Why the RBA wasn’t tempted to lower rates

Published 06-NOV-2015 10:00 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Those who were expecting the Reserve Bank to lower the cash rate on Melbourne Cup Day because the banks had raised theirs had short attention spans.

That’s the call from Reserve Bank chairman Glenn Stevens, who in giving a speech in Melbourne ysterday said the RBA was not tempted to cut rates in response to banks raising theirs recently.

Last month all four major banks lifted their lending rates in response, they said, in response to requirements from the Australian Prudential Regulatory Authority for banks to keep more capital on hand.

The APRA rules were put in place to make sure banks had enough cash on hand to keep themselves ticking over, even in the case of a global financial crisis.

Banks elected to raise the capital by charging customers more on their loans rather than passing the costs onto shareholders via a dividend cut or other measures.

With the big four all raising their rates, some had speculated that the RBA would lower the official cash rate to offset any shock to the economy which may flow from the banks’ move.

After all, the RBA has done this before.

It did it back in May of 2012 following similar raises in the lending rate from major lenders, and some expected this to happen again.

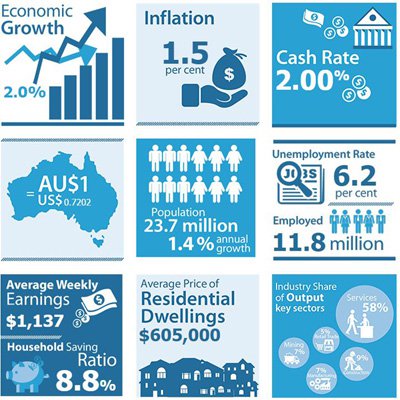

The latest snapshot of the Australian economy from the RBA

But Stevens told a business breakfast yesterday that the banks had been overly generous with cash rate drops in 2014 and 2015.

As the RBA moved its rates, Stevens said, the big banks had in effect elected to drop their rates at a greater pace than the central bank.

“For fixed rate mortgages and many business loan rates the fall was quite marked. The average rate on outstanding business loans, for example, fell by over 90 basis points during a period in which the cash rate fell by 50 basis points,” Stevens explained.

“Even for floating rate mortgages, rates had fallen a bit more than the cash rate.”

He said the recent rate rises by the banks had in effect reversed under half of the declines from last year. However, he stopped short of endorsing the banks’ move to raise rates.

Stevens said another impact of the banks’ generosity last year and the early parts of this year was that a lot of owner-occupiers were ahead on mortgage payments.

“We also note that a significant proportion of owner occupier households is ahead of schedule on mortgage repayments – in large part because these households did not lower their payments as interest rates fell,” he said.

“Most of these households are unlikely to need to part with extra cash each month as a result of the recent interest rate changes.”

He also predicted that the macroeconomic effects of the rate rises were not expected to be large, but that the RBA would keep an eye on things.

Elsewhere, he said if the RBA were to move on rates in the near-term, “it would almost certainly be an easing, not a tightening.”

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.