US markets finally claim the 20,000 point mark

Published 27-JAN-2017 14:42 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

After the Dow closed above 20,000 points for the first time in history on Thursday (Australian time), this morning it was hovering in the vicinity of 20,100 points just before the close with measured confidence across most sectors even though reporting season has been mixed.

The NASDAQ has also maintained its position well above the 5600 mark, hitting 5670 points early in the session before retracing to circa 5650 points.

On the political front, it would appear that President Trump has a worthy social media adversary in Mexico’s President Enrique Pena Nieto.

After Trump signed off on an executive order to build an immigrant blocking wall between the two countries, the Mexican president flooded his social media channels, saying he doesn’t believe in walls and that he regrets and disapproves of the decision to continue the construction of the wall that will only lead to division.

A planned meeting between the two leaders which was due to occur on January 31 was subsequently cancelled by the Mexican president after he was told by Trump to stay home if he didn’t want to pay for the wall.

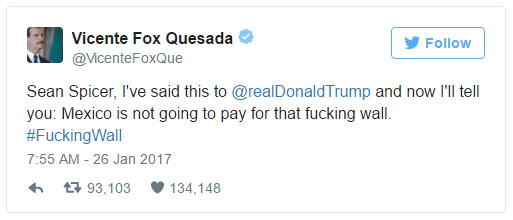

Former Mexican president, Vincente Fox Quesada who first started the social media wars with Trump was even more pointed with this twitter post being released in the last 24 hours in response to developments regarding the #f****** wall.

European markets were mixed with the FTSE 100 flat, the DAX up 0.3% and the Paris CAC 40 down 0.2%.

Fluctuations in the UK tended to be a reflection of reporting season as the Unilever plc disappointed and Diageo plc delivered a strong first half profit. With the latter leveraged to alcohol consumption, perhaps the school of thought that investing in chocolates, tobacco and alcohol when times are tough isn’t a bad strategy.

On the commodities front, oil finished up 2% while gold extended the previous day’s losses as it fell below US$1200 an ounce to hit a low of US$1187 per ounce before closing just above US$1190 per ounce.

All base metals trended lower with a marked decline in the nickel price as it fell from the previous day’s close of US$4.37 per pound to US$4.23 per pound.

The Australian dollar was fetching US$0.755 as US markets drew to a close.

It should be noted that broker projections and price targets are only estimates and may not be met. Also, historical data in terms of earnings performance and/or share trading patterns should not be used as the basis for an investment as they may or may not be replicated. Those considering this stock should seek independent financial advice.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.