What is gypsum and why is it forecast for 9.9% CAGR growth?

Published 20-JUL-2018 11:50 A.M.

|

5 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

The benefits of gypsum as a plaster were discovered a long time ago by the ancient Greeks and Romans.

Yet its extensive usefulness in the field of agriculture wasn’t discovered until the 18th century, when both Germany and France realised gypsum had some major crop-boosting attributes.

Interestingly, in France this discovery came about because men who were working with alabaster/ plaster of paris (made with gypsum) had noticed the grass was growing better in the spots where they shook off the dust from their work clothes.

It was Benjamin Franklin who brought the idea of using gypsum as a fertiliser to the US in the 1780s, and it is actually one of the earliest forms of fertilisers used in the country.

Gypsum is considered a moderately soluble source of the essential plant nutrients, calcium and sulfur, and is known to improve overall plant growth.

According to The Future of Gypsum: Market Forecasts to 2026, the global gypsum market was valued at US$1.49 billion in 2016, equivalent to 252 million tonnes. According to Smithers Apex, the gypsum market is forecast to grow at a CAGR of 9.9% to reach nearly US$2.4 billion by 2018 and $3.8 billion by 2026.

One Australian company – American Pacific Borate and Lithium (ASX:ABR) – that we will look at in depth shortly is looking to capitalise on the growth of this market.

However, the size of the market share ABR can secure remains to be seen at this stage, so if considering this stock for your portfolio do your own research and seek professional financial advice.

Agricultural sustainability, fertilisers & gypsum

Fertiliser demand saw a 2.4% increase in 2016/17. This isn’t a huge surprise when you take into account the major global issue of soil erosion, which has a significant effect on the land’s ability to support the growth of crops.

In 2013, the UN wrote the following regarding the status of global soil resources: ‘...the majority of the world’s soil resources are in only fair, poor or very poor condition’. Soil erosion is a problem that is largely considered to be the result of human practices, such as deforestation, overgrazing, tillage and other unsuitable agricultural practices.

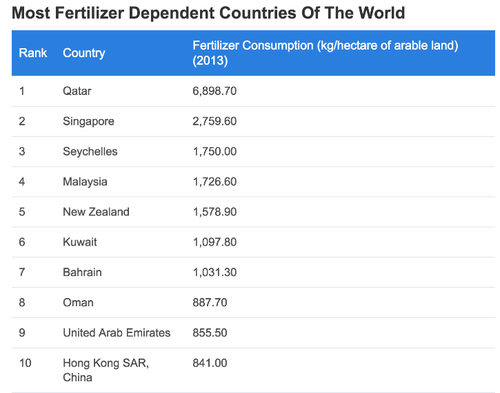

The below table shows the top most fertiliser-dependent countries in the world, and their use as of 2013:

Due to a range of environmental factors, in many areas plants are becoming more deficient in the vital nutrient sulfur; that’s where gypsum’s abundance of sulfur comes in very handy for crop growers as an additive to the soil.

Calcium is required for most nutrients to be absorbed by plants roots, and is therefore also vital for plant growth. So, add in the fact that gypsum is a source of calcium too, and you can see why it is heralded as an ideal fertiliser, and why it has been widely used for hundreds of years.

Beyond those two vital elements, gypsum also improves water infiltration of crops which is extremely useful for the costly global phenomenon of drought — a long-standing threat with potentially disastrous consequences for farmers (and all of us who depend on them as a source of food!) in Australia and beyond.

As an agricultural product, gypsum is generally applied to soils in areas where sodium levels are high, as it has the ability to neutralise the effect of sodium on crops. As a convenient source of sulfur and calcium, and with the ability to improve water infiltration, the positives are clearly stacked as far as gypsum’s applications as a fertiliser.

ASX small cap a potential player in the gypsum market

American Pacific Borate and Lithium (ASX:ABR) is in the process of commercialising its 100% owned Fort Cady Borate Project in Southern California — a multi-asset project from which ABR is hoping to produce boric acid, Sulphate of Potash (SOP), lithium and gypsum.

ABR has stated that its scoping study is targeting steady state production of 246,000 tonnes per annum of boric acid and 54,000 tonnes per annum of SOP, a premium type of soil fertiliser which ABR wants to leverage to its advantage by producing hydrochloric acid for use in its intended boric acid solution mine.

As part of ABR’s multi-faceted plants, it is exploring options to sell by-product gypsum into the large Californian agricultural market.

The US gypsum soil amendment market has been estimated at US$30—US$40 million per annum by the company’s US-based fertiliser consultants, Context Inc. As well as bringing in cass, the sale of gypsum will also result in minimal waste products from ABR’s proposed operations.

Beyond its common use in agriculture, gypsum is also widely used in the construction of walls and ceilings in the construction industry — and boron-based gypsum, such as what ABR hopes to produce, actually improves product performance, user convenience and process efficiency.

ABR has undertaken recent discussions with local gypsum suppliers that suggest the company should be able to sell gypsum into the Californian market, and that there would be considerable demand for its enriched boron-gypsum product.

Context Inc.’s recent studies into US micronutrient markets for boron and SOP found that boron is the second most used micronutrient by value, and that its value is expected to grow by a strong 9 per cent CAGR through to 2022.

These findings reinforce ABR’s North American specialty fertiliser target market and supports the theory that a boron fertiliser and boron-enriched gypsum will attract high demand in both California and wider US domestic markets.

For now, ABR’s onsite testworks and bulk sampling program is ongoing and designed to: test the scoping study flowsheet; obtain bulk samples for equipment sizing; progress detailed engineering in preparation for the start of construction, and obtain product samples to provide to potential customers and partners.

ABR has stated that a definitive feasibility study is on track for completion in the second half of the calendar year.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.