Wall Street turns bearish as Trumphoria comes to a grinding halt

Published 22-MAR-2017 11:34 A.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Most global markets experienced significant falls overnight mainly triggered by weakness in the resources sector.

Iron ore came off substantially (circa 4%) and the oil price declined approximately 1.5%. Base metals were also weak.

Negative sentiment towards financial stocks also contributed to the substantial fall in the Dow.

Both the Dow and the NASDAQ delivered their worst daily drop since September, coming off 1.1% and 1.8% respectively. The larger fall in the NASDAQ could be significant in that it is home to riskier stocks such as those in the IT and biotech sectors.

Some analysts are questioning whether the Trump factor which has had such a significant impact on the bullish trading conditions that have prevailed since his election has run its race. Furthermore, could there be a pronounced Trump slump around the corner if pre-election promises aren’t fulfilled.

Is the Black Swan gauge on the mark

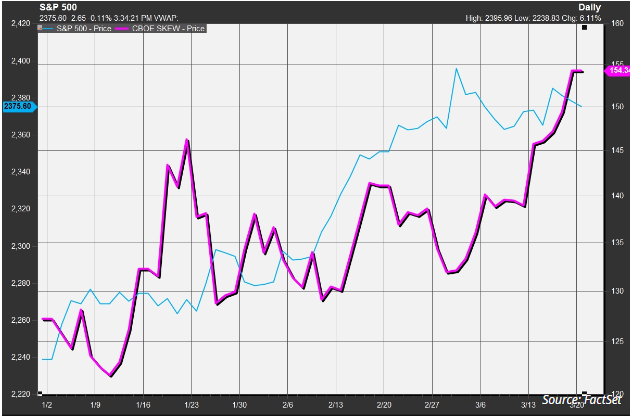

As he explains, the chart is a popular options market gauge of so-called Black Swan, or difficult to predict, events.

The CBOE Skew Index measures the relative cost of purchasing out of the money put options on the S&P 500. Put options provide the opportunity, but not necessarily an obligation, to sell an asset at a specific price and time, while call options give the owner the right to buy an underlying asset.

In highlighting the outperformance of the Skew index against the S&P 500, DeCambre noted that it demonstrates investors are more concerned about downside protection.

European markets also hit by downturn in commodities

Negative sentiment extended to Europe with the FTSE 100 coming off 0.7% to close at 7378 points.

The DAX and the Paris CAC 40 declined 0.7% and 0.2% respectively to close at 11,962 points and 5002 points.

While base metals weren’t sold down to the extent that iron ore was, the across-the-board decline dragged down major mining stocks listed on the LSE including Rio Tinto and BHP Billiton, suggesting they could come under pressure today.

The latter has the added burden of being exposed to the declining oil price.

Copper (-1.8%) and zinc (-1.5%) experienced the most substantial declines, while lead and nickel came off less than 0.2%, a good performance in a bearish environment.

As is often the case in this environment, investors flocked to gold because of its safe haven status. The precious metal was up nearly 0.9%, closing in the vicinity of US$1245 per ounce, a level it hasn’t traded at since the start of March.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.