WiseTech growth profile justifies premium multiple

Published 18-OCT-2016 16:36 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Paul Mason from RBC Capital Markets has initiated coverage of WiseTech Global (ASX: WTC), a developer of cloud-based software solutions for the international and domestic logistics industries.

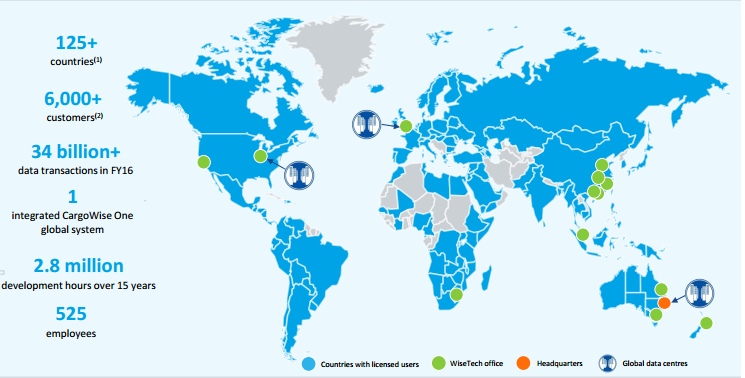

The group only listed on the ASX in mid-April, but since 1994 it has been involved in managing the movement of goods and information. WiseTech boasts more than 6000 customers across 125 countries with its core CargoWise One global logistics brand at the centre of its product offering.

Mason has an outperform recommendation on WTC as he sees the business model as highly scalable which is certainly evident when looking at the company’s performance over the four-year period to June 30, 2016.

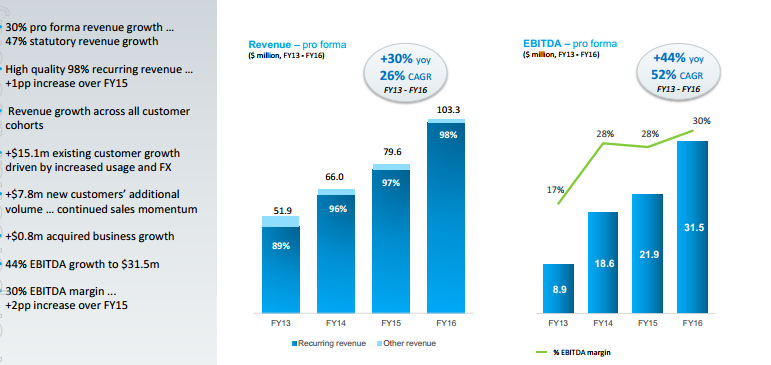

During this period revenues have approximately doubled to $103.3 million and EBITDA has increased from $8.9 million to $31.5 million.

WTC outperforms prospectus forecasts and broker expectations

Not only has WTC’s underlying business performed well in recent years, the group delivered an outstanding fiscal 2016 result with the net profit of $14.2 million representing growth of 37%, well above the prospectus forecast of $13 million.

Following the strong fiscal 2016 performance management lifted its 2017 revenue and EBITDA guidance from $148 million to $155 million and $50 million to $55 million respectively.

It should be noted that growth levels such as these are never guaranteed to continue and as such professional financial advice should be sought if considering this stock for your portfolio.

Mason is forecasting the group to generate a net profit of $29.8 million in fiscal 2017 from revenues of $152.2 million. This represents earnings per share of 10.2 cents, placing the company on what would appear to be a testing PE multiple of 53.

However, exponential growth is forecast over the next five years with Mason projecting the company to generate five-year compound annual growth in EBITDA of nearly 60%, a level that very few ASX listed companies could boast. Consequently, on a price-earnings to growth basis (PEG) the company doesn’t look expensive.

Acquisitions to complement organic growth

Mason sees WTC’s lean operating model and genuine product differentiation as key factors in enabling it to achieve significant margin expansion as sales growth occurs. He also believes there is substantial scope for expansion with the company’s ultimate addressable market being in a range between US$7.1 billion and US$10.8 billion.

Mason expects strong organic growth to be complemented by the acquisition of leading global software providers in overseas markets. Purchasing new businesses allows WTC to integrate the acquired functionality into CargoWise One, and then offer all modules (including acquired functions) to both the acquired customer list and all existing customers.

WTC has already proven its expertise in identifying quality businesses and integrating them efficiently. In fiscal 2016 it acquired and commenced integration of South African leading software vendor, Compu-Clearing Outsourcing Ltd and Australian and New Zealand air messaging distributor, Cargo Community Network.

The company also increased its strategic holding in German domiciled global sea freight software provider, Softship AG, and in July achieved a majority shareholding of 50.01%.

WTC’s shares have retraced from their all-time high of $5.89 in early October to yesterday’s closing price of $5.40, perhaps representing a useful entry point given Mason has a 12 month price target of $6.50 on the stock.

Broker forecasts and price targets may not be met, and this data along with past trading performances shouldn’t form the basis of an investment decision. Independent advice should be sought before investing in this stock.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.