain leverage to the gold price through the stock market.

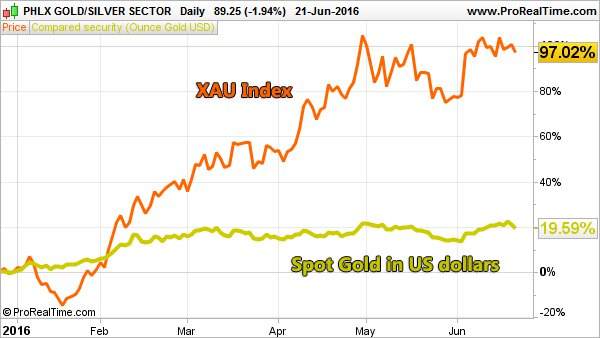

For example a +10% move in the price of gold could see gold stocks gain 100% in turn, we have seen this already in 2016 through the XAU and HUI gold sector indexes both doubling since the beginning of the year.

The XAU is a capitalisation-weighted index composed of companies involved in the gold and silver mining industry.

It is important here to remember that past performance is no guarantee of future performance.

Let’s take a closer look at the XAU index vs the spot price of gold in USD:

The chart above demonstrates how gold stocks can be used as a leverage tool over the actual physical commodity.

Drilling down into specific companies, the world’s biggest gold miner, Barrick Gold Corp (NYSE:ABX), ended 2015 at $7.38 per share. Since then the gold price has risen only 20% in relation to the US dollar, yet the stock is now trading at around $19-20 a share, increasing its market capitalisation by around 260%.

The same can be seen with reference to many gold companies on the ASX, with Australia’s biggest gold miner, Newcrest Mining (ASX:NCM), going from $12.97 per share to be trading currently in the $21-22 range over the same time frame, up 66%.

Soon to be gold producer Blackham Resources (ASX:BLK) is another Australian company that has seen its share price almost double over the past 6 months.

Once again, past performance is no guarantee of future performance and if you are looking into investing in these stocks, you should seek professional financial advice.

Should the gold price take off as many experts believe, including commodities expert Jim Rickards who is calling for US$10,000 p/oz gold in the future, we could see many gold miners and explorers experience a strong re-rating.

With the world’s power elite moving into gold it may be worth considering getting some gold exposure into your portfolio. Especially for those looking to leverage any potential upside moves in the price of the precious metal through gold stocks.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.