Will $100M mining dataset bonanza spur exploration?

Published 04-MAY-2016 14:50 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The Australian government has done a bit of its own counter-cyclical investment and budgeted in $100 million over four years to find the next great mineral resources.

It outlined a program in last night’s budget whereby it would Geoscience Australia $100 million over four years to come up with a pre-competitive dataset on frontier mineral and hydrocarbon basins.

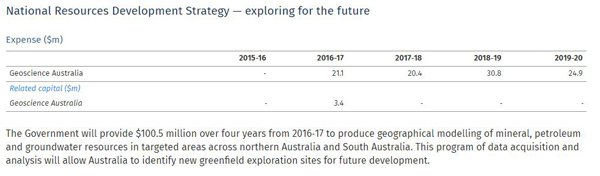

An outline of the four-year funding

The government said that 80% of Australia’s land mass remains “under-explored” – and the new datasets would focus on the Northern Territory, Queensland, Western Australia, and South Australia.

The government has been talking about this initiative for a while now – but exactly how much money would be attributed to the program was up until last night somewhat of a mystery.

As expected, the government was talking up the potential economic return on its investment.

It pointed to a $3 million investment into analysis of the Browse Basin – which it said helped identify the Ichthys field, which is slated to produce $70 billion in export earnings over the next 40 years.

It also pointed to a $350,000 investment back in the 1960’s which it said helped identify the initial Olympic Dam resource.

The Minerals Council of Australia was even more bullish, saying in a press release that “by some estimates” the rate of return for every dollar invested in pre-competitive programs had a multiplier of more than 20 times.

It also said Australia was the second-most effective country at turning exploration into mineral discoveries.

In any case, it’s firmly in the counter-cyclical camp of investment, with commodity prices currently riding low.

There are, however, rays of sunshine in the area.

Former Rio Tinto boss Tom Albanese recently called the bottom of the commodities cycle – as dangerous as a prediction like that is to make.

“I believe with what we’ve witnessed early in 2016 will be the trough for the commodity markets,” Albanese was quoted as saying by Bloomberg on a conference call after Vedanta reported quarterly earnings.

“Commodity prices have improved materially in the last couple of months, and investor sentiment has started to turn cautiously positive on the resources sector.”

Bloomberg’s commodities index backs up the bullish sentiment – with it saying its basket of commodities has rebounded by 7.9% towards the back-end of April.

With the Australian dollar expected to climb lower on the back of rate cuts from the Reserve Bank of Australia, exploration companies willing to ride out the current volatility in commodity sentiment could be in a position to benefit.

Australian greenfield assets could very well become attractive at the right price point for foreign companies dealing in US currency – and should Geoscience Australia be able to produce compelling data with the $100 million this could be the start of something.

Nothing’s certain in life and even less is certain in commodities though.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.